Despite challenges such as tariffs that have increased the cost of solar modules, the overall market outlook remains positive. While tariff increases have led to higher costs for utility-scale projects, driving up the expense of solar systems by roughly 30%, the adoption of mounting systems in ground-mounted solar projects continues to grow.

The ground-mounted solar systems segment is anticipated to reach USD 44.5 billion by 2034, driven by increasing demand for renewable energy and the need for large-scale solar installations. Ground-mounted systems offer several advantages, including ease of installation and cost-effectiveness, especially in regions with large, inexpensive land areas. The affordability and scalability of these systems make them particularly attractive for utility-scale solar projects, where maximizing energy output while minimizing installation costs is critical. Technological advancements in mounting system design, materials, and installation techniques have significantly lowered the overall cost of these systems, further boosting their financial viability.

The utility segment accounted for 51.2% in 2024, reflecting the growing reliance on large-scale solar power projects to meet renewable energy targets and increase energy production. Ground-mounted solar systems, simpler and more affordable to deploy than tracking systems, are widely favored for utility-scale installations. The evolving financial and policy landscape, including government incentives and supportive regulations, continues to enhance the attractiveness of ground-mounted solutions in solar energy generation.

United States Fixed Solar PV Mounting Systems Industry was valued at USD 1.45 billion in 2024 driven by favorable political regulations, financial incentives, and rapid technological advancements. These factors are accelerating the adoption of solar PV systems, particularly for utility-scale projects. As the demand for renewable energy production continues to rise, deploying efficient solar mounting systems is expected to grow, contributing to the region's shift toward more sustainable and cleaner energy sources.

The Global Fixed Solar PV Mounting Systems Industry includes key players such as Aerocompact, Arctech, Clenergy, Convert Italia SPA, Esdec, K2 Systems GmbH, Mounting Systems, Schletter Group, UNIRAC, Versolsolar Hangzhou Co., Ltd., Xiamen Grace Solar New Energy Technology Co., Ltd. Companies in the fixed solar PV mounting systems industry implement several strategic initiatives. They prioritize innovation in design and technology to meet the growing demand for energy-efficient solutions. Many are investing in R&D to enhance product performance, including durability and ease of installation. Additionally, key players are expanding their product portfolios to cater to residential and commercial segments, ensuring they offer a range of systems that meet diverse customer needs. Strategic partnerships with solar module manufacturers and construction firms are also rising, enabling companies to streamline operations and expand market reach.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Fixed Solar PV Mounting Systems market report include:- Aerocompact

- Arctech

- Clenergy

- Convert Italia SPA

- Esdec

- K2 Systems GmbH

- Mounting Systems

- Schletter Group

- UNIRAC

- Versolsolar Hangzhou Co., Ltd.

- Xiamen Grace Solar New Energy Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

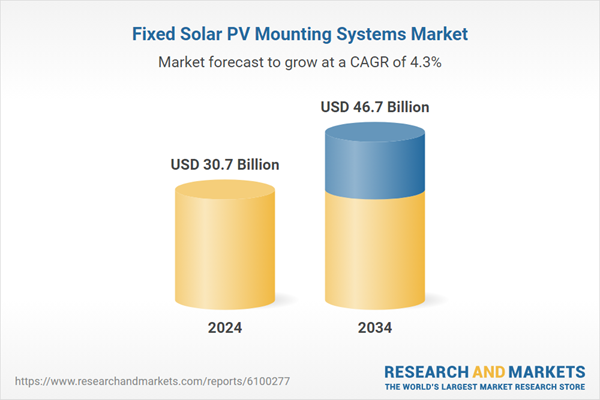

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 30.7 Billion |

| Forecasted Market Value ( USD | $ 46.7 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |