The adoption of commission-free trading continues to reshape the e-brokerage space, eliminating traditional cost barriers and attracting a new generation of investors focused on affordability and ease of use. By removing fees that once discouraged frequent or small-scale trading, these platforms have democratized access to financial markets. This shift has opened the doors to younger, first-time investors who prioritize low-cost, tech-driven solutions and prefer managing their portfolios independently. Commission-free models also encourage higher trading activity and user engagement, which in turn generate revenue through alternative channels such as payment for order flow, margin lending, premium account tiers, and subscription-based financial tools.

Mobile trading segment held 44% share in 2024 and projected to grow at a CAGR of 9.8% through 2034. These platforms are preferred for their instant accessibility, real-time insights, and seamless transaction capabilities. Enhanced features like voice activation, biometric login, integrated analytics, and user-friendly dashboards further enhance their appeal. The inclusion of educational tools, gamified experiences, and social trading functions is also contributing to increased engagement among users, particularly younger investors.

Retail investors segment held 68% share in 2024 and is projected to maintain a CAGR of 9.8% through 2034. This dominance stems from the broader democratization of investment access, enabled by easy-to-use mobile applications and the removal of traditional entry barriers. The availability of fractional shares, extended trading hours, and digital assets such as ETFs and cryptocurrencies has made it easier for individuals with limited capital to invest actively. Rising awareness of financial planning and investment opportunities, supported by digital communities and real-time learning resources, continues to drive strong growth in this segment.

North America E-Brokerage Market held 92% share and generated USD 5.7 billion in 2024. The country’s leadership in the space is bolstered by high internet usage, widespread adoption of mobile finance apps, and a consumer base well-versed in digital investing. A well-established regulatory structure, combined with advanced tools for market analysis and data tracking, supports continuous platform innovation. The expanding interest in assets like cryptocurrencies and options, along with robust consolidation activity, is helping platforms evolve, differentiate, and scale within an increasingly competitive environment.

Leading names in the E-Brokerage Industry include SoFi Invest, Interactive Brokers, Fidelity Investments, Robinhood, Ally Invest, Vanguard, Upstox, Groww, Charles Schwab Corporation, and Merrill Edge (Bank of America). To strengthen their market foothold, major e-brokerage players are focusing on innovation, strategic acquisitions, and user-centric enhancements. Many firms are expanding their service offerings by integrating features such as robo-advisory tools, AI-driven analytics, and real-time market alerts. Platforms are also investing in global expansion strategies, targeting emerging markets where internet and smartphone use are rapidly rising. Strategic alliances with fintech firms, simplified onboarding processes, and the rollout of educational content for new investors are also critical approaches.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this E-Brokerage market report include:- Ally Invest

- Charles Schwab

- E*TRADE (Morgan Stanley)

- eToro

- Exness

- Fidelity Investments

- Firstrade

- Futu Holdings (Moomoo)

- Groww

- Interactive Brokers

- Merrill Edge (Bank of America)

- Robinhood

- SoFi Invest

- Tastytrade

- Tiger Brokers

- TradeStation

- Upstox

- Vanguard

- Webull

- Zerodha

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2025 |

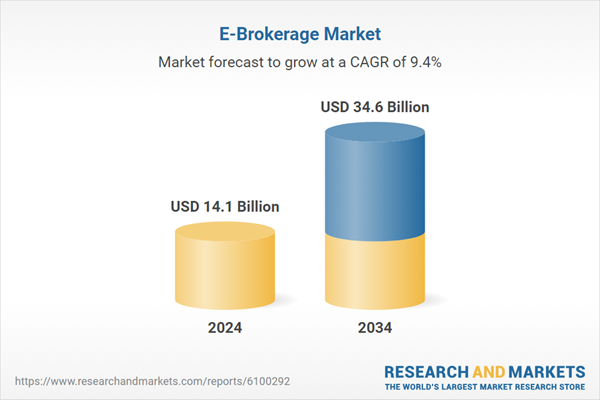

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 14.1 Billion |

| Forecasted Market Value ( USD | $ 34.6 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |