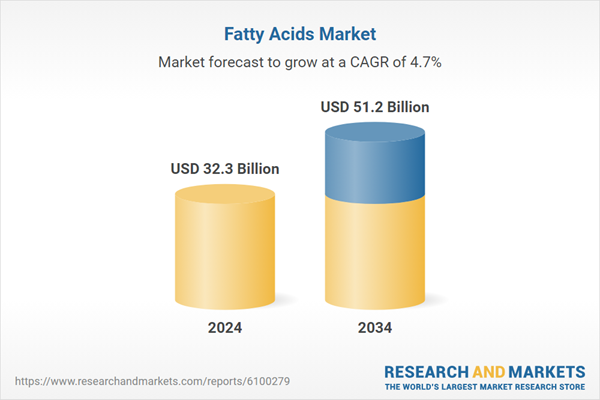

As a functional component, fatty acids have played a critical role in the food industry and have become a staple in personal care and pharmaceutical products due to their beneficial properties. The growing consumer shift toward plant-based and clean-label ingredients is expected to fuel future growth. Plant oils like coconut, soybean, and palm are projected to remain key sources. Advancements in refining and extraction technologies are also expanding the scope of industrial applications and elevating product quality. With rising interest in wellness and sustainability, demand for fatty acids is anticipated to maintain a robust upward trend.

In 2024, the polyunsaturated fatty acids (PUFAs) segment generated USD 12.9 billion and is forecasted to grow at a CAGR of 4.9% through 2034. These essential fatty acids hold a dominant position in the market due to their widespread use in functional foods, infant nutrition, dietary supplements, and therapeutic formulations. Known for their health-promoting properties - such as improving cardiovascular wellness, reducing inflammation, and supporting brain development - PUFAs are especially in demand in mature markets where awareness of omega-3 and omega-6 benefits is strong. The increasing focus on balanced nutrition and preventive health is further driving PUFA consumption across various applications.

Vegetable oils segment accounted for USD 12.1 billion in 2024, holding a 37.7% share and expected to grow at a CAGR of 4.9% through 2034. These oils dominate the raw material segment due to their widespread availability, affordability, and flexible applications across multiple industries. From food manufacturing and skincare to pharmaceuticals and industrial uses, vegetable oils form a reliable foundation for fatty acid extraction. The increasing consumer preference for natural, plant-derived alternatives over animal-based products is reinforcing demand. These oils contribute to sustainable supply chains in agribusiness and support the expansion of plant-based product offerings globally.

U.S. Fatty Acids Market was valued at USD 7.3 billion in 2024 and is projected to grow at a 4.5% CAGR between 2025 and 2034. Rising demand across the food, pharmaceutical, and industrial sectors has positioned the U.S. as a major market contributor. Consumers are increasingly valuing the nutritional and functional benefits of fatty acids, especially in fortified food products and supplements. The country’s strong manufacturing capabilities and infrastructure support consistent supply and innovation. Fatty acids are also finding growing applications in non-food sectors such as bio-lubricants, coatings, and renewable fuels. Regulatory emphasis on sustainable sourcing and clean-label products is fostering innovation and shaping market dynamics in favor of domestic manufacturers.

Noteworthy companies in the Global Fatty Acids Market include P&G Chemicals, Wilmar International Limited, BASF SE, Cargill Incorporated, and KLK Oleo’s. Leading companies in the fatty acids industry are focusing on broadening their product portfolios by developing high-purity and specialty fatty acid variants to meet evolving consumer and industrial needs. They are investing in eco-friendly production technologies to align with growing environmental standards and consumer expectations for sustainability. Many firms are also strengthening supply chains through backward integration and strategic partnerships with raw material suppliers. Geographic expansion in high-growth regions and increased R&D efforts aimed at exploring new applications in health, wellness, and bio-based industries are also central to their long-term growth strategies.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Fatty Acids market report include:- Akzo Nobel N.V.

- Archer Daniels Midland Company

- Baerlocher GmbH

- BASF SE

- Behn-Meyer Holding AG

- Calumet Specialty Products Partners, L.P.

- Cargill, Incorporated

- Chiba Fatty Acid Co. Ltd.

- Croda International Plc

- Eastman Chemical Company

- Emery Oleochemicals Group

- Evonik Industries AG

- Godrej Industries Limited

- IOI Oleochemical Industries Berhad

- Kao Corporation

- KLK OLEO

- Koninklijke DSM N.V.

- Musim Mas Holdings

- Oleofinos

- Oleon NV

- P&G Chemicals

- Stepan Company

- Twin Rivers Technologies

- Vantage Specialty Chemicals

- Wilmar International Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 32.3 Billion |

| Forecasted Market Value ( USD | $ 51.2 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |