To tackle these challenges, there is a strong focus on wastewater treatment, recycling, and reuse, particularly in urban and industrial settings. As freshwater resources become more limited, industries are increasingly looking to treat and recycle process water not only to reduce competition for surface and groundwater but also to cut down on the costs associated with sourcing fresh water. Wastewater reuse technologies, such as robotic bio-reactors, reverse osmosis (RO), ultrafiltration (UF), and zero-liquid discharge (ZLD) systems, are gaining traction across the region as solutions to address water scarcity.

The membrane systems segment contributed USD 7.4 billion in 2024 and is projected to grow at a CAGR of 7.7% between 2025 and 2034. As the demand for clean drinking water rises due to factors like pollution, water scarcity, and limited freshwater resources, membrane technologies, including ultrafiltration, nanofiltration, microfiltration, and reverse osmosis, are becoming increasingly popular. These systems are compact, reliable, and capable of providing high-quality water output, making them ideal for water treatment in industrial hubs and urban areas facing water challenges. Countries with high levels of industrial activity, such as China, India, and Singapore, are leveraging membrane systems to reduce wastewater and restore usable water supplies.

The reverse osmosis (RO) segment held a 33.7% share in 2024 and is expected to grow at a rate of 6.6% through 2034. Reverse osmosis has become a key technology in the water treatment market due to its efficient purification capabilities. In regions dealing with critical issues such as groundwater contamination, industrial discharge, and water shortages, RO membranes are vital in municipal and industrial water treatment systems. RO is effective at removing dissolved salts, heavy metals, and organic contaminants, making it essential for producing clean water in both urban and industrial environments.

China Water Treatment Equipment Market held a 34.8% share, with an estimated USD 9.5 billion in 2024. The Chinese government has made substantial investments in improving water quality and enhancing water treatment infrastructure to combat pollution. This government focus has stimulated the adoption of advanced technologies such as membrane filtration, ultraviolet disinfection, and reverse osmosis systems, further contributing to the growth of the water treatment equipment market.

Key players in the Asia-Pacific Water Treatment Equipment Market include Xylem, Veolia Water Technologies, Toray Industries, Pentair, Suez Water Technologies & Solutions, Mitsubishi Chemical Aqua Solutions, Lenntech, Organo, Hyflux, Hitachi Aqua-Tech Engineering, Kurita Water Industries, Thermax, Evoqua Water Technologies, Aqua-Tech Solutions, and Ebara. To strengthen their market presence and foothold in the Asia-Pacific region, companies are focusing on product innovation, expanding their service offerings, and forming strategic partnerships. These firms are investing heavily in research and development to create cutting-edge water treatment solutions, particularly in membrane technologies, which address growing concerns over water scarcity and quality. Companies are also focusing on automation and remote monitoring capabilities to improve the efficiency and reliability of their systems.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Asia-Pacific Water Treatment Equipment market report include:- Aqua-Tech Solutions

- Ebara

- Evoqua Water Technologies

- Hitachi Aqua-Tech Engineering

- Hyflux

- Kurita Water Industries

- Lenntech

- Mitsubishi Chemical Aqua Solutions

- Organo

- Pentair

- Suez Water Technologies & Solution

- Thermax

- Toray Industries

- Veolia Water Technologies

- Xylem

Table Information

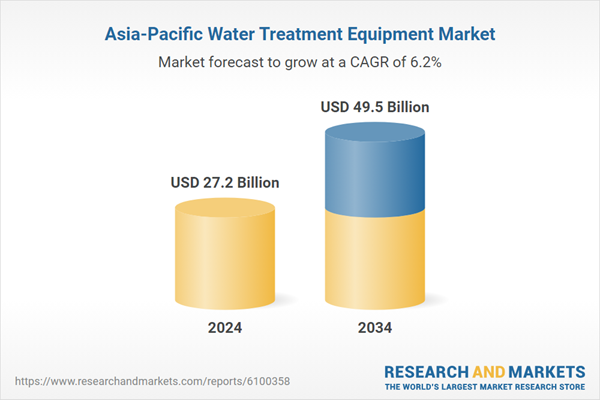

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 27.2 Billion |

| Forecasted Market Value ( USD | $ 49.5 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 16 |