Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological progress in horizontal drilling, multi-stage fracking, and real-time digital monitoring has significantly improved operational efficiency and cost-effectiveness. Environmental concerns are also shaping innovation, with an industry-wide shift toward electric frac fleets and waterless fracking methods. North America continues to lead in hydraulic fracturing activity, supported by favorable oil prices and robust infrastructure, while other regions including Latin America, the Middle East, and Asia-Pacific are expanding their unconventional resource development. Industry consolidation and integrated service offerings by major players are also enhancing competitiveness and scalability across global operations.

Key Market Drivers

Expansion of Unconventional Oil & Gas Exploration

The rapid development of unconventional hydrocarbon resources is a key driver of the global frac services market. As traditional oil fields mature, energy producers are increasingly turning to unconventional sources such as shale gas, tight oil, and coal-bed methane, which require hydraulic fracturing to enable production.Regions like the United States have pioneered the shale revolution, notably in the Permian Basin, Eagle Ford, and Bakken formations. This trend is expanding globally, with countries including China, Argentina, and Canada actively investing in shale resource development, while others like India and Saudi Arabia are initiating exploration programs.

To support this growth, frac service providers offer advanced technologies such as horizontal drilling, multi-stage fracturing, and real-time analytics. These capabilities improve well productivity and make fracking economically feasible even at moderate oil prices, thus reinforcing its long-term viability in global energy strategies.

Key Market Challenges

Environmental Regulations and Public Opposition

Environmental concerns remain a significant challenge for the frac services industry. Issues such as groundwater contamination, methane emissions, excessive water use, and seismic risks have intensified scrutiny from regulators and the public. In response, many governments are enacting stricter rules related to emissions, chemical disclosure, and waste management.In the U.S., agencies like the Environmental Protection Agency (EPA) have introduced rigorous standards for methane monitoring and well integrity. European nations such as France and Germany have gone further by imposing outright bans or moratoriums on hydraulic fracturing.

These regulatory pressures not only increase compliance costs but also pose operational risks and reputational challenges, particularly in environmentally sensitive or politically volatile regions.

Key Market Trends

Electrification and Greener Frac Fleets

A transformative trend in the frac services market is the growing shift toward electric frac fleets (e-fleets). Traditional diesel-powered equipment contributes significantly to greenhouse gas emissions and operational noise, prompting operators to seek cleaner and more efficient alternatives.E-fleets, powered by grid electricity or natural gas turbines, offer reduced emissions, lower fuel costs, and quieter operations. Major industry players such as Halliburton (Zeus™ e-fleet), Liberty Energy (Clean Fleet®), and NexTier are leading the transition to electrified or hybrid systems.

This trend is further supported by the adoption of dual-fuel and Tier 4-compliant engines, as well as increased investment in digital platforms for real-time fuel and emissions monitoring. With growing emphasis on ESG compliance and carbon reduction, the electrification of fracturing fleets is expected to become a standard industry practice.

Key Market Players

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

- Liberty Energy Inc.

- Patterson-UTI Energy, Inc.

- ProFrac Holding Corp.

- RPC, Inc. (Cudd Energy Services)

- FTS International Services, LLC

Report Scope:

In this report, the Global Frac Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Frac Services Market, By Technology:

- Plug-and-Perforation

- Sliding Sleeve

- Others

Frac Services Market, By Application:

- Crude Oil

- Shale Gas

- Tight Oil

- Others

Frac Services Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- South America

- Brazil

- Colombia

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Frac Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

- Liberty Energy Inc.

- Patterson-UTI Energy, Inc.

- ProFrac Holding Corp.

- RPC, Inc. (Cudd Energy Services)

- FTS International Services, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | June 2025 |

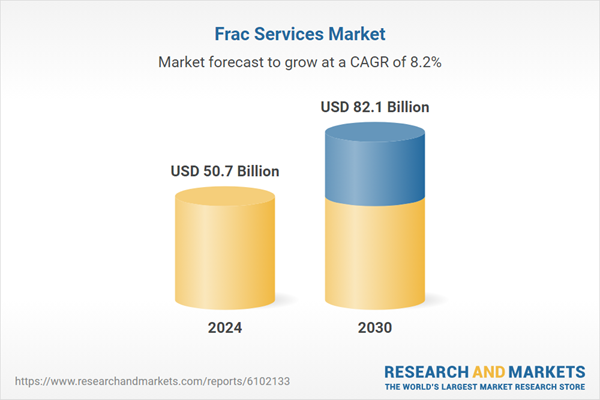

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 50.7 Billion |

| Forecasted Market Value ( USD | $ 82.1 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |