This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

This industry encompasses a range of vehicle transport methods, including open and enclosed carriers, each suited to different logistical requirements and customer preferences. Open carriers are widely used due to their cost-effectiveness and ability to transport a large number of vehicles in one trip, whereas enclosed carriers provide extra protection for high-value, luxury, or classic cars.

The evolution of the car carriers industry is closely linked to trends in automotive manufacturing, urbanization, and international trade, with advancements in carrier design and technology improving operational efficiency, safety standards, and environmental impact. For instance, innovations such as hydraulic ramps, adjustable decks, and lightweight yet durable materials have enhanced loading and unloading processes, vehicle security, and fuel efficiency.

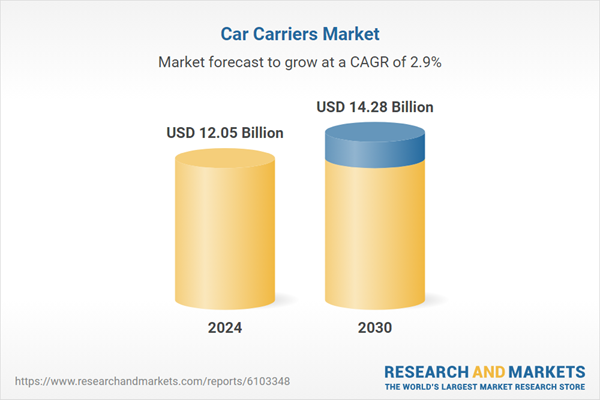

According to the research report “Global Car Carriers Market Outlook, 2030” the global market is projected to reach market size of USD 14.28 Billion by 2030 increasing from USD 12.05 Billion in 2024, growing with 2.94% CAGR by 2025-30. Additionally, the rise of e-commerce platforms for vehicle sales has amplified the demand for reliable and timely car transportation services, further bolstering the industry's growth. However, the sector also faces challenges such as fluctuating fuel prices, regulatory compliance related to vehicle weight and dimensions, and the need for skilled drivers trained to handle sophisticated loading equipment.

Moreover, environmental concerns have prompted the industry to explore greener alternatives, including the adoption of electric or hybrid carrier trucks and optimized routing software to reduce emissions. The car carriers market is highly competitive and fragmented, with regional players focusing on domestic vehicle transportation and global logistics companies providing integrated multimodal solutions. Geographically, regions with large automotive production hubs like North America, Europe, and Asia-Pacific dominate the market, driven by robust manufacturing activities and expansive dealership networks.

Market Drivers

- Growth in Vehicle Production and Global Trade: The continuous increase in global automobile manufacturing, especially in emerging markets, fuels the demand for efficient car transportation solutions. As manufacturers expand their production capacities and export vehicles internationally, car carriers become essential for moving large volumes safely and cost-effectively from factories to dealerships and end consumers.

- Rise of E-commerce and Online Vehicle Sales: The growing popularity of online platforms for buying and selling vehicles has significantly increased the need for reliable and timely vehicle delivery services. Consumers expect fast, transparent shipping, which pushes the car carriers industry to innovate and improve service quality to meet these expectations.

Market Challenges

- Regulatory and Safety Compliance: Car carriers must navigate a complex web of regulations regarding vehicle weight limits, transport dimensions, driver qualifications, and road safety standards. Compliance can be costly and complicated, particularly when operating across multiple jurisdictions with varying laws.

- Environmental Concerns and Fuel Costs: Rising fuel prices and stricter emissions regulations put pressure on carriers to optimize fuel efficiency and reduce their carbon footprint. Transitioning to greener technologies like electric or hybrid trucks poses both financial and operational challenges in an industry traditionally reliant on diesel-powered vehicles.

Market Trends

- Technological Advancements in Carrier Design and Fleet Management: Innovations such as hydraulic lifts, adjustable decks, and lightweight materials improve vehicle loading efficiency and safety. Simultaneously, digital tools including GPS tracking, route optimization software, and IoT-enabled fleet monitoring enhance operational efficiency, reduce delivery times, and improve customer experience.

- Shift Toward Sustainable and Eco-Friendly Transportation: The industry is increasingly adopting alternative fuels, electric carriers, and eco-friendly practices to comply with environmental standards and reduce operating costs. This trend aligns with the broader automotive industry's push towards sustainability and is expected to accelerate in the coming years.

Enclosed car carriers offer unparalleled protection against external elements such as weather, road debris, dust, and potential vandalism, which makes them the preferred choice for transporting luxury, classic, exotic, and newly manufactured vehicles that require extra care. Unlike open carriers, which expose vehicles to environmental risks and potential damage, enclosed carriers ensure that the transported cars remain in pristine condition from origin to destination. This level of security is particularly crucial for premium automakers, collectors, and dealerships that cannot afford even minor cosmetic damages during transit.

Furthermore, enclosed carriers often come equipped with advanced suspension systems and climate control options, reducing the risk of mechanical shocks and preserving the vehicle’s interior quality. As consumer awareness about vehicle protection grows and demand for high-end automobiles increases, the preference for enclosed transportation continues to rise, driving market growth.

Additionally, the rise of online vehicle sales and auctions, where buyers expect their cars to arrive without any damage, has further boosted the adoption of enclosed carriers. Despite their higher cost compared to open carriers, the benefits of enhanced safety and guaranteed vehicle integrity make enclosed carriers the leading segment in the car carriers market, especially for segments involving luxury and sensitive vehicles.

The main reason Automotive Sales Service Shops, commonly known as 4S shops, are leading in the car carriers market is their integrated role in vehicle sales, servicing, spare parts, and feedback, making them a central hub for efficient and reliable vehicle delivery and transportation solutions.

4S shops serve as a one-stop destination for customers to purchase new cars, get authorized maintenance and repairs, and access genuine spare parts, which positions them as critical players in the automotive supply chain. Because these shops handle large volumes of vehicles - from brand-new cars fresh off the production line to vehicles needing after-sales service - they require consistent, timely, and secure transportation solutions to maintain inventory levels and meet customer demand. Car carriers are indispensable to 4S shops as they facilitate the movement of vehicles between manufacturers, regional distribution centers, and retail outlets.

The reliance on professional and dependable vehicle transportation is essential for these shops to uphold their reputation for quality and customer satisfaction. Additionally, 4S shops often manage fleet vehicles or offer trade-in and resale services, further increasing their need for specialized transportation. Their leadership in the car carriers market is also influenced by the increasing penetration of organized retail in emerging markets and the growing preference among consumers for authorized dealers, which drives higher volumes of vehicle shipments to these outlets. This demand makes 4S shops the primary end-users of car carrier services, pushing logistics providers to tailor solutions that prioritize vehicle safety, punctuality, and handling care specific to the needs of premium and mass-market vehicles alike.

The main reason Europe is leading in the car carriers market is its well-established automotive industry combined with a dense network of manufacturing hubs, advanced infrastructure, and stringent regulatory standards that demand efficient and high-quality vehicle transportation solutions.

Europe is home to some of the world’s largest and most prestigious automobile manufacturers, including Volkswagen, BMW, Mercedes-Benz, and Audi, which produce millions of vehicles annually for both domestic consumption and export. This extensive production capacity creates a continuous and substantial demand for reliable car carriers to transport vehicles from factories to dealerships, ports, and export destinations. Additionally, Europe’s highly developed road and logistics infrastructure facilitates efficient vehicle movement across countries, making it an ideal region for extensive car carrier operations.

Strict safety and environmental regulations in Europe further encourage the use of advanced, secure, and eco-friendly transportation methods, pushing the market towards higher standards of service and innovation. Moreover, the increasing trend of cross-border trade within the European Union, supported by customs union policies and open borders, simplifies logistics and expands the reach of car carriers, contributing to market growth. The rising preference for premium and luxury vehicles in Europe also boosts demand for specialized carriers, such as enclosed transporters, which offer enhanced protection.

- In 2024, Chinese electric vehicle (EV) manufacturer BYD launched its first dedicated car carrier, the Explorer No. 1, capable of transporting up to 7,000 vehicles. This vessel, measuring 199.9 meters in length, embarked on its maiden voyage from China to Europe, specifically to ports in the Netherlands and Germany. Powered by a dual-fuel LNG and conventional engine, it aims to enhance BYD's logistics capabilities amid its global expansion.

- Following this, BYD introduced the BYD Heifei, a hybrid LNG-powered car carrier with a capacity of 7,000 vehicles. This vessel is part of BYD's strategy to own a fleet of eight car carriers by early 2026, supporting its EV exports to Europe.

- SAIC Motor Corporation unveiled its first customized ocean-going car carrier, a dual-fuel LNG roll-on/roll-off (RoRo) vessel with a capacity of 7,600 vehicles. This ship is designed for European routes and is part of a broader plan to add 12 new car carriers to SAIC Anji Logistics' fleet by 2026, enhancing the company's vehicle export capabilities.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Car Carriers Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type

- Open-Air Car Carrier

- Enclosed Car Carrier

By Components

- Automotive Sales Service Shop 4S

- Terminals

- Others (corporate fleets, auction houses, used vehicle dealers, rentals)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to this industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Montway Auto Transport

- Safeeds Transport Inc

- RoadRunner Auto Transport

- TEC Equipment Co

- Internationale Spedition Willi Betz GmbH & Co. KG

- PUREPROGRESS GmbH

- Hert-Transport

- UAB Autologa

- DAX Logistic

- ACERTUS

- SGT Auto Transport

- Chetak Logistics Limited

- NX Auto Transport

- Hamana Works Company Limited

- Matro Logistics

- Seamless Autotech Pvt. Ltd.

- Chitlangia Industries

- Kailash Vahn Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.05 Billion |

| Forecasted Market Value ( USD | $ 14.28 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |