As environmental consciousness continues to influence consumer behavior, the U.S. market is set to expand significantly. Electric mowers are gaining popularity for their green attributes and integration with smart technologies like AI and GPS, improving navigation and safety. With intelligent systems that detect and avoid obstacles, these machines deliver enhanced performance in commercial and residential landscapes. Manufacturers are increasingly pivoting toward compact, efficient, and user-friendly designs to attract a broader customer base.

By battery type, the lead acid batteries segment generated USD 706.8 million in 2024. These batteries are more economical to manufacture compared to lithium-ion versions and continue to attract cost-conscious buyers across commercial and residential sectors. Their ease of recycling adds an environmentally responsible dimension, especially appealing in jurisdictions with strict ecological mandates. Although they offer lower energy density, their durability and low upfront cost make them a practical choice for users prioritizing affordability over extended runtimes or rapid charging.

Based on applications, the playgrounds segment captured a 73.9% share in 2024, illustrating its vital role in driving overall demand. The segment’s growth is fueled by the operational silence and zero-emission functionality of electric mowers critical in noise-sensitive areas like schools and parks. Their ability to maintain even, well-manicured turf helps prevent the spread of allergens and weeds, promoting a safer, cleaner play environment. These benefits make electric mowers a practical solution for institutions to maintain high-traffic public spaces.

United States Electric Zero Turn Mower Market generated USD 842.8 million in 2024, driven by a mix of regulatory support, increased environmental awareness, and rising demand from municipalities and landscaping contractors. Incentive programs and tax rebates have played a major role in encouraging adoption, while the country’s broader push toward decarbonization has positioned electric landscaping equipment as a mainstream alternative. As infrastructure investments continue and electric mower technology becomes increasingly accessible, the U.S. is poised to remain the primary engine of growth for the regional market over the coming decade.

Key players in this sector include RYOBI, EcoTeq, SCAG Power Equipment, Bobcat Company, Briggs & Stratton Corporation, Greenworks Tools, EGO POWER+, Honda Power Equipment, Swisher Inc, The Toro Company, MTD Products, Hustler Turf Equipment, Ariens Company, Deere & Company, Husqvarna Group, CRAFTSMAN, Generac Power Systems, Inc., Cub Cadet, and Kubota Corporation.

To strengthen their market position, companies focus on battery innovation, cost optimization, and product differentiation through smart technology integration. Manufacturers are developing AI-powered features, improving energy efficiency, and expanding product lines tailored to residential, commercial, and municipal needs. Many collaborate with local retailers and leverage e-commerce platforms to widen their distribution network. Eco-centric branding, investment in R&D, and enhanced after-sales service offerings are central to building long-term customer loyalty in a rapidly evolving market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this North America Electric Zero Turn Mower market report include:- Ariens Company

- Bobcat Company

- Briggs & Stratton Corporation

- CRAFTSMAN

- Cub Cadet

- Deere & Company

- EcoTeq

- EGO POWER+

- Generac Power Systems, Inc.

- Greenworks Tools

- Honda Power Equipment

- Husqvarna Group

- Hustler Turf Equipment

- Kubota Corporation

- Kubota Tractor Corporation

- MTD Products

- RYOBI

- SCAG Power Equipment

- Swisher Inc

- The Toro Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | May 2025 |

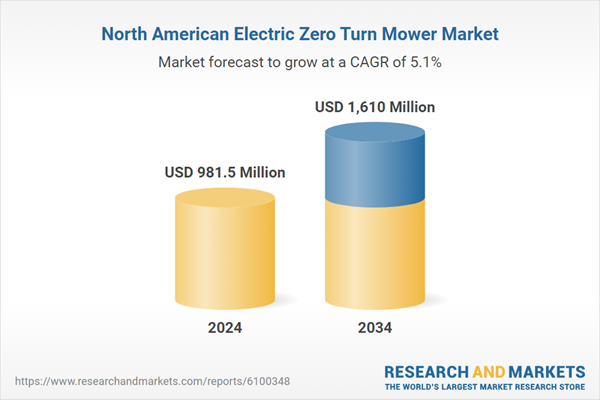

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 981.5 Million |

| Forecasted Market Value ( USD | $ 1610 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 21 |