The growing intricacy of global supply chains has created a need for predictive analytics and real-time data, allowing businesses to analyze massive amounts of data from sensors, GPS, and enterprise resource planning (ERP) systems to optimize inventory management and reduce costs. AI helps companies adapt quickly to shifts in market conditions, prevent disruptions, and improve customer satisfaction. The expansion of e-commerce and omnichannel retail further emphasizes the need for speed, accuracy, and flexibility, where AI technologies help streamline order processing, automate delivery schedules, and forecast customer behavior.

In 2024, the software sector led the market with a share of 56%, anticipated to grow at a CAGR of 26% through 2034. Software helps in empowering intelligent decision-making, automation, and real-time data analysis throughout the supply chain. AI-driven software solutions, including route optimization, demand forecasting, and warehouse automation, are widely adopted by logistics providers to optimize operations, reduce costs, and enhance efficiency. These solutions are key to improving planning accuracy, minimizing human error, and quickly adjusting to market fluctuations. The emphasis on predictive analytics and real-time visibility significantly contributes to the growing demand for AI-powered software applications.

The machine learning (ML) segment held a 47% share in 2024. Its capability to process massive datasets and generate actionable insights in real time makes it essential for analyzing structured and unstructured data from IoT devices, GPS systems, and customer interactions. ML algorithms optimize inventory management, uncover demand patterns, and eliminate operational bottlenecks, thus enhancing efficiency and cost-effectiveness. These algorithms evolve continuously, providing predictive insights and automation opportunities that outperform traditional systems.

United States AI in the Logistics and Supply Chain Market held an 85% share and generated USD 6.2 billion in 2024 due to its advanced digital infrastructure and widespread adoption of emerging technologies. U.S.-based logistics firms are among the first to integrate AI for solutions such as route optimization, demand forecasting, warehouse automation, and predictive maintenance. The country's leading position is further bolstered by the presence of major tech companies and AI providers, accelerating AI adoption in logistics. Public and private sector investments in AI research and development, coupled with government initiatives like the National AI Initiative Act, support the adoption of AI technologies across the logistics and supply chain landscape.

Prominent players in the AI in Logistics and Supply Chain Market include Amazon Web Services, Oracle, Blue Yonder, SAP SE, FourKites, C3.ai, Google, Microsoft, IBM, and Manhattan Associates. To strengthen their market position, companies are focusing on strategic partnerships and acquisitions to enhance their AI capabilities and broaden service offerings. Leveraging cutting-edge technologies, these companies are integrating machine learning, robotics, and automation into logistics and supply chain operations to improve efficiency and reduce costs. Many firms invest in AI-driven software solutions for real-time analytics, route optimization, and demand forecasting, allowing them to stay competitive in a rapidly evolving market. Additionally, AI solution providers are increasing their focus on the e-commerce sector, ensuring quick, flexible, and accurate delivery systems to meet growing consumer expectations.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this AI in Logistics and Supply Chain market report include:- Amazon Web Services

- Blue Yonder

- C3.ai

- ClearMetal

- Fetch Robotics

- FourKites

- Fetch Robotics

- FourKites

- GE Digital

- Honeywell International

- Infor

- Körber Supply Chain

- Llamasoft

- Manhattan Associates

- Microsoft Corporation

- NVIDIA Corporation

- SAP SE

- Siemens AG

- Zebra Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | May 2025 |

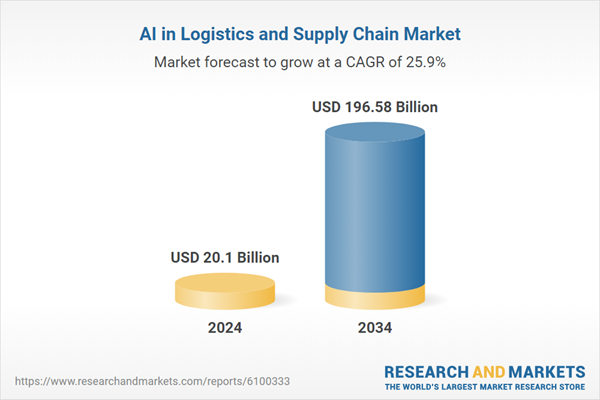

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 20.1 Billion |

| Forecasted Market Value ( USD | $ 196.58 Billion |

| Compound Annual Growth Rate | 25.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |