Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market includes an array of offerings such as short-term and long-term test kits, continuous radon monitors, digital detectors, and professional inspection and mitigation services. Demand is rising due to increasing public awareness, tightening indoor air quality regulations, and greater emphasis from governments on health safety and environmental monitoring. As a result, radon testing is gaining prominence not only in high-risk regions but also in broader preventive safety strategies globally.

Key Market Drivers

Increasing Health Awareness and Regulatory Pressure on Indoor Air Quality Standards

Heightened awareness of radon exposure as a public health threat is a key factor driving demand in the radon gas testing market. Recognized as a leading cause of lung cancer among non-smokers by health organizations including the WHO, radon exposure is now a serious concern for homeowners, real estate developers, and commercial building managers. This rising concern is further reinforced by public health campaigns and educational efforts promoted by governments and environmental bodies.In addition, evolving building codes and regulatory mandates across regions such as North America, Europe, and parts of Asia-Pacific are requiring radon testing in homes, workplaces, schools, and healthcare facilities - especially in high-risk areas. In some U.S. states and Canadian provinces, radon disclosure is mandated during real estate transactions, while European nations are increasingly embedding radon protocols in construction standards. Green building certifications like LEED and WELL also incentivize testing, contributing to wider integration of radon testing into standard environmental and health safety assessments.

Key Market Challenges

Low Public Awareness and Limited Regulatory Enforcement

A major obstacle for the radon gas testing market is the ongoing lack of public awareness and inconsistent enforcement of regulatory guidelines. Despite the well-documented health risks associated with radon exposure, awareness remains low among homeowners, tenants, and even construction professionals, especially in developing regions. This knowledge gap results in limited prioritization of radon testing during home purchases, renovations, or occupancy assessments. Even where regulations exist, enforcement tends to be fragmented or weak, limiting their effectiveness.In many areas, there is no federal radon policy or infrastructure to support large-scale monitoring, creating little motivation for property owners or developers to pursue testing or mitigation. This situation is further exacerbated by confusion over acceptable radon thresholds and mitigation approaches, which reduces consumer confidence and slows market adoption. Consequently, market growth is often confined to areas with strong government programs or high-risk zones, hindering broader international expansion.

Key Market Trends

Growing Regulatory Support and Public Health Campaigns Fueling Market Expansion

The radon gas testing market is being shaped by growing regulatory mandates and widespread public health advocacy that promote proactive radon detection and mitigation. Governments across North America, Europe, and the Asia-Pacific are increasingly adopting and enforcing stricter regulations that require routine radon testing in sensitive environments such as schools, hospitals, and residential structures. In parallel, sustained educational campaigns are raising awareness about the health dangers of long-term radon exposure, encouraging voluntary testing even outside high-risk zones. This has led to rising adoption of both short-term and long-term monitoring devices, ranging from DIY kits to advanced digital and continuous radon detectors. These trends are enabling a broader, more consistent demand for radon testing technologies, especially in regions with emerging environmental health regulations and growing interest in air quality as a factor in sustainable and safe building practices.Key Market Players

- Air Chek, Inc.

- Airthings ASA

- Radonova Laboratories AB

- SunRADON LLC

- Professional Laboratories, Inc.

- Radon Specialist Services, Inc.

- Family Safety Products, Inc.

- Ducon Technologies Limited

- Resideo Technologies, Inc.

- RAdata, Inc.

Report Scope:

In this report, the Global Radon Gas Testing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Radon Gas Testing Market, By Product Type:

- Active

- Passive

Radon Gas Testing Market, By Application:

- Schools

- Hospitals

- Houses

Radon Gas Testing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Radon Gas Testing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Air Chek, Inc.

- Airthings ASA

- Radonova Laboratories AB

- SunRADON LLC

- Professional Laboratories, Inc.

- Radon Specialist Services, Inc.

- Family Safety Products, Inc.

- Ducon Technologies Limited

- Resideo Technologies, Inc.

- RAdata, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

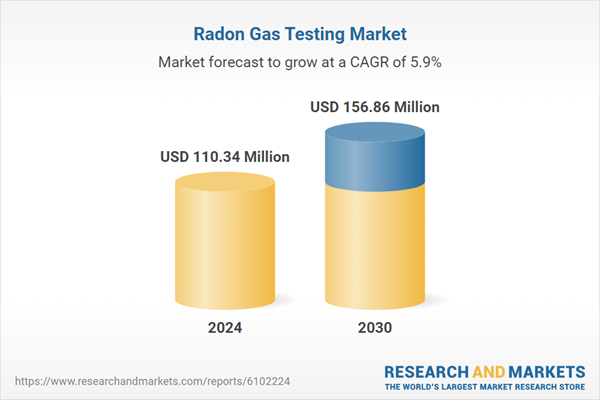

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 110.34 Million |

| Forecasted Market Value ( USD | $ 156.86 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |