The long-term growth of the sector is supported by expanding chemical exports and stricter global regulations regarding the transport of dangerous substances. These shifts push companies to invest in high-performance, durable packaging solutions that meet compliance standards while ensuring cost-effectiveness and sustainability. Although tariffs on imported aluminum and steel raised production costs and disrupted supply chains, the market has adapted by recalibrating pricing strategies and exploring domestic sourcing. Industrial development and robust cross-sector integration keep the momentum strong for rigid packaging producers worldwide.

As sectors like automotive, agriculture, petrochemicals, and construction expand, the demand for durable, safe, and cost-efficient packaging solutions rises in parallel. These industries require high-volume transportation and storage systems that maintain product integrity under extreme environmental conditions, making rigid packaging indispensable. Moreover, integrating global manufacturing ecosystems prompts standardized packaging formats, streamlining logistics, and driving operational efficiencies.

In 2023, the drums segment generated USD 15.4 billion, reflecting its solid role as a preferred container for liquid products across the oil and chemical sectors. These drums offer safe, stackable, and reusable solutions that comply with safety regulations, especially for bulk transport. They are highly valued for their strength and efficiency in storage, handling, and transit applications.

Plastic-based rigid packaging segment is expected to contribute 35.3% share in 2024. The popularity of plastic stems from its corrosion resistance, lightweight, and adaptability across end-use sectors, including food and chemicals. Innovations in recyclable and eco-friendly plastics further strengthen its market position, aligning with the rising demand for sustainable industrial packaging alternatives.

U.S. Rigid Industrial Packaging Market was valued at USD 15.2 billion in 2024 fueled by the pharmaceutical and chemical sectors, which rely heavily on high-integrity containers. The country's focus on eco-conscious materials and expanding advanced logistics infrastructure create favorable conditions for reusable rigid packaging. Enhanced infrastructure and digitalized shipping networks support the wide adoption of high-performance packaging that meets environmental and operational goals.

The leading players in this space include SCHÜTZ GmbH & Co. KGaA, Mauser Packaging Solutions, and Greif, Inc. To maintain a competitive edge in the rigid industrial packaging market, companies prioritize innovation in reusable and sustainable materials while enhancing their global supply chain resilience. They invest in smart packaging technologies and automated manufacturing processes to increase efficiency and reduce operational costs. Partnerships with key clients across chemical, food, and pharma industries allow tailored product development that meets specific compliance and safety standards.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Rigid Industrial Packaging market report include:- Balmer Lawrie

- Berry Global

- DS Smith Rigid

- Greif

- HOYER

- Mauser Packaging Solutions

- Mauser-Werke

- Nefab

- Rikutec Group

- Schoeller Allibert

- SCHÜTZ

- Thielmann Group

- Time Technoplast

- Tosca Services

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | May 2025 |

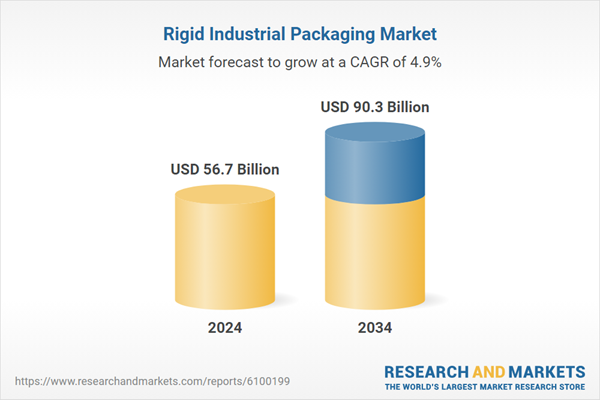

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 56.7 Billion |

| Forecasted Market Value ( USD | $ 90.3 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |