The demand for integrated biometric seat-sensor market is primarily driven by the increasing consumer preference for intelligent vehicle safety systems that go beyond crash mitigation to proactively manage driver health and attention. Biometric seat sensors enable features such as drowsiness detection, emergency health monitoring, and personalized in-cabin settings based on authenticated user profiles. Regulatory focus on driver attention and distraction, particularly for Level 2/3 ADAS vehicles, has accelerated OEM interest. Additionally, rising consumer expectations for AI-driven personalized infotainment are fueling investment in embedded biometric solutions that adapt seat positioning, media content, and climate preferences in real-time.

Another significant growth driver for the integrated biometric seat-sensor market is the electrification of mobility is another growth engine, as electric vehicles (EVs) increasingly serve as digital platforms. With fewer mechanical distractions, the cabin becomes the main human-machine interface, driving OEMs to embed intelligent sensor technology into key touchpoints like the seat. Simultaneously, data monetization models are emerging - where anonymized health or behavior data from biometric seats is used to inform insurance underwriting, driver wellness programs, or subscription services. These use cases strengthen the ROI for biometric seat integration, particularly in premium EVs and future mobility-as-a-service (MaaS) fleets.

However, despite the strong momentum, several hurdles challenge widespread adoption. First, data privacy concerns are significant - biometric information is highly sensitive and governed by strict regulations such as GDPR and CCPA. OEMs and suppliers must ensure end-to-end encryption, edge processing, and secure user consent protocols. Second, the cost and complexity of integrating multimodal biometric sensors into mass-market vehicles limit scale, especially in price-sensitive regions. Interoperability with other vehicle ECUs and infotainment systems also requires standardized APIs and testing cycles, often prolonging product development timelines.

Opportunities in the integrated biometric seat-sensor market are expanding integrated biometric seat sensors into fleet and commercial vehicles, particularly for logistics and ride-hailing services. Driver monitoring systems that can prevent fatigue-induced accidents are being mandated in regions like Europe under GSR (General Safety Regulation) 2024. Additionally, the rise of in-car payment and personalization features offers a natural pathway for biometric authentication - such as secure logins, purchase verification, or parental controls. Long-term, integrating these sensors with in-cabin wellness systems could open adjacent markets in automotive health tech and insurance-linked risk management.

The Asia-Pacific integrated biometric seat-sensor market is emerging as a high-growth hub due to the strong presence of automotive electronics manufacturers in China, Japan, and South Korea. Automakers in the region are actively investing in next-gen human-machine interfaces as part of smart mobility strategies. For example, Chinese OEMs like NIO and BYD are integrating biometric seat platforms into premium trims as part of AI-powered cabin experiences. The region’s advanced supply chain for MEMS sensors, proximity sensors, and automotive electronics supports faster innovation cycles. Moreover, urban population growth and government mandates on driver monitoring are converging to accelerate deployment in both private and shared mobility models.

Market Lifecycle Stage

The integrated biometric seat-sensor market is currently in a growth-to-early-maturity phase. Pilot deployments and premium segment installations are becoming more common, particularly in luxury EVs and ADAS-equipped vehicles. However, mass-market penetration remains limited due to cost and integration complexity. Over the next five to seven years, as edge AI chips, standardized biometric modules, and regulatory clarity improve, the market is expected to enter a rapid expansion stage. Long-term viability will depend on seamless integration into broader vehicle electronics architecture and the development of robust monetization models around user data and personalization.Global Integrated Biometric Seat-Sensor Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Segmentation 2: by Propulsion Type

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EV)

Segmentation 3: by Sensor Type

- Capacitive Sensors

- Electrocardiogram (ECG) Sensor

- Pressure Mapping Sensors

- Thermal Sensor

- Others

Segmentation 4: by Sales Channel

- OEM

- Aftermarket

Segmentation 5: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, U.K., Italy, Spain, and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, Australia, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Key Market Players and Competition Synopsis

The global integrated biometric seat-sensor market is growing considerably with presence key players including Adient plc, Bosch Mobility, Continental AG, and Lear Corporation among others. These companies having wide large manufacturing capacities with wide distribution network, extensive research and development, and strategic partnerships with automakers. Emerging players are focusing on sustainable and cost-effective solutions to meet the growing demand for high-performance electric vehicles. The market is characterized by intense competition driven by technological advancements, regulatory compliance, and increasing vehicle production, leading to rapid innovation and collaboration across the automotive value chain.Some of the prominent established names in the integrated biometric seat-sensor market are:

- Adient plc

- airbaglightoff limited

- Bosch Mobility

- Continental AG

- Flexpoint Sensor Systems

- Forvia Faurecia

- Gentex

- Lear Corporation

- National Seating (CVG Group)

- Novel GmbH

- Sensor Products Inc.

- Sensing Tex

- TE Connectivity

- Tekscan Inc.

- XSENSOR Tech.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Adient plc

- airbaglightoff limited

- Bosch Mobility

- Continental AG

- Flexpoint Sensor Systems

- Forvia Faurecia

- Gentex

- Lear Corporation

- National Seating (CVG Group)

- Novel GmbH

- Sensor Products Inc.

- Sensing Tex

- TE Connectivity

- Tekscan Inc.

- XSENSOR Tech.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

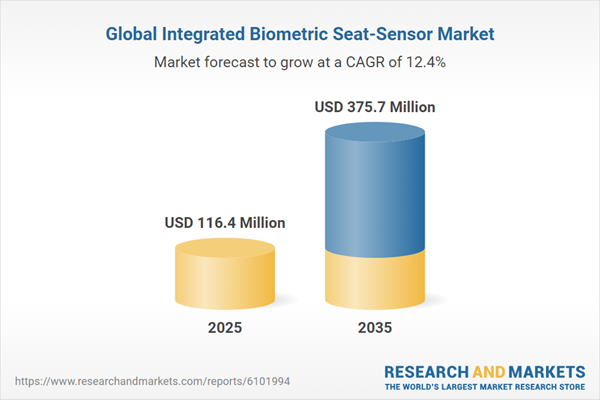

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 116.4 Million |

| Forecasted Market Value ( USD | $ 375.7 Million |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |