Japan Autoinjector Market Overview

The market is witnessing significant growth, driven by the country’s expanding aging population, rising prevalence of chronic diseases, and increasing focus on self-administered treatments. Japan’s healthcare system, known for its technological advancement and patient-centric approach, is supporting the adoption of autoinjectors for biologic therapies, thereby boosting market demand. Moreover, companies such as Eisai Co., Ltd., SHL Medical Japan, Ypsomed Japan, and Terumo Corporation are actively contributing to the market growth through innovations in device design, ease of use, and collaborations with pharmaceutical firms.Japan Autoinjector Market Growth Drivers

Rising Prevalence of Chronic Diseases to Augment Market Demand

Rheumatoid arthritis affects an estimated 0.65% of the population in Japan, highlighting the country’s growing chronic disease burden. Additionally, Japan has an aging population of 36.25 million people aged 65 and older, making up nearly one-third of the total population, as reported by the Ministry of Internal Affairs and Communications. This combination of an aging population and rising rates of chronic illnesses is driving the demand for reliable drug delivery systems like autoinjectors, which is anticipated to bolster market growth.Japan Autoinjector Market Trends

The market is witnessing trends like new product launches and rapid technological innovations, boosting demand.Rise in New Product Launches to Elevate the Japan Autoinjector Market Value

In May 2024, Eisai Co., Ltd. and Nippon Medac Co., Ltd. announced the launch of Metoject® Subcutaneous Injection in Japan. This anti-rheumatic treatment, available in prefilled pen autoinjector formats of 7.5mg, 10mg, 12.5mg, and 15mg, contains methotrexate (MTX), a key drug for managing rheumatoid arthritis. The product received manufacturing and marketing approval on February 15, 2024. The rise in product approvals and commercial availability of such innovations is expected to elevate the market value in Japan.Rapid Technological Innovation Likely to Augment Japan Autoinjector Market Demand

One of the major market trends is the rising development of smarter and safer autoinjectors, including features like ergonomic designs, needle concealment, and smart connectivity for dose tracking. These advancements aim to enhance patient safety, usability, and confidence in self-administration. For instance, devices like the YpsoMate® autoinjector, developed by Ypsomed, incorporate intuitive handling and audible/visual feedback mechanisms.Japan Autoinjector Market Segmentation

The market report offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Disposable

- Reusable

- Empty

- Prefilled

Market Breakup by Route of Administration

- Subcutaneous

- Intramuscular

Market Breakup by Application

- Rheumatoid Arthritis

- Diabetes

- Multiple Sclerosis

- Anaphylaxis

- Others

Market Breakup by End User

- Hospitals & Clinics

- Homecare Settings

- Ambulatory Surgical Centers

- Others

Japan Autoinjector Market Share

Segmentation Based on Application to Witness Substantial Growth

Based on the application, the market is segmented into rheumatoid arthritis, diabetes, multiple sclerosis, anaphylaxis, and others. Rheumatoid arthritis holds a substantial market share as it is one of the most prevalent chronic autoimmune diseases in Japan. The condition often requires long-term, consistent administration of biologics, many of which are delivered via autoinjectors for convenience and adherence. The elderly population, which is more prone to rheumatoid arthritis, further supports the growth of this segment.Leading Players in the Japan Autoinjector Market

The key features of the market report comprise patent analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Nipro Corporation Japan

Nipro Corporation, headquartered in Osaka, is a leading Japanese manufacturer of medical devices, pharmaceuticals, and pharmaceutical packaging. The company has made significant strides in the development of advanced drug delivery devices. In the Japan autoinjector market, Nipro contributes by supplying components and integrated systems for prefilled syringes and autoinjectors, supporting both domestic and global pharmaceutical companies.Terumo Corporation

Terumo Corporation, based in Tokyo, is one of Japan’s most prominent medical technology companies. Its focus in the autoinjector market revolves around delivering high-precision injection systems, including prefillable syringes and custom autoinjector platforms. The company’s capabilities in device design, material science, and usability testing contribute to the development of autoinjectors that meet the needs of Japanese patients and regulatory standards.Otsuka Pharmaceutical Co. Ltd.

Otsuka Pharmaceutical, a major Japanese healthcare company, focuses on pharmaceuticals, nutraceuticals, and medical devices. The company actively collaborates with global players like Pfizer to bring advanced therapies and delivery systems to Japan. Otsuka supports the localization, distribution, and adaptation of autoinjector-based therapies for chronic illnesses, particularly in the fields of psychiatry and oncology.

SHL Medical Japan K.K.

SHL Medical Japan K.K. is a key innovator and supplier in the Japan autoinjector market. Specializing in the design and manufacturing of advanced autoinjector systems, SHL Medical offers customizable and patient-friendly solutions for biologics and high-viscosity drugs. The company is known globally for its Molly® and Amber® autoinjector platforms, which are widely used in therapies for autoimmune diseases and other chronic conditions.

Other key players in the market include Ypsomed Japan, Mylan N.V., Pfizer, Eisai Co. Ltd., and Biogen Idec.

Key Questions Answered in the Japan Autoinjector Market Report

- What was the Japan autoinjector market value in 2024?

- What is the Japan autoinjector market forecast outlook for 2025-2034?

- What is the market segmentation based on type?

- What is the market breakup based on the route of administration?

- How is the market segmented based on application?

- How is the market segmented based on the end user?

- What are the major factors aiding the Japan autoinjector market demand?

- How has the market performed so far, and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- What are the major Japan autoinjector market trends?

- Which type is expected to dominate the market segment?

- Which route of administration is projected to lead the market segment?

- Which application is anticipated to drive the market segment?

- Which end user is likely to dominate the market segment?

- Who are the key players involved in the Japan autoinjector market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Nipro Corporation Japan

- Terumo Corporation

- Otsuka Pharmaceutical Co. Ltd.

- SHL Medical Japan K.K.

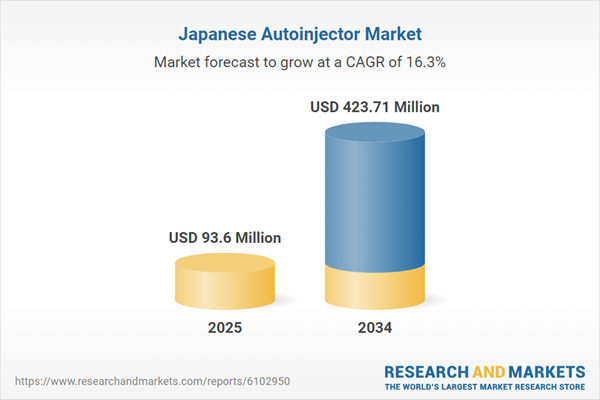

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 93.6 Million |

| Forecasted Market Value ( USD | $ 423.71 Million |

| Compound Annual Growth Rate | 16.3% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 4 |