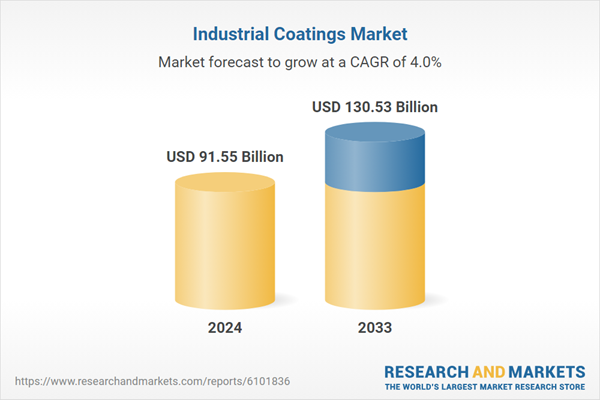

Industrial Coatings Global Market Report by Product (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others), Technology (Solvent Borne, Water Borne, Powder Based, Others), End User (General Industrial, Marine, Automotive and Vehicle Refinish, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others), Countries and Company Analysis, 2025-2033.

Global Industrial Coatings Industry Overview

In manufacturing and industrial environments, industrial coatings are applied to a variety of surfaces to increase performance, improve appearance, and offer protection. These consist of corrosion-resistant coatings, epoxy, polyurethane, and powder. They are designed to resist corrosion, wear and tear, chemicals, and extreme environmental conditions. They stop rust and corrosion by forming a barrier between the underlying material and corrosive substances like chemicals and moisture. They support the durability and functionality of machinery, buildings, and goods in a variety of sectors, including manufacturing and the automobile industry.The need for coatings to shield buildings, bridges, and other structures from weather and wear is being driven by the world's rapid urbanization and infrastructure initiatives. Furthermore, the market is expanding due to the growing usage of antimicrobial coatings in the healthcare sector to preserve clean surfaces, especially in hospitals and other healthcare facilities. In addition, the need for specialized coatings to improve performance, durability, and weather resistance is being driven by the expansion of renewable energy sources like solar panels and wind turbines. The market is also expanding due to the extensive use of coatings in the maritime industry for anti-fouling and anti-corrosion, friction reduction, and fuel efficiency improvements.

Nippon Paint Holdings Co., Ltd., BASF SE, AKZO NOBEL N.V., and PPG Industries Inc. are a few of the significant businesses that are actively involved in the industry. The existence of major international and regional companies makes the industry extremely competitive. Some of the businesses have several routes for producing and distributing their final goods worldwide, and they are integrated across the value chain. For example, AkzoNobel N.V. introduced the Interpon D Stone Effect, a new powder coating product, in July 2023. The substance assists in giving metal surfaces a texture similar to that of genuine stone. It aids in creating a stone appearance in a more economical and ecological manner.

Key Factors Driving the Industrial Coatings Market Growth

Smart coatings and digitization

The market is being pushed by the growing trend toward digitization and smart coatings, which is being fueled by Industry 4.0 and the Internet of Things (IoT). Smart coatings are designed to change their characteristics in response to outside stimuli including light, moisture, and temperature. Global demand for these coatings is also being driven by the aerospace industry's growing use of them to identify structural deterioration and give real-time feedback on the state of aircraft. In addition, the market is expanding due to the growing use of self-healing coatings in the automobile sector, which fix small dings and scratches. Additionally, by incorporating sensors and data gathering tools into coatings, predictive maintenance and remote monitoring are made possible, which lowers operating expenses and downtime.Combining cutting-edge technology

Another significant element driving the market expansion is the use of nanotechnology into industrial coatings. In order to improve characteristics like hardness, scratch resistance, and anti-corrosion performance, nanocoatings manipulate particles at the nanoscale. In addition, the market is expanding due to the growing need for coatings that provide exceptional durability and protection across various industrial verticals. Additionally, the need for nanocoatings is being driven internationally by their growing application in the electronics, automotive, and aerospace sectors due to their capacity to create thin, lightweight, and extremely effective protective layers. Furthermore, the market is being favorably impacted by the extensive use of these coatings in food processing and healthcare.Sustainability and environmental regulations

One of the main drivers of the market's expansion is the growing awareness of environmental sustainability among people and businesses. In addition, firms are being encouraged to embrace greener techniques by the growing demand for environmentally friendly and sustainable products. Companies are also spending money on research and development to produce coatings that function well but have a less environmental effect. In addition, international organizations and national regulatory bodies are enforcing increasingly stringent laws against volatile organic compounds (VOCs) and dangerous chemicals used in coatings. As a result, low-VOC, water-based coatings that are environmentally benign and in line with global sustainability goals are being developed.Challenges in the Industrial Coatings Market

Raw Material Price Volatility

The price volatility of raw materials, especially resins, solvents, and pigments, presents serious difficulties for the industrial coatings industry. These price swings are caused by a number of variables, including shifting demand, supply chain interruptions, and geopolitical conflicts. For example, paint makers now face higher prices as a result of the European Union's taxes on Chinese imports of titanium dioxide, which has prompted worries about possible bankruptcy and the necessity of moving production. Paint costs also increased significantly as a consequence of supply chain disruptions brought on by the COVID-19 epidemic; since early 2020, the Producer Price Index for paint and coating manufacture has increased by more than 28%. Manufacturers are challenged by these cost constraints to continue being profitable while maintaining product quality and adhering to legal requirements.Technological Advancements and Innovation

Continuous technical innovation is required to meet the need for advanced coatings with qualities like improved corrosion resistance and self-healing capabilities. Novel materials like hexagonal boron nitride are being investigated for anticorrosion coatings as a result of advancements in materials science. Furthermore, covalent and reversible networks have been integrated into self-healing elastomers to increase their mechanical strength and longevity. Nevertheless, there are drawbacks to these developments, such as the requirement for specific expertise, the high expense of research and development, and the difficulty of expanding manufacturing procedures. Investing in such cutting-edge technology may be especially difficult for smaller enterprises, which might put them at a competitive disadvantage in the market.Industrial Coatings Market Overview by Regions

Economic activity, industrialization, and regulatory frameworks all have an impact on the geographical variations in the industrial coatings industry. Due to its industrial hubs in China and India, Asia-Pacific holds the largest market share. Due to demand from the infrastructure, automotive, and aerospace industries, North America and Europe continue to hold sizable shares. Although their contributions are less, Latin America, the Middle East, and Africa are growing as a result of infrastructural and industrial development. The following provides a market overview by region:United States Industrial Coatings Market

Protective, ornamental, and specialized coatings for a range of sectors, including manufacturing, automotive, aerospace, and construction, are all part of the vibrant U.S. industrial coatings industry. The market is dominated by major companies like Sherwin-Williams, PPG Industries, and Akzo Nobel, who provide a variety of goods such powder, solventborne, and waterborne coatings. Recent patterns show a move toward environmentally friendly solutions, with strict environmental restrictions driving up demand for low-VOC and sustainable coatings. High-performance coatings, such as self-healing and corrosion-resistant formulations, have been developed as a result of technological breakthroughs, increasing the lifespan and durability of products. The sector faces difficulties such labor shortages and fluctuating raw material prices, which affect manufacturing costs and service quality despite growth potential.United Kingdom Industrial Coatings Market

The UK market for industrial coatings is a thriving industry that includes protective, ornamental, and specialized coatings for a range of sectors, such as manufacturing, automotive, aerospace, and construction. The market is dominated by major companies like PPG Industries and AkzoNobel, which provide a variety of goods such powder, solventborne, and waterborne coatings. Recent patterns show a move toward environmentally friendly solutions, with strict environmental restrictions driving up demand for low-VOC and sustainable coatings. High-performance coatings, such as self-healing and corrosion-resistant formulations, have been developed as a result of technological breakthroughs, increasing the lifespan and durability of products. The sector faces difficulties such labor shortages and fluctuating raw material prices, which affect manufacturing costs and service quality despite growth potential.India Industrial Coatings Market

The market for industrial coatings in India is expanding significantly due to the country's fast industrialization, growing manufacturing sector, and improved infrastructure. The need for ornamental and protective coatings is fueled by the large customer bases of the appliance, construction, and automobile sectors. Due to stricter environmental restrictions and a greater focus on sustainability, manufacturers are progressively implementing eco-friendly solutions, such as waterborne coatings and low-VOC. High-performance coatings, such as formulas that are corrosion-resistant and self-healing, have been developed as a result of technological developments, increasing the longevity and durability of products. Notwithstanding the optimistic outlook, issues like labor shortages and fluctuating raw material prices continue to affect manufacturing costs and service quality. Among the major participants in the industry are Kansai Nerolac, Asian Paints, and Berger Paints.United Arab Emirates Industrial Coatings Market

Due to the country's ambitious Vision 2030 project, which aims to diversify the economy and lessen reliance on oil earnings, the Saudi Arabian industrial coatings market is expected to rise significantly. Important industrial centers that serve a variety of sectors, including manufacturing and petrochemicals, such as Sudair Industrial City and Jubail Industrial City, the biggest industrial city in the world, are essential to this transition. Demand for locally made coatings is increased by the government's "Made in Saudi" initiative, which further promotes domestic production. Furthermore, the need for innovative coatings solutions is being driven by the growth of infrastructure projects like NEOM and The Red Sea Global. High-performance and sustainable coatings are becoming more and more important as the market develops in order to satisfy industrial demands and environmental norms.Recent Developments in Industrial Coatings Industry

- BASF SE said in July 2023 that all of the energy used to make their automobile OEM coatings comes from renewable sources. This is an effort by the corporation to lower its carbon emissions.

- Kansai Paint Co. Ltd. announced in May 2023 that it has acquired the global Railway Coatings business assets from Beckers Group.

Market Segmentations

Product

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Technology

- Solvent Borne

- Water Borne

- Powder Based

- Others

End User

- General Industrial

- Marine

- Automotive and Vehicle Refinish

- Electronics

- Aerospace

- Oil and Gas

- Mining

- Power Generation

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Wacker Chemie AG

- Akzo Nobel N.V.

- Nippon Paint Holdings Co., Ltd

- Jotun

- The Sherwin-Williams Company

- BASF SE

- Chugoku Marine Paints Ltd.

- Kansai Paint Co. Ltd.

- PPG Industries Inc.

- Axalta Coating Systems Ltd.

Table of Contents

Companies Mentioned

- Wacker Chemie AG

- Akzo Nobel N.V.

- Nippon Paint Holdings Co., Ltd

- Jotun

- The Sherwin-Williams Company

- BASF SE

- Chugoku Marine Paints Ltd.

- Kansai Paint Co. Ltd.

- PPG Industries Inc.

- Axalta Coating Systems Ltd.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 91.55 Billion |

| Forecasted Market Value ( USD | $ 130.53 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |