Despite the growing opportunities, high initial capital investment remains a major hurdle in this market. Acquiring micro-manufacturing equipment such as micro-CNC machines, laser micromachining systems, precision measurement tools, and micro injection molding units often runs into hundreds of thousands or even millions of dollars per unit. These investments go beyond just the equipment, they typically involve advanced software, facility upgrades such as cleanrooms or vibration isolation systems, and long-term maintenance. This makes the cost of ownership quite steep, especially for small to mid-sized enterprises. Additional expenses for operator training, part quality validation, and recurring maintenance further challenge scalability, especially in the early stages.

Micro injection molding segment generated USD 6 billion in 2024. This technology is essential for creating highly detailed and dimensionally accurate parts, often in the micrometer range. It is particularly suited for producing complex assemblies where high precision is critical. The molding process involves injecting molten polymers into precise molds under tightly controlled temperature and pressure conditions. Once cooled, the final product is removed, either manually or via automation, to ensure consistency and repeatability in mass production.

The subtractive manufacturing processes segment held a 42.4% share in 2024. This segment includes material-removal techniques like micro-drilling, micro-milling, micro-turning, and electrical discharge machining, which are frequently used to manufacture finely detailed components. Micro-milling allows for intricate shapes and smooth surface finishes by progressively cutting material with ultra-small tools. Micro-turning, another key subtractive method, rotates the workpiece to shape cylindrical parts. These techniques are vital in producing components used in electronics, aerospace, and automotive sectors, where dimensional accuracy is paramount.

Asia-Pacific Micro-Manufacturing Equipment Market generated USD 9.3 billion holding a 33% share in 2024 driven by the robust industrial expansion and rising demand for precise manufacturing across sectors like electronics, aerospace, automotive, and medical devices. Countries such as Japan, India, China, and South Korea play a pivotal role by adopting cutting-edge micromanufacturing techniques. There is significant traction in the use of advanced micromachining technologies, including micro-EDM, micro-milling, and laser-based processes. This shift is closely tied to the rising demand for high-performance microcomponents in applications such as semiconductors, sensors, and implants.

Key companies shaping the competitive landscape of the Micro-Manufacturing Equipment Market include ARBURG GmbH + Co KG, FANUC, Oxford Instruments, Raith GmbH, ASML, Nanoscribe GmbH, Coherent Corp, Hitachi High-Tech Corporation, Sumitomo (SHI) Demag, Applied Materials, SÜSS MicroTec, Hikari Kikai Seisakusho Co Ltd, Matsuura Machinery, KUKA AG, and Posalux. To expand their market position, leading players focus on strategic technology integrations such as automation, AI-driven process optimization, and hybrid manufacturing techniques. Companies invest in R&D to develop compact, energy-efficient machines capable of high-precision work under demanding conditions. Many are forging collaborations with end-use industries to co-develop application-specific solutions, reducing time-to-market and improving customization.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Micro-Manufacturing Equipment market report include:- Applied Materials

- ARBURG GmbH + Co KG

- ASML

- Coherent Corp

- FANUC

- Hikari Kikai Seisakusho Co Ltd

- Hitachi High-Tech Corporation

- KUKA AG

- Matsuura Machinery

- Nanoscribe GmbH

- Oxford Instruments

- Posalux

- Raith GmbH

- Sumitomo (SHI) Demag

- SÜSS MicroTec

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | May 2025 |

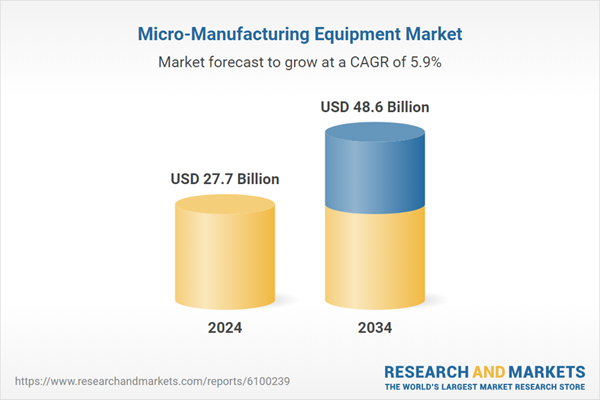

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 27.7 Billion |

| Forecasted Market Value ( USD | $ 48.6 billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |