The growing focus on environmentally sustainable financing is helping to expand the mortgage lender market. Green mortgages, which provide better terms for energy-efficient homes, are gaining popularity as eco-conscious borrowers seek financial products aligned with sustainability goals. These lending products are further supported by government-backed incentives such as lower rates and tax relief. As climate and ESG considerations move to the forefront, demand for sustainable mortgage instruments continues to rise, prompting lenders to develop tailored underwriting standards that align with environmental priorities.

In 2024, the traditional banks segment accounted for 48% share and is projected to grow at a CAGR of 3% through 2034 attributed to strong brand credibility, large-scale infrastructure, and access to low-cost deposits. With expansive branch networks and digital tools, banks offer borrowers full-spectrum mortgage services that include cross-selling of financial products like savings accounts, insurance, and investments. This allows banks to build enduring customer relationships and foster long-term loyalty. Access to cheap capital and favorable regulations enables them to maintain competitive interest rates, giving them an edge, especially among creditworthy clients.

Fixed-rate mortgages captured a 50% share in 2024 due to their predictable repayment structures, offering borrowers financial stability over time. With a fixed monthly payment that doesn’t change, homeowners avoid the risk of rate fluctuations. Such predictability appeals to budget-conscious consumers and first-time buyers. During low interest rates, borrowers take advantage of locking in favorable terms for 15 to 30 years, minimizing the long-term cost of borrowing. This stability is increasingly appealing amid global economic uncertainties.

North America Mortgage Lender Market held an 84% share and generated USD 5.6 billion in 2024. Despite headwinds from higher interest rates, the U.S. mortgage market remains resilient. Lenders are shifting focus toward higher-credit borrowers and tailoring loan offerings to align with evolving preferences. As demand for refinancing dips, institutions are tightening credit conditions to reduce risk exposure. At the same time, the focus on digital transformation has grown stronger, with lenders investing in automation tools, AI-based credit evaluations, and personalized lending platforms to deliver better borrower experience and improve operational efficiency.

Key companies in the Mortgage Lender Industry include Rocket Mortgage, JPMorgan Chase, CrossCountry Mortgage, U.S. Bank, Rate, Bank of America, DHI Mortgage, Fairway Independent Mortgage, Veterans United Home Loans, and United Wholesale Mortgage (UWM). These players are pursuing strategic investments in digital platforms, expanding their mobile lending capabilities, and enhancing AI-driven underwriting systems. They are also forming partnerships with fintech companies to introduce more flexible and personalized loan products. Market leaders are focusing on providing hybrid lending models that combine human interaction with digital convenience, while also exploring ESG-aligned loan offerings to attract eco-conscious borrowers and meet regulatory expectations.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Mortgage Lender market report include:- AmeriHome Mortgage

- Bank of America

- Citibank

- CrossCountry Mortgage

- DHI Mortgage

- Fairway Independent Mortgage

- Guaranteed Rate

- Guild Mortgage

- JPMorgan Chase

- LoanDepot

- Navy Federal Credit Union

- Newrez

- Pennymac

- Planet Home Lending

- PNC Bank

- Rate

- Rocket Mortgage

- U.S. Bank

- United Wholesale Mortgage (UWM)

- Veterans United Home Loans

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2025 |

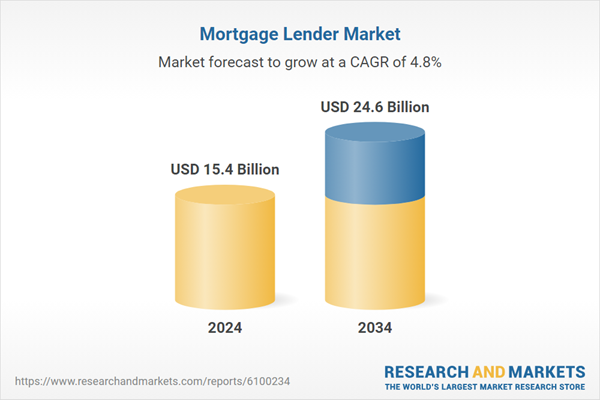

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 15.4 Billion |

| Forecasted Market Value ( USD | $ 24.6 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |