Governments worldwide are driving OEMs toward factory-installed telematics systems by enforcing strict safety and tracking regulations. Various mandates require all new vehicles to be equipped with features that support emergency alerts and automatic crash notifications. These legislative moves across countries such as India, Brazil, Russia, and EU nations are establishing connected safety technologies as a global standard, encouraging manufacturers to make telematics integration a priority. As a result, these government actions are not only enhancing public safety but also broadening consumer awareness and acceptance.

The embedded telematics segment generated USD 20 billion in 2024, by offering a seamless, secure, and high-performance solution compared to retrofit alternatives. Built directly into the vehicle’s architecture, these systems support continuous monitoring, OTA updates, remote diagnostics, and data gathering in real-time. Automakers prefer these embedded platforms due to their tighter control over vehicle data, better system compatibility, and integration with proprietary vehicle technology. As more vehicles become software-oriented, the demand for natively installed telematics continues to increase, driven by consumer preferences for instant connectivity and smart features from day one.

The passenger vehicles segment accounted for 71% share in 2024. Connectivity is no longer limited to luxury vehicles - compact cars, SUVs, and sedans are increasingly outfitted with integrated telematics from the factory. Even entry-level models are expected to include real-time performance tracking, OTA software capabilities, and remote service features. OEMs are tapping into data generated from daily driving to craft tailored infotainment services, predictive maintenance, and behavior-based insights, allowing for highly customized ownership experiences while unlocking recurring revenue streams.

United States Automotive OEM Telematics Market generated USD 10.5 billion in 2024, which held an 88% share. Leading American OEMs are enhancing their telematics capabilities through both in-house development and strategic technology alliances. These initiatives support the delivery of connected services, including diagnostics, real-time updates, vehicle health monitoring, and driver assistance features. With subscription models increasingly prevalent, automakers are transforming telematics data into dependable income channels, reinforcing the strategic value of integrated digital systems.

Key players actively shaping the Global Automotive OEM Telematics Industry include Tesla, Continental, Mercedes-Benz Group, Robert Bosch, Toyota Motor, Hyundai Motor Company, BMW Group, Ford Motor Company, General Motors, and Volkswagen Group. In the automotive OEM telematics market, companies are adopting multiple strategies to reinforce their competitive positioning and expand market presence. A key approach involves integrating telematics directly into vehicle platforms to deliver factory-installed solutions that enhance user experience and ensure seamless connectivity from day one. Automakers are also investing in proprietary software ecosystems that support over-the-air updates, diagnostics, and data-driven services. Strategic collaborations with tech firms and cloud service providers enable scalable and secure telematics infrastructure.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Automotive OEM Telematics market report include:- Aptiv

- BMW Group

- Continental

- Denso

- Ford Motor Company

- General Motors

- Harman International

- Honda Motor Company

- Hyundai Motor Company

- LG Electronics

- Marelli

- Mercedes-Benz Group

- Nissan Motor

- Panasonic Automotive Systems

- Robert Bosch

- Tesla

- Toyota Motor

- Valeo

- Visteon

- Volkswagen Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | May 2025 |

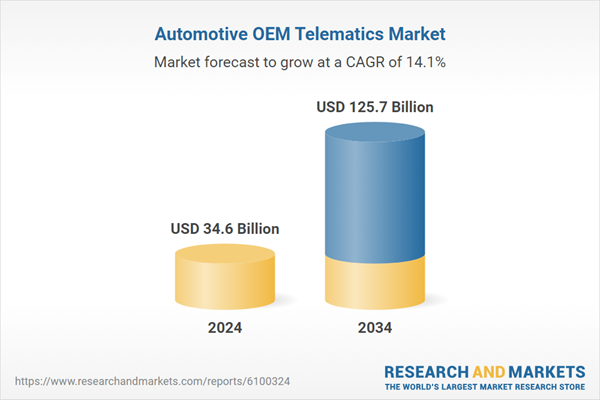

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 34.6 Billion |

| Forecasted Market Value ( USD | $ 125.7 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |