India In Vitro Diagnostics Market Overview

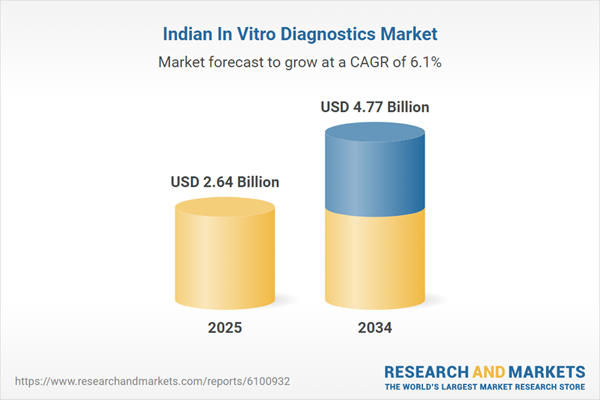

In vitro diagnostics (IVD) encompass medical tests conducted on biological samples such as blood, urine, or tissues to detect diseases, monitor health conditions, and support clinical decision-making. These diagnostics play a vital role in preventive healthcare, disease management, and personalized medicine. The market was valued at USD 2.64 Billion in 2024 and is experiencing significant growth, driven by rising healthcare awareness, increased prevalence of chronic diseases, and advancements in diagnostic technologies. Expanding healthcare infrastructure and greater emphasis on early and accurate diagnosis further support market expansion.India In Vitro Diagnostics Market Growth Drivers

Rising Burden of Non-Communicable Diseases to Drive Growth in the Market

The escalating prevalence of chronic and non-communicable diseases (NCDs) in India is a key driver of growth in the in vitro diagnostics market. According to the Ministry of Science and Technology, Government of India, NCDs are responsible for 53% of all deaths and contribute to 44% of disability-adjusted life years lost across the country. This substantial disease burden necessitates early and accurate diagnosis, leading to increased demand for advanced in vitro diagnostic technologies. Consequently, the rising incidence of NCDs is expected to significantly propel the expansion of the market in the coming years.India In Vitro Diagnostics Market Trends

The market is experiencing several key trends, including in vitro diagnostics companies expanding their direct operations and local manufacturing in India, alongside the growth of disease-specific in vitro diagnostic solutions:Localization and Direct Operations Driving Expansion in the Market

One of the significant trends include companies expanding direct operations and local manufacturing in India is reshaping the market landscape. In August 2024, Sysmex India strengthened its footprint by establishing state-of-the-art reagent manufacturing facilities and shifting from distribution partnerships to direct operations. This move enhances product availability, ensures supply chain stability, and improves customer support, collectively boosting market growth and fostering greater adoption of IVD solutions across India.Rising Application of In Vitro Diagnostics Across Various Diseases to Elevate the India In Vitro Diagnostics Market Demand

There is a trend towards using in vitro diagnostics (IVDs) in various conditions such as diabetes, cardiovascular diseases, and infectious diseases. This is increasing the demand for precise diagnostic tools. For example, in April 2024, the World Health Organization (WHO) expanded its prequalification scope to include diabetes-related IVDs like blood glucose and HbA1c tests. This shift toward targeted diagnostics is expected to accelerate market growth by improving disease management and patient outcomes.

India In Vitro Diagnostics Market Segmentation

The market report offers a detailed analysis of the market based on the following segments:

Market Breakup by Product & Services

- Reagents and Kits

- Instruments

- Software and Services

Market Breakup by Technology

- Immunodiagnostics

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Enzyme-Linked Immunospot (ELISPOT)

- Rapid Tests

- Radioimmunoassay (RIA)

- Western Blotting

- Others

- Clinical Chemistry

- Basic Metabolic Panels

- Liver Panels

- Renal Profiles

- Lipid Profiles

- Thyroid Function Panels

- Electrolyte Panels

- Specialty Chemical Tests

- Molecular Diagnostics

- Polymerize Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Hybridization

- DNA Diagnostics

- Microarray

- Others

- Hematology

- Microbiology

- Coagulation and Haemostasias

- Urinalysis

- Others

Market Breakup by Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Drug Testing/Pharmacogenomics

- HIV/AIDS

- Autoimmune Diseases

- Nephrology

- Others

Market Breakup by End User

- Hospitals

- Diagnostic Centers

- Point-of-Care Testing

- Academic Institutes

- Others

Market Breakup by Region

- Northern and Central

- Southern

- Eastern

- Western

India In Vitro Diagnostics Market Share

Reagents and Kits Segment is Likely to Lead the Market

The market encompasses three primary segments based on products and services, including reagents and kits, instruments, and software and services. The reagents and kits segment is expected to hold a significant share in the market, driven by its critical role in diagnostic testing. For instance, in May 2022, Cipla Limited introduced the ‘RT-Direct’ multiplex COVID-19 RT-PCR test kit, validated by the Indian Council of Medical Research, exemplifying the increased adoption of advanced diagnostic kits. This growth is supported by rising incidences of chronic and infectious diseases and advancements in point-of-care testing technologies.Leading Players in the India In Vitro Diagnostics Market

The key features of the market report comprise funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Abbott

Founded in 1888 and headquartered in Abbott Park, Illinois, Abbott is a leading global healthcare company. In February 2025, Abbott received FDA clearance for its self-collected Simpli-COLLECT molecular test for sexually transmitted infections. This innovation strengthens Abbott’s role in in vitro diagnostics market by enhancing accessible, accurate molecular testing solutions.Qiagen

Qiagen continues to drive innovation in molecular diagnostics with plans to launch three automated sample preparation instruments by 2026, including the high-throughput QIAsymphony Connect and QIAsprint Connect systems. Founded in 1984, the company leverages these technologies to enhance laboratory efficiency and precision, solidifying its significant role in the expanding in vitro diagnostics market.Quidel Corporation

Quidel Corporation, headquartered in San Diego, California, has a significant presence in the market. The company offers MicroVue diagnostic products, including ELISA kits for assessing bone health and complement system activity. These specialized immunoassays help monitor bone turnover and immune function, supporting early diagnosis and clinical decision-making across diagnostic laboratories in India.Danaher Corporation

Danaher Corporation is headquartered in Washington, DC, and was established in 1984. Through its subsidiary, Beckman Coulter, the company specializes in innovative in vitro diagnostic systems that support disease detection, treatment decisions, and patient monitoring. The company’s advanced diagnostic technologies contribute significantly to addressing the rising burden of chronic diseases and improving healthcare outcomes.Other key players in the market include F. Hoffmann-La Roche Ltd, Transasia Bio-Medicals Ltd, Bio-Rad Laboratories, Inc., bioMérieux SA, Thermo Fisher Scientific Inc., and Sysmex Corporation.

Key Questions Answered in the India In Vitro Diagnostics Market Report

- What was the India in vitro diagnostics market value in 2024?

- What is the India in vitro diagnostics market forecast outlook for 2025-2034?

- What major factors aid the India in vitro diagnostics market demand?

- How has the market performed so far, and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- What are the major trends in the India in vitro diagnostics market?

- Which product and services is expected to dominate the market segment?

- Which technology is projected to lead the market segment?

- Which application is anticipated to drive the market segment?

- Which end user is likely to dominate the market segment?

- Who are the key players involved in the India in vitro diagnostics market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Abbott

- Qiagen

- Quidel Corporation

- Danaher Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.64 Billion |

| Forecasted Market Value ( USD | $ 4.77 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 4 |