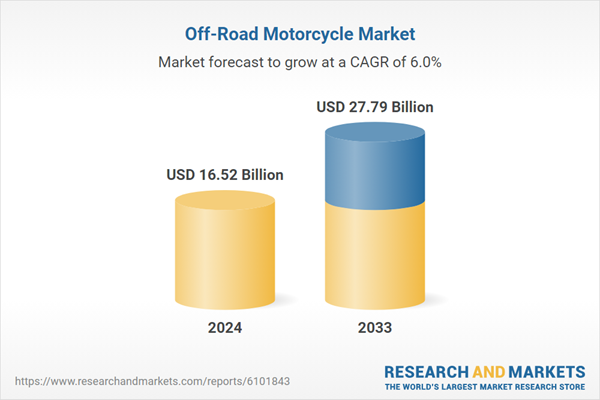

Off-Road Motorcycle Market Report by Type (Motocross Motorcycles, Enduro Motorcycles, Trail Motorcycles, Track-racing Motorcycles), Application (Commercial, Personal, Industrial, Others), Engine Capacity (Less than 500 cc, 500 cc to 1000 cc, More than 1000 cc), Price Range (Low to Mid, High), Countries and Company Analysis 2025-2033.

Off-Road Motorcycle Market Overview

A motorbike specifically designed to navigate tough, rough landscape, such as dirt paths, mud, boulders, and sand, is referred to as an off-road motorcycle. Off-road motorbikes, unlike street motorbikes, possess high ground clearance, knobby tires, long-travel suspensions, and light frames for better traction and shock absorption. They are often used for recreational activities such as enduro racing, motocross racing, and trail riding. To reduce weight and enhance mobility, the motorcycles often have minimalist designs. To resonate with eco-conscious riders, some are electric. Off-road motorcycles are popular among adventurers and nature enthusiasts because they give riders the opportunity to explore difficult terrain.Growing interest in adventure travel and outdoor recreation is driving the off-road motorbike market by enticing more people to try off-road riding. Technological advancements that increase ride quality and draw enthusiasts include lightweight materials, improved engine performance, and sophisticated suspension systems. Programs targeting the youth are designed to promote early entry and skills acquisition, thus increasing the market. A growing awareness of environmental issues is pushing demand for more environmentally friendly, battery-powered off-road motorcycles. Competition sport such as enduro and motocross popularizing activity inspires innovation and publicity for the product, thus increasing popularity. Strong communities supporting off-road motor bike and frequent organized competitions increase participation and sales in the global off-road motorbike market.

Growth Drivers for the Off-Road Motorcycle Market

Increasing popularity of outdoor recreational activities and adventure tourism

Off-road motorbike market growth is being driven by growing interest in adventure travel and outdoor leisure pursuits. Many more people are looking for exciting nature-based activities, and off-road riding offers a unique opportunity to experience untamed landscapes, trails, and isolated locations. Both expert and inexperienced riders are urged to buy off-road motorcycles by the increasing popularity of outdoor recreation. Off-road cycling is increasingly popular all over the globe as adventure tourism companies offer it as part of their packages. Furthermore, the need for tough, versatile motorcycles that could travel on many types of landscapes is being fueled by the quest for active outdoor lifestyles. This trend helps to create long-term market growth by increasing the clientele and stimulating new riding trails, activities, and facilities to be built.Technological advancements

Technological progress is driving the off-road motorcycle market expansion. Car makers are constantly finding new ways to enhance rider comfort, safety, and performance. New developments in suspension technology, lightweight components, and more efficient engines are increasing the capabilities and usability of off-road motorcycles. The new 2025 KTM 390 Adventure was spied testing on Indian roads during September 2024 as KTM were preparing to launch it. The new bike boasts a twin round LED headlamp setup, a taller position, increased ground clearance, and a beefier design. It's expected to go international later in 2025, powered by a new 399cc engine. The industry's emphasis on changing customer needs and off-road performance is reflected in these technological advancements.Rising disposable incomes and lifestyle shifts towards adventure and thrill-seeking

The market for off-road motorcycles is growing significantly due to factors like rising disposable incomes and changing attitudes toward adventure and thrill-seeking. Consumers, especially those in younger demographics, are investing more in outdoor and exciting recreational activities as their financial situation improves. These adventure-seekers are attracted to off-road bikes as they present a thrilling way of traversing challenging landscapes and remote areas. In addition, the thrill of off-road motorcycle riding has been brought to the mainstream through social media and online platforms, which has led to more individuals embracing the sport as a hobby or lifestyle. Because rising salaries are making it possible for first-time purchasers to enter the market, this trend is especially prominent in emerging nations. In order to satisfy these aspirational customers, manufacturers are extending their product portfolios, which is speeding up market expansion.Challenges in the Off-Road Motorcycle Market

High Initial Costs

One major obstacle in the off-road motorbike business is the high startup expenses. Higher production costs are a result of the advanced components used in the design of these motorcycles, which include high-performance engines, long-lasting suspension systems, and tires made specifically to endure rough terrain. Because of this, the retail price may be too high for novice riders or buyers on a tight budget, particularly in developing nations. The whole investment is further increased by the requirement for maintenance, transportation, and protective gear. Affordability is a major obstacle to long-term market expansion and wider consumer reach since it restricts market penetration and delays acceptance among new customers.Limited Infrastructure

In the market for off-road motorcycles, inadequate infrastructure is a significant obstacle. For off-road riding to be safe and legal, many areas lack the defined trails, riding parks, and associated infrastructure that are required. Because of land use restrictions, environmental concerns, or a lack of public investment in recreational infrastructure, access to off-road terrain is sometimes limited in metropolitan and semi-urban locations. Potential riders are deterred by this shortage, which also reduces the number of options for training sessions or planned competitions. Inadequate trail connectivity, maintenance, and signage can also result in safety hazards and lower rider satisfaction. Despite growing interest in off-road adventures, industry growth may be limited in the absence of adequate infrastructure development.United States Off-Road Motorcycle Market

The growing popularity of motorsports and outdoor leisure activities is fueling the off-road motorbike market's steady expansion in the US. The updated Pan America 1250, a multipurpose adventure touring motorcycle with five pre-programmed Ride Modes, including an off-road mode, was introduced by Harley-Davidson in April 2023. This model's off-road skills are improved with a 1250cc Revolution Max V-twin engine that produces 150 horsepower, sophisticated suspension systems, and electronic aids including traction control and cornering ABS. The launch of the Pan America 1250 highlights the rising need for motorcycles that satisfy riders looking for a variety of riding experiences by providing both off-road performance and on-road comfort.Germany Off-Road Motorcycle Market

The market for off-road motorcycles in Germany is expanding gradually due to growing interest in motorsports and outdoor recreation. Customers are looking for motorcycles that are tough and adaptable enough to tackle difficult terrain. The market's growth is mostly attributed to the popularity of off-road trips and adventure travel. A great riding environment is offered by Germany's vast network of off-road trails and tracks, which draw both local enthusiasts and visitors. Furthermore, there is a growing trend toward electric off-road motorcycles, which reflects consumers' increased awareness of environmental issues. This change reflects the market's adjustment to changing consumer tastes and the off-road motorbike segment's emphasis on sustainability.India Off-Road Motorcycle Market

The market for off-road motorcycles in India is expanding significantly due to growing interest in motorsports and adventure travel. This trend is fueled by rising young involvement in leisure riding clubs and off-road biking communities. For both novice and expert riders, manufacturers are releasing models that prioritize performance and price. An important factor in the growth of the National Highway network, which increased from 91,287 km in 2014 to 1,46,145 km in 2024, is government funding for adventure tourism and infrastructure development. Furthermore, by November 2024, 18,926 km of roads had been built as part of the Bharatmala Pariyojana. The allure of off-road motorcycles is further enhanced by technological developments in safety features and suspension. As more fans take up off-road riding, this vibrant market is expected to continue expanding.Saudi Arabia Off-Road Motorcycle Market

The market for off-road motorcycles in Saudi Arabia is expanding significantly due to a mix of economic diversification, government encouragement, and cultural zeal. The country's rough topography and expansive desert vistas make it the perfect place for off-road riding, drawing both domestic aficionados and foreign visitors. Government programs like Vision 2030 are designed to encourage recreation and sports, which will increase demand for off-road motorcycles. The market is dominated by major multinational companies like Yamaha, Honda, KTM, and Husqvarna, which provide a variety of models to suit different riding tastes. Furthermore, the popularity of electric off-road motorcycles appeals to riders who care about the environment because it fits in with both the Kingdom's Green Initiative and worldwide sustainability trends.Recent Developments in Off-Road Motorcycle Market

- HARLEY-DAVIDSON introduced the updated Pan America 1250 in April 2023. With five pre-programmed ride modes, including off-road mode, this motorcycle is incredibly adaptable.

- Honda Motor Co., Ltd. debuted the XL750 Transalp in November 2022. Showa 43mm SFF-CATM USD forks are fitted to the new motorcycle to handle off-road bumps.

- November 2022: India In India, Kawasaki Motors Pvt. Ltd. (IKM) declared the arrival of the new MY23 KX250. For off-road races in mountain and desert environments, the latest model boasts improved engine performance.

Off-Road Motorcycle Market Segments:

Type

- Motocross Motorcycles

- Enduro Motorcycles

- Trail Motorcycles

- Track-racing Motorcycles

Application

- Commercial

- Personal

- Industrial

- Others

Engine Capacity

- Less than 500 cc

- 500 cc to 1000 cc

- More than 1000 cc

Price Range

- Low to Mid

- High

Country

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- United Arab Emirates

- Saudi Arabia

All companies have been covered from 5 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- SWOT Analysis

- Sales Analysis

Key Players Analysis

- Harley-Davidson Incorporation

- Yamaha Motor Co., Ltd.

- Ducati Motor Holding S.p.A.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BMW AG

- Suzuki Motor Corporation

- Hero MotoCorp Limited

- Bajaj Auto Ltd.

- TVS Motor Company

Table of Contents

Companies Mentioned

- Harley-Davidson Incorporation

- Yamaha Motor Co., Ltd.

- Ducati Motor Holding S.p.A.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BMW AG

- Suzuki Motor Corporation

- Hero MotoCorp Limited

- Bajaj Auto Ltd.

- TVS Motor Company

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 16.52 Billion |

| Forecasted Market Value ( USD | $ 27.79 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |