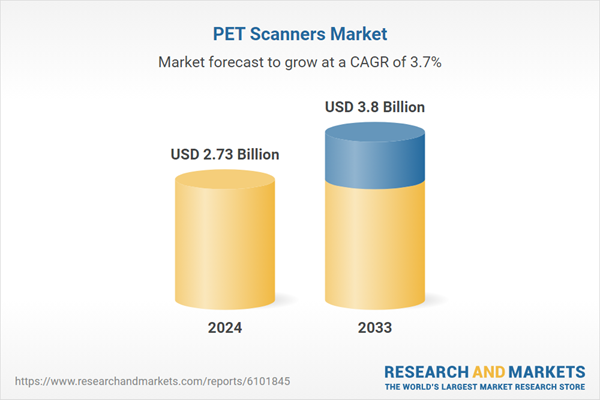

PET Scanners Market Report by Product Type (Full Ring PET Scanner, Partial Ring PET Scanner), Modality (PET-CT, PET-MRI), Application (Oncology, Cardiology, Neurology, Others), End Use (Hospitals, Diagnostic Imaging Centers, Academic & Research Institutes), Countries and Company Analysis 2025-2033.

PET Scanners Market Overview

Sophisticated medical imaging equipment known as Positron Emission Tomography (PET) scanners is employed to track the metabolic activity of the body. PET scans create detailed images of organ and tissue function by detecting pairs of gamma rays that are indirectly emitted by a radioactive tracer administered in the body. PET scanners are commonly employed to examine brain disorders such as Alzheimer's disease, make cancer diagnoses, and assess heart function. For enhanced diagnostic accuracy, PET scans are often combined with CT or MRI. They are critical for the detection of early diseases, planning for treatment, and the monitoring of therapeutic efficacy due to their ability to reveal changes in metabolism at the cellular level.The demand for PET scanners is growing remarkably due to the increasing prevalence of neurological, cardiovascular, and cancer disorders, all of which require advanced diagnostic devices. The application of PET imaging is growing as individuals become more aware of early and accurate identification of disease. Advances in technology, including AI integration and hybrid imaging systems (such as PET/CT and PET/MRI), are enhancing operating effectiveness and the accuracy of diagnoses. The market will also increase due to increased healthcare infrastructure investments, government programs that stimulate, and an aging population. The PET scanner market is being spurred worldwide, especially in emerging nations, by the shift towards personalized medicine and the increasing demand for non-invasive diagnostic procedures.

Growth Drivers for the PET Scanners Market

Rising prevalence of cancer and neurological disorders

Among the primary drivers of the PET scanner market is the rising rate of neurological disorders and cancer. Since PET imaging provides extensive information regarding cellular and metabolic functions, it is crucial in the early detection, diagnosis, and monitoring of numerous disorders. The demand for advanced imaging systems that allow precise staging and treatment planning is being fueled by the increasing occurrence of cancer globally. PET scanner use is also being spurred by the increasing number of neurological disorders such as Alzheimer's disease. Approximately 6.7 million Americans aged 65 and above had Alzheimer's disease in March 2023, as per the Alzheimer's Association. This indicates approximately a quarter of one in nine individuals in this age group (10.7%) have the disease. Since PET scans are able to identify amyloid plaques and other atypical brain activity, they prove very useful in detecting initial signs of Alzheimer's disease. The need for accurate, non-surgical diagnostics such as PET continues to grow as these conditions become increasingly common in older populations.Advancements in imaging technology

Growth in the market for PET scanners is being largely stimulated by advancements in imaging technology. The accuracy, resolution, and speed of PET scans have been enhanced by advances such as time-of-flight (TOF) technology, hybrid imaging systems (PET/CT and PET/MRI), and improved detector materials. These advances improve PET imaging in terms of efficiency and patient comfort through facilitating enhanced disease detection, reduced scanning time, and reduced radiation exposure. Diagnosis accuracy and image interpretation are also improved through the union of AI and machine learning. A prominent Pennsylvania cardiovascular practice became Positron Corporation's newest client in November 2024. The practice will utilize the Positron Attrius PET System and services. This partnership is a testament to how advanced PET technologies are being utilized in the clinic more and more, especially for cardiac imaging. Physicians are putting more money into PET scanners to enhance patient outcomes and diagnostic capabilities as imaging devices become more readily available and efficient.Expansion of healthcare infrastructure

The demand for PET scanners is greatly impacted by the expansion of healthcare infrastructure, especially in the emerging markets. Upgrading healthcare facilities to include advanced imaging technology such as PET scanners becomes increasingly costly for both public and private organizations. This improvement in diagnostic capability makes early detection of disease and personalized planning for treatment possible. PET scanner market adoption is increasing due to the upgrading of medical infrastructure and rising healthcare expenditure. Demand for PET imaging systems is also increasing throughout the world due to aging populations and an increase in the prevalence of chronic conditions that are forcing healthcare providers to expand diagnostic services.Challenges in the PET Scanners Market

High Cost of Equipment and Procedures

One major obstacle in the market for PET scanners is the high cost of procedures and equipment. PET scanners can cost millions of dollars to buy, and they also need a lot of money for maintenance, installation, and shielding. The requirement for specialized radiotracers, cyclotron facilities, and skilled workers also contributes to the high operating expenses. These costs result in expensive diagnostic tests, which restrict patient access, particularly in low- and middle-income nations. Despite PET technology's therapeutic benefits in illness detection and management, healthcare providers would be reluctant to engage in it in the absence of clear payment paths, which would further limit market expansion and acceptance.Regulatory and Reimbursement

Regulatory and reimbursement challenges significantly impact the PET scanners market. Strict and varied regulatory requirements for approval, use, and handling of radioactive tracers increase the complexity and time needed to bring PET technologies to market. Additionally, inconsistent reimbursement policies across different countries and healthcare systems limit financial incentives for hospitals and clinics to invest in PET scanners. Delays or low reimbursement rates for PET procedures can discourage healthcare providers from offering these diagnostic services, reducing patient access. Together, these factors hinder widespread adoption and slow market growth despite the proven clinical benefits of PET imaging in early disease detection and treatment monitoring.United States PET Scanners Market

The U.S. PET scanner market is distinguished by quick product introductions and innovation aimed at enhancing image quality and cutting down on scan times. The advent of digital PET scanners with improved sensitivity and resolution is one notable development. PET scans are increasingly being used for accurate tumor localization and treatment response tracking as a result of the U.S. healthcare system's emphasis on customized medicine. Partnerships between healthcare providers and technology companies also encourage research into novel radiotracers that can more precisely target particular diseases, increasing the range of clinical applications.United Kingdom PET Scanners Market

Government efforts to improve cancer care pathways through improved diagnostic capabilities have an impact on the UK PET scanner industry. To guarantee prompt cancer detection and treatment, the National Health Service (NHS) has been making significant investments in cutting-edge imaging technologies. AI-driven analytics are increasingly being included into PET imaging procedures because they help physicians make well-informed decisions more rapidly. For example, the UK's National PET Imaging Platform (NPIP), a nationwide total-body PET imaging effort, was introduced in October 2023. This innovative project intends to support drug discovery procedures and medical research. The Medicines Discovery Catapult, the Medical Research Council, and Innovate UK are among the important institutions that collaborate on the NPIP.China PET Scanners Market

The market for PET scanners in China is expanding significantly due to rising healthcare costs and the incidence of chronic illnesses like cancer. As part of its healthcare reforms, the Chinese government aggressively supports cutting-edge imaging technologies, which raises investments in medical infrastructure. The use of hybrid imaging techniques, including PET/CT and PET/MRI, which provide improved diagnostic capabilities, has notably increased. Additionally, to meet the increasing demand from hospitals and diagnostic centers, regional manufacturers are coming up with innovative, affordable solutions.Saudi Arabia PET Scanners Market

The market for PET scanners in Saudi Arabia is expanding steadily due to initiatives to enhance diagnostic capabilities and modernize healthcare infrastructure. The need for sophisticated imaging technology like PET scanners is being driven by the rising incidence of chronic illnesses like cancer and neurological conditions. The increased diagnostic accuracy of hybrid imaging techniques, especially PET/CT, is driving their popularity. The use of these technologies is most prevalent in major cities like Riyadh, Jeddah, and Dammam, but there is a lot of room for expansion in underserved areas. The market is anticipated to be further driven by initiatives to increase healthcare access and the focus on early disease detection, which will encourage investments in both stationary and portable PET scanner technologies.Recent Developments in PET Scanners Market

- In June 2024, for clinical whole-body PET/CT imaging, augmented whole-body scanning via magnifying PET (AWSM-PET), a recently introduced technology, has demonstrated notable improvements in picture clarity and system sensitivity.

- In May 2024, Canon Medical Systems is pleased to announce that Steinberg Diagnostic Medical Imaging (SDMI), located in Las Vegas, Nevada, has installed the Aquilion Serve SP CT scanner with INSTINX, an AI-driven workflow automation system, for the first time in the United States. The Aquilion Serve SP CT scanner raises the bar for medical imaging technology by fusing superior imaging capabilities with increased throughput, consistency, and efficiency.

- In April 2024, by delivering cutting-edge PET/CT imaging services straight to medical facilities on their schedules, CDL Nuclear Technologies' ground-breaking Mobile Dedicated Cardiac PET/CT Trailer is set to revolutionize cardiac treatment.

PET Scanners Market Segments:

Product Type

- Full Ring PET Scanner

- Partial Ring PET Scanner

Modality

- PET-CT

- PET-MRI

Application

- Oncology

- Cardiology

- Neurology

- Others

End Use

- Hospitals

- Diagnostic Imaging Centers

- Academic & Research Institutes

Country

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- United Arab Emirates

- Saudi Arabia

All companies have been covered from 5 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- SWOT Analysis

- Sales Analysis

Key Players Analysis

- Canon Medical Systems

- GE Healthcare

- Kindsway Biotech

- Koninklijke Phillips N.V.

- Mediso Ltd.

- PerkinElmer

- Positron

- Shimadzu Corporation

- Siemens Healthineers AG

Table of Contents

Companies Mentioned

- Canon Medical Systems

- GE Healthcare

- Kindsway Biotech

- Koninklijke Phillips N.V.

- Mediso Ltd.

- PerkinElmer

- Positron

- Shimadzu Corporation

- Siemens Healthineers AG

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.73 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |