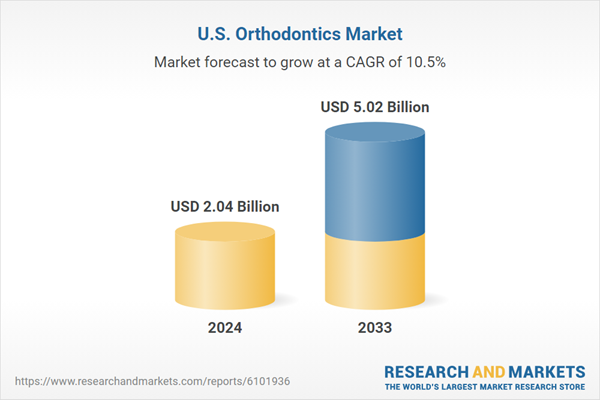

United States Orthodontics Market Report by Product (Instruments, Supplies), Age Group (Adult, Teen), End User (Hospitals, Dental Clinics, Others), and Company Analysis 2025-2033.

United States Orthodontics Market Outlooks

Orthodontics is a dental specialty dealing with the prevention, diagnosis, and treatment of teeth and jaw irregularities. The ultimate aim is to enhance oral function, beauty, and overall health of the teeth by eliminating problems like crooked teeth, overbites, underbites, gaps, and crowding. Orthodontists employ devices such as braces, clear aligners (e.g., Invisalign), retainers, and other dental appliances to move teeth little by little to the right positions.In the U.S., orthodontic care is particularly coveted by adolescents and adults because of the increasing focus on dental appearance and oral health. Parents particularly endeavor to have their children treated in the early years to avoid more serious dental issues later in life. Adults are now choosing discreet aligner solutions for aesthetic purposes as well as enhanced self-esteem. With teledentistry and improved orthodontic technologies, care has become more accessible, efficient, comfortable, and readily available for diverse populations in the U.S.

Growth Drivers in the United States Orthodontics Market

Increased Demand for Aesthetic Dental Treatments

Increased attention to personal appearance and the need for flawless smiles have greatly impacted the U.S. orthodontics market. Numerous people are opting for cosmetic dental treatments, including clear aligners, to secretly enhance the alignment of their teeth. This is especially true among working adults and professionals who want non-invasive, cosmetic solutions. Advances in aligners, combined with the growing power of social media, are promoting the use of orthodontic therapy for aesthetic reasons, further propelling the market. In February 2025, LuxCreo introduced the 4D Bright Aligner, a revolutionary dental appliance that brings together the functionality of the 4D Aligner with the cosmetic look of whiter teeth. Driven by LuxCreo's end-to-end 4D Aligner system and ActiveMemory polymer, this aligner provides accurate orthodontic correction and delivers consistent elastic forces over treatment duration, enabling patients to keep their natural smile.Technological Advancements and Digital Orthodontics

Digital orthodontics with 3D imaging, computer-aided design (CAD), and intraoral scanners has changed the way treatment planning and execution is done. The technologies provide quicker diagnosis, improved patient comfort, and more tailored treatment options. Added benefits include accuracy and outcomes improvement through the use of artificial intelligence in treatment simulations. These innovations render orthodontic treatments more desirable and convenient, particularly to technology-oriented people, thus driving the market in the U.S. to increase. In August 2023, Angelalign Technology Inc. introduced its tailor-made clear aligners to the U.S. market. The firm is a global leader in clear aligner dental technology and provides evidence-based clinical knowledge.Expanding Adult and Teen Patient Base

There has been a steep rise in orthodontic treatment amongst adolescents and adults alike within the U.S. In the past, adolescents traditionally formed the backbone of the orthodontic patient pool, but increasingly adults form an expanding portion of the market, largely because of clear and removable aligners. Increased orthodontic awareness, affordable financing options, and increased insurance benefits are motivating more patients to seek corrective dental treatments, leading to increased demand for orthodontic treatment. In December of 2023, Align Technology, Inc., a leading global medical device company, reported that the FDA has given its approval for its Invisalign® Palatal Expander System to use commercially in the U.S. This approval makes for wider patient use, encompassing children, adolescents, and adults (who might also need surgery or other methods).United States Orthodontics Market Challenges

Excessive Treatment Prices and Limited Insurance Coverage

Orthodontic treatments can be quite expensive, especially when it relates to enhanced options like clear aligners which guarantee an invisible and efficient method for straightening teeth. Sadly, most insurance companies provide partial or no coverage for orthodontic treatment, posing a great hindrance to access for families attempting to afford these services. This is most severe among low- and middle-income families, where the cost of high out-of-pocket spending can deter patients from initiating their treatment process or make them drop their plans along the way. Consequently, even with increasing demand for orthodontic treatment, the market is unable to expand because it has many limitations placed upon it, leaving many people without access to smile-improving treatments they would like.Lack of Trained Orthodontists in Rural Areas

Urban areas of the United States abound with an abundance of orthodontic practitioners and state-of-the-art facilities, offering a location where patients can readily have access to prompt and superior dental treatment. In contrast, rural communities greatly lack skilled orthodontists, depriving many of its population of basic services. This geographic inequality not only limits immediate access to care, but also seriously jeopardizes the dental health of children. Delayed early treatment results in more complicated and expensive orthodontic problems in the future, as issues are not treated in the early stages. Thus, addressing the uneven dispersal of dental practitioners is key to nurturing balanced market development and guaranteeing that every patient, irrespective of where they are located, has access to what they require.United States Orthodontics Instruments Market

The U.S. orthodontics instruments market includes a range of must-have devices that are used for diagnosis and treatment, which include specialized pliers, precision cutters, strong brackets, and universal archwires. These instruments are very important in manual orthodontic practice and cater to both orthodontists and general dentists. As volumes of patients increase and complexities in treatments follow, demand for precision, high-quality tools has become ever greater. Manufacturers are addressing this by focusing on ergonomic construction that provides increased usability and comfort, while choosing long-lasting materials that guarantee duration and reliability. Such focus on innovation has driven consistent growth within the market. In a major announcement, July 2024 witnessed Biolux Technology launch the U.S. introduction of OrthoPulse, the company's signature orthodontic optimization platform. The new version features enhancements based on solid clinical research, a major milestone for the company's continued commitment to evolving the dental and orthodontic industries. The introduction not only reflects technological innovation but also represents the commitment to equipping practitioners with efficient tools that support patient care.United States Orthodontics Supplies Market

Orthodontic materials such as braces, bands, adhesives, and aligners constitute a critical component of the dental market. In the United States, there has been a significant rise in consumer demand for customized and aesthetically pleasing orthodontic treatments, with clear aligners taking center stage. This need is not only ignited by esthetics but also by technological progress and novel solutions that claim to reduce the duration of treatment and increase patient comfort. Additionally, the introduction of do-it-yourself (DIY) aligner kits and mail-order convenience has expanded the boundaries of the marketplace, opening up new opportunities for consumers to get their dream smile.United States Adult Orthodontics Market

The U.S. adult orthodontics market is seeing phenomenal growth, prompted by a mix of aesthetic reasons and an increased sensitivity to oral health. Increasing numbers of adults are turning to orthodontic treatment more than ever before, thanks mainly to the advent of invisible solutions like clear aligners that blend perfectly with their lifestyles. The world pandemic that led to the change in working from home has further promoted this trend, as working professionals are now able to avail themselves of convenient online consultations to start and monitor their orthodontic treatment processes without having to visit clinics repeatedly. Additionally, there is an increased societal focus on lifelong dental care and aesthetic desire, which play a crucial role in developing a culture where such treatments are appreciated. Consequently, this market is not just flourishing but is placed on a path of long-term growth, catering to the changing needs of today's health-conscious adults.United States Teen Orthodontics Market

Teenagers are a critical segment of the orthodontics market, especially in the United States, where the majority of orthodontic treatments are initiated during the developmental teen years. This is the perfect moment to treat overlapping and crooked teeth, which can be more successfully treated when teens are young. While metal braces still remain a popular standard for many, there is a significant growing trend toward clear aligners fueled by the looks-conscious attitudes prevalent among present-day youth. A number of forces contribute to creating this market. Schools usually have a conducive environment where dental health topics are discussed, and parental influence is key to motivating adolescents to receive orthodontic treatment. Moreover, pediatric dentists also refer their child patients to orthodontists so that oral problems can be detected early. Stressing frequent visits to the dentist and preventive treatment also heightens the possibilities of early detection and successful treatment, finally resulting in healthier grins for teens.United States Orthodontics Hospitals Market

Orthodontic hospitals in the United States play a critical role in delivering orthodontic services, particularly when dealing with complex or multidisciplinary cases that need a high degree of expertise. These facilities tend to have the latest imaging equipment and sophisticated operating suites, enabling them to correct extensive malocclusions and complicated jaw alignment problems with accuracy. In addition, teaching hospitals are instrumental in their capacity as critical training facilities for the future generations of orthodontists, where they are able to gain the skills and knowledge required to become successful professionals in the industry. With increased investments going into hospital dental departments and integrated health systems, emphasis on providing holistic and patient-orientated care is increasing, with increasing consistency in this critical aspect of healthcare.United States Orthodontics Dental Clinics Market

Dental clinics form the foundation for the provision of orthodontic services across the United States. These clinics offer specialized services that cater to each patient's individual needs, proposing treatment plans that clearly define the process to a healthier smile. The clinics are convenient to the patients and incorporate advanced technologies like 3D scanning and printing of aligners to streamline the process of treatment as well as enhance accuracy. Transparency in pricing is another substantial benefit of dental clinics, as they promote confidence and transparency in the financial exchange of orthodontic treatment. The orthodontic landscape is experiencing an impressive evolution, with independent practices and group practices equally thriving. This development is driven primarily by a focus on patient-centric models of care that stress each person's individual preference and needs, combined with wide-ranging localized outreach efforts to connect with communities. Consequently, the clinic division has entrenched itself as a lead player in the orthodontics industry, defining the future of dental services across the country and assuring patients of the best level of service in their quest for optimal oral health.Market Segmentation

Product

- Instruments

- Supplies

Age Group

- Adult

- Teen

End User

- Hospitals

- Dental Clinics

- Others

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- 3M Company

- Envista Holdings Corporation

- Align Technology, Inc.

- Dentaurum GmbH & Co. KG

- Dentsply Sirona Inc.

- G&H Orthodontics, Inc.

- Henry Schein, Inc.

- Rocky Mountain Orthodontics, Inc.

Table of Contents

Companies Mentioned

- 3M Company

- Envista Holdings Corporation

- Align Technology, Inc.

- Dentaurum GmbH & Co. KG

- Dentsply Sirona Inc.

- G&H Orthodontics, Inc.

- Henry Schein, Inc.

- Rocky Mountain Orthodontics, Inc.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.04 Billion |

| Forecasted Market Value ( USD | $ 5.02 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |