Urbanization and rising disposable incomes are also contributing significantly to market expansion. In densely populated city environments, where fast-paced lifestyles dominate, consumers are increasingly leaning toward convenient and high-performance cleaning solutions. As income levels rise, households are more inclined to spend on products that offer not only superior cleanliness but also time-saving features. Moreover, evolving lifestyles have led to greater acceptance of new product innovations and advanced cleaning formulations. This shift in consumer behavior is prompting companies to diversify their offerings and invest in R&D to bring forward novel, effective, and user-friendly solutions to meet changing market needs. As hygiene awareness and income levels continue to climb, the household cleaning products market is set to experience robust and sustained growth throughout the forecast period.

By product type, the market is divided into surface cleaners, toilet cleaners, glass and metal cleaners, floor cleaners, and others. The surface cleaners segment led the market in 2024 with an estimated revenue of USD 68.5 billion and is forecasted to grow at a CAGR of 6.5% between 2025 and 2034. These cleaners are essential for routine cleaning tasks, offering versatility across a range of surfaces, including counters, kitchen appliances, and furniture. Their ease of use and wide availability make them a staple in most households. Toilet cleaners follow closely in popularity, targeting disinfection, stain removal, and odor control. Glass and metal cleaners serve a more specific purpose by maintaining the clarity and shine of glass panes and metallic fittings, often offering streak-free finishes. Each category caters to distinct cleaning requirements, collectively fulfilling the hygiene needs of modern households.

In terms of ingredients, the household cleaning products market is segmented into Organic/Natural and Chemical/Synthetic categories. The Chemical/Synthetic segment dominated in 2024, accounting for 61% of the overall market share. It is expected to expand at a CAGR of over 6% from 2025 to 2034. The continued dominance of this segment can be attributed to its affordability, proven effectiveness, and wide consumer acceptance. Synthetic formulations often provide quicker results in cleaning, disinfecting, and stain removal, making them particularly popular in urban households and institutional settings. Continuous innovation has led to safer chemical profiles with fewer harsh side effects, enabling brands to position their offerings as powerful yet safe. Additionally, lower production costs and scalability contribute to the widespread availability of these products across both developed and emerging markets.

Regarding distribution channels, the household cleaning products market is categorized into online and offline platforms. In 2024, offline channels led with a market share of 58.9% and are projected to grow at a CAGR of 5.5% during the forecast period. Brick-and-mortar stores, including large-scale retailers, supermarkets, and neighborhood convenience stores, continue to be the primary shopping venues for cleaning products. Consumers often prefer in-person purchases due to the tactile nature of shopping, immediate product availability, and the opportunity to read labels and compare offerings on the spot. Additionally, offline retailers often provide added services like customer support, return policies, and product exchanges, which add value to the overall shopping experience. While online platforms are gaining momentum, offline stores remain deeply rooted in consumer buying behavior, especially for essential, frequently used household items.

In North America, the United States emerged as the leading market for household cleaning products, valued at USD 39.8 billion in 2024. The country is anticipated to grow at a CAGR of 6.7% between 2025 and 2034. Disinfection remains a top priority for American consumers, who are increasingly leaning toward non-toxic, biodegradable cleaning solutions. Environmental consciousness is influencing purchasing decisions, with more consumers opting for products that are free from harmful chemicals and safe for children and pets. This trend is encouraging manufacturers to introduce plant-based alternatives and sustainable packaging options. As awareness about health and sustainability rises, the U.S. market continues to push for innovation and transparency in product offerings.

Leading players shaping the competitive landscape of the household cleaning products industry include Church & Dwight, Bona, Cleansing Solutions, Colgate-Palmolive, Clorox, Ecolab, Kimberly-Clark, Henkel, Method Products, Reckitt Benckiser, Procter & Gamble (P&G), S. C. Johnson Professional, Seventh Generation, SC Johnson, and Unilever. These companies are actively expanding their product portfolios and leveraging both traditional and digital channels to capture consumer interest across global markets.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Household Cleaning Products market report include:- Bona

- Church & Dwight

- Cleansing Solutions

- Clorox

- Colgate-Palmolive

- Ecolab

- Henkel

- Kimberly-Clark

- Method Products

- Procter & Gamble (P&G)

- Reckitt Benckiser

- S. C. Johnson Professional

- SC Johnson

- Seventh Generation

- Unilever

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

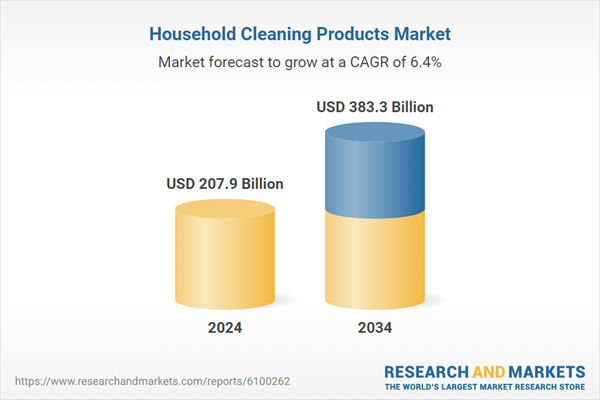

| Estimated Market Value ( USD | $ 207.9 Billion |

| Forecasted Market Value ( USD | $ 383.3 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |