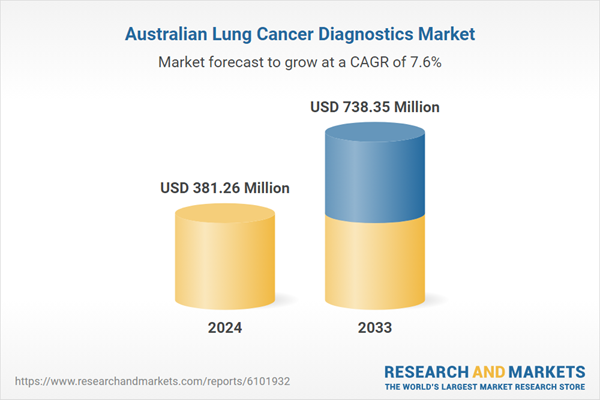

Australia Lung Cancer Diagnostics Market Report by Diagnosis Test Type (Imaging Test, Biopsy, Sputum Cytology, Molecular Test, Others), Cancer Type (Non- Small Cell Lung Cancer, Small Cell Lung Cancer), End-User (Hospital Associated Labs, Independent Diagnostic Laboratories, Diagnostic Imaging Centers, Cancer Research Institutes, Others) and Company Analysis, 2025-2033.

Australia Lung Cancer Diagnostics Industry Overview

The market for lung cancer diagnostics in Australia is expanding significantly due to improvements in diagnostic technology and increased emphasis on early diagnosis. Artificial intelligence (AI)-enhanced imaging and liquid biopsies, which identify circulating tumor DNA, are two examples of technologies that are changing the landscape by providing quick, accurate, and non-invasive diagnostic alternatives. Better patient outcomes result from these advancements because they allow physicians to detect lung cancer earlier. Additionally, thorough genetic profiling is made possible by the incorporation of next-generation sequencing (NGS) into diagnostic procedures, which enables individualized treatment plans. The nation's commitment to improving oncology patient care and diagnostic skills is demonstrated by the Australian government's efforts to address the disease, such as the creation of the Australian Comprehensive Cancer Network.The market is supported not just by technology developments but also by growing accessibility and awareness. Programs aimed at high-risk groups, such as individuals with a family history of lung cancer or a history of smoking, are growing. In order to ensure more access to diagnostic services, mobile screening units and community outreach programs are being introduced in disadvantaged regions. Public health campaigns that inform the public about the value of early detection and the availability of screening methods support these initiatives. When taken as a whole, these elements support Australia's lung cancer diagnostics market's explosive expansion and place the nation at the forefront of cutting-edge cancer treatment.

Key Factors Driving the Australia Lung Cancer Diagnostics Market Growth

Rising Incidence of Lung Cancer

Lung cancer cases have significantly increased in Australia, not just among smokers and other typical high-risk categories, but also among older people and non-smokers. This tendency is caused by a number of factors, including genetic predispositions, occupational dangers, and environmental exposures. There is a pressing need for earlier and more precise detection techniques since the chance of being diagnosed with lung cancer increases with population age. The need for cutting-edge diagnostic tools that can detect the illness at an early stage and cure it is being driven by this rising occurrence. The development and application of cutting-edge lung cancer detection technologies is a major goal in the Australian healthcare system since early diagnosis is essential for increasing survival rates.Advancements in Diagnostic Technologies

Rapid advances in medical technology are having a substantial impact on the lung cancer diagnostics business in Australia. Advancements like liquid biopsies, which use blood samples to identify circulating tumor DNA, offer a non-invasive and incredibly sensitive early detection method. Imaging aided by artificial intelligence (AI) improves radiological data interpretation by decreasing human error and increasing accuracy. Furthermore, thorough genetic profiling of cancers is becoming possible because to next-generation sequencing (NGS), which advances precision medicine by enabling doctors to customize therapies according to the unique characteristics of each patient. By making procedures quicker, less invasive, and more precise, these technological advancements are revolutionizing the way lung cancer is detected, improving patient outcomes and propelling market expansion.Growing Awareness and Screening Campaigns

Growing public knowledge of lung cancer and the value of early diagnosis is crucial for the market's growth. Nationwide initiatives to inform the public about risk factors, symptoms, and available diagnostic methods are being aggressively carried out by government and nonprofit groups. More people are actively seeking screening services as a result of these initiatives, particularly those who fall into high-risk groups. Additionally, focused outreach programs in underprivileged and rural areas are assisting in closing the diagnostics access gap. More individuals will probably take part in screening programs as awareness grows, which directly contributes to earlier diagnosis and higher survival rates.Challenges in the Australia Lung Cancer Diagnostics Market

High Cost of Advanced Diagnostics

The high cost of sophisticated diagnostic technology is one of the main issues facing the lung cancer diagnostics business in Australia. Although they provide less intrusive and more reliable diagnostic choices, innovative techniques like liquid biopsies and next-generation sequencing (NGS) are sometimes more expensive. For patients who are not sufficiently covered by private insurance or public healthcare systems, these expenses may be unaffordable. Because of this, access to these state-of-the-art diagnostics is still unequal, especially for those who lack insurance or have low incomes. Hospitals and healthcare providers are also impacted by the high cost, and they could be reluctant to implement newer technology because of financial limitations. This financial obstacle prevents broad adoption and impedes initiatives for early cancer detection and individualized cancer treatment.Limited Access in Rural and Remote Areas

The large size of Australia poses a major obstacle to the equitable detection of lung cancer, especially in rural and isolated areas. Specialized medical facilities including pathology labs, diagnostic imaging centers, and cancer treatments are lacking in many of these places. The problem is also made worse by the lack of qualified medical personnel in these areas. Long travel times for patients to receive diagnostic services can cause delays in diagnosis and treatment. In non-urban communities, this regional mismatch leads to greater death rates and worse health outcomes. Ensuring uniform and prompt access to high-quality lung cancer diagnostics in every location is still a major challenge for the Australian healthcare system, notwithstanding telemedicine and mobile health initiatives.Recent Developments in Australia Lung Cancer Diagnostics Industry

- The first new national cancer screening program in almost two decades, the National Lung Cancer Screening Program, was announced by the Australian government in April 2025 and is scheduled to launch in July of that year.

Market Segmentations

Diagnosis Test Type

- Imaging Test

- Biopsy

- Sputum Cytology

- Molecular Test

- Others

Cancer Type

- Non- Small Cell Lung Cancer

- Small Cell Lung Cancer

End-User

- Hospital Associated Labs

- Independent Diagnostic Laboratories

- Diagnostic Imaging Centers

- Cancer Research Institutes

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Llumina

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Roche Holding AG.

- Sanofi S.A.

- Agilent Technologies

- bioMérieux

Table of Contents

Companies Mentioned

- Llumina

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Roche Holding AG.

- Sanofi S.A.

- Agilent Technologies

- bioMérieux

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 381.26 Million |

| Forecasted Market Value ( USD | $ 738.35 Million |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 8 |