This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

This not only drastically reduces congestion and travel delays but also cuts down on vehicle emissions caused by idling and stop-and-go traffic around toll plazas, thereby supporting broader environmental sustainability goals. With the rise of urbanization and the growing volume of vehicles on roads worldwide, the pressure on toll operators to manage traffic efficiently and maintain infrastructure funding has never been greater, driving a robust demand for modern electronic tolling solutions.

Moreover, the ETC industry is benefiting from a global push toward smart mobility and intelligent transportation systems (ITS), which aim to integrate data, connectivity, and automation across urban and interurban networks. Governments and private concessionaires are increasingly investing in interoperable toll systems that allow a single on-board unit or account to function across different regions and even countries, improving the travel experience for motorists and reducing administrative burdens for operators.

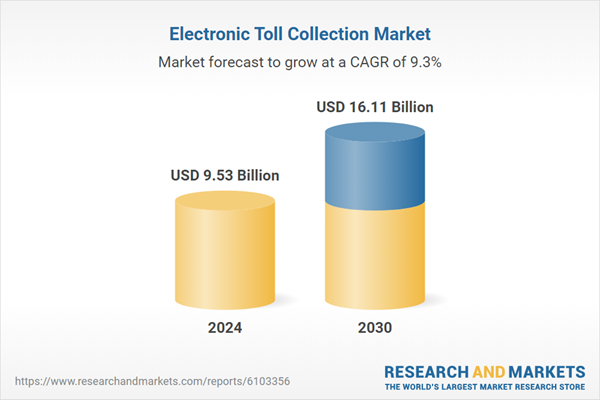

According to the research report “Global Electric Toll Collection Market Outlook, 2030” the global Electric Toll Collection market is projected to reach market size of USD 16.11 Billion by 2030 increasing from USD 9.53 Billion in 2024, growing with 9.33% CAGR by 2025-30. In countries such as the United States, India, China, and several European nations, large-scale electronic tolling projects have been rolled out to replace outdated manual methods, enabling greater transparency, more accurate revenue auditing, and a more user-friendly experience for drivers.

These systems often integrate with broader smart-city infrastructure, connecting to traffic management centers, law enforcement databases, and digital payment ecosystems, opening up new opportunities for data-driven policy decisions and better infrastructure planning. In addition to improving operational efficiency, electronic toll collection has significant financial benefits for toll operators and government agencies. By reducing staffing costs, minimizing revenue leakages from fraud or human error, and ensuring round-the-clock toll collection even during peak congestion or off-hours, ETC systems help maximize the return on investment from costly road infrastructure projects.

The ability to deploy dynamic pricing adjusting toll rates based on congestion levels or time of day is also a crucial advantage of electronic toll systems, incentivizing motorists to travel during less busy periods and thereby distributing traffic loads more evenly. This demand-management approach not only boosts revenue but also extends the life of roads and bridges by reducing excessive wear and tear during high-traffic periods.

Market Drivers

- Growing Urban Traffic Congestion: Rapid urbanization and rising vehicle ownership are causing severe congestion on highways and urban corridors. Electric toll collection systems help alleviate bottlenecks by enabling seamless, contactless toll payments, eliminating stop-and-go queues, and supporting smoother traffic flow.

- Government Push for Digital Infrastructure and Transparency: Many governments are prioritizing digital transformation and better revenue collection. ETC systems provide accurate, auditable, and efficient toll revenue streams, reducing cash leakages and ensuring fair, transparent tolling practices that boost public trust and infrastructure funding.

Market Challenges

- Interoperability and Standardization: Integrating different ETC systems across regions or countries is complex, with diverse technologies, standards, and policies creating barriers for seamless cross-border or multi-operator tolling, frustrating both operators and road users.

- Cybersecurity and Data Privacy Concerns: As ETC relies on vehicle data, user accounts, and networked payment systems, the risk of cyberattacks or data misuse is significant. Ensuring secure, encrypted transactions and protecting personal driver data is a constant challenge for operators and regulators.

Market Trends

- Integration with Smart Mobility and Connected Vehicles: ETC is increasingly being woven into broader intelligent transportation systems, connecting with vehicle telematics, real-time traffic management, and mobility apps to deliver a smoother, more data-driven travel experience.

- Adoption of Dynamic and Congestion-Based Pricing: More toll operators are leveraging ETC to implement variable toll rates based on real-time traffic volumes or peak hours, encouraging off-peak travel, reducing congestion, and optimizing road utilization.

Transponder or tag-based tolling systems have emerged as the dominant solution in the electric toll collection market due to their simplicity, speed, and reliability in handling high traffic volumes without interrupting vehicle flow. These systems use compact electronic tags or transponders, typically mounted on a vehicle’s windshield, to communicate wirelessly with roadside antennas as vehicles pass through toll points. This ensures near-instant, contactless toll deductions and minimizes delays, making them especially effective for high-capacity highways and urban expressways where congestion can be a serious problem.

Tag-based systems are also highly cost-effective for both toll operators and drivers, with affordable installation and minimal maintenance compared to more complex camera-based or video tolling solutions, which may require higher image-processing power and frequent recalibration. Furthermore, transponder systems have proven scalability, allowing easy integration with regional and even cross-border interoperability frameworks, giving drivers a seamless tolling experience over wide areas with a single account or device. Their mature technology, established supply chain, and user familiarity mean that transponder-based ETC networks can be expanded or upgraded incrementally without major system overhauls, lowering long-term operational risks and costs.

RFID is leading the electric toll collection (ETC) market because it offers a highly efficient, low-cost, and reliable technology for fast, contactless vehicle identification and toll processing at scale.

Radio-frequency identification (RFID) has emerged as the dominant technology in the electric toll collection market because it enables seamless, high-speed, and accurate identification of vehicles without requiring them to stop or even slow down, dramatically improving traffic flow and user convenience. RFID tags, which are inexpensive and easy to install on vehicles, interact with readers mounted at toll plazas or gantries to automatically deduct toll charges from a linked account as vehicles pass through. This contactless system eliminates the delays, errors, and labor costs associated with manual toll collection while supporting far higher throughput, making it ideal for busy expressways, urban corridors, and intercity highways.

RFID’s mature, standardized technology allows for consistent performance across diverse road networks and can easily integrate with regional or national tolling frameworks to enable interoperability, giving drivers the convenience of a single tag for multiple routes and regions. In addition, RFID is highly scalable and cost-effective for toll operators, requiring minimal maintenance and providing strong resistance to environmental conditions like dust, rain, or fog, which can hamper camera-based systems. These advantages make RFID the backbone of ETC deployments in countries across Asia, Europe, and the Americas, driving its widespread adoption as a trusted, proven, and future-ready solution for managing modern tolling operations efficiently.

Hardware dominates the electric toll collection (ETC) market because physical devices like RFID readers, antennas, cameras, and gantry systems are essential for the accurate, real-time identification and processing of vehicles, forming the backbone of any tolling operation.

Hardware remains the leading component in the electric toll collection market because, without robust and reliable physical infrastructure, even the most advanced software or backend systems cannot function effectively. Essential devices such as RFID readers, transponder scanners, automatic number plate recognition (ANPR) cameras, vehicle classifiers, and gantries are the front-line tools that directly interact with vehicles on the road, capturing critical data like identity, class, and axle count with high speed and accuracy. These hardware systems enable real-time, contactless tolling by ensuring vehicles can be identified and billed without stopping, greatly reducing congestion and improving the driver experience.

Moreover, tolling hardware is built to withstand challenging outdoor environments, operating reliably despite dust, rain, temperature fluctuations, and heavy traffic volumes, which is crucial for maintaining 24/7 revenue collection. As governments and private concessionaires continue to upgrade roads with smarter and more automated tolling systems, investments in durable, scalable, and interoperable hardware solutions remain a top priority to guarantee long-term performance and security. While software, cloud platforms, and payment gateways play vital roles in ETC ecosystems, they ultimately rely on these on-the-ground hardware elements to gather accurate, real-time data for smooth, efficient toll collection cementing hardware’s place as the foundation of the entire ETC market.

Highways lead the electric toll collection (ETC) market because they handle the highest vehicle volumes over long distances, requiring efficient, reliable, and congestion-free tolling systems to maintain smooth traffic flow and consistent revenue collection.

Highways have emerged as the dominant application area in the electric toll collection market because they are the critical arteries of national and regional transportation networks, carrying massive volumes of passenger and freight vehicles every day. Manual tolling on highways traditionally led to long queues, travel delays, fuel waste, and increased emissions as vehicles stopped and idled at toll booths. Electric toll collection systems, particularly on highways, eliminate these inefficiencies by providing seamless, contactless toll payments, allowing vehicles to travel at normal speeds through toll points without stopping.

This is essential for maintaining the operational efficiency and safety of high-speed, high-capacity road networks, where even small traffic disruptions can ripple into significant congestion and lost productivity. Furthermore, highways are a major revenue generator for road authorities and concessionaires, and implementing ETC maximizes revenue by reducing leakage, improving transaction accuracy, and extending tolling capabilities to multiple lanes or open-road configurations.

As governments expand and modernize highway infrastructure to accommodate growing populations and trade flows, ETC solutions on highways continue to gain priority because they support long-distance travel, regional connectivity, and economic development, while aligning with broader sustainability goals by cutting emissions and promoting smoother, more predictable journeys. This combination of economic, environmental, and operational benefits makes highways the leading segment within the global ETC market.

North America leads the electric toll collection (ETC) market because of its extensive highway networks, strong public-private investment, and early adoption of advanced tolling technologies that have created a mature, scalable, and interoperable tolling ecosystem.

North America has secured its position at the forefront of the electric toll collection market thanks to a combination of well-developed highway infrastructure, robust traffic volumes, and a proactive approach to modernizing transportation systems. The United States and Canada have vast networks of interstates, turnpikes, and expressways that require efficient tolling solutions to manage congestion, reduce environmental impacts, and ensure steady revenue streams for road maintenance and expansion.

Public agencies and private concessionaires in the region have been early adopters of technologies like RFID transponders, dedicated short-range communication (DSRC), and advanced video tolling systems, which have laid the foundation for sophisticated, multi-lane free-flow ETC environments. North America’s focus on interoperability allowing drivers to use a single transponder across multiple states and toll agencies has further strengthened adoption and user confidence.

This region also benefits from strong regulatory frameworks, public-private partnerships, and a mature supplier ecosystem, making it easier to deploy, scale, and upgrade ETC infrastructure over time. In addition, the cultural acceptance of electronic payments, high rates of vehicle ownership, and consistent government initiatives to support smart transportation have created an environment where ETC can flourish.

- In April 2025, Q-Free received important contracts from top US toll agencies to set up its Kinetic Mobility Advanced Traffic Management System (ATMS). It introduced the company into the US tolling market and was a breakthrough.

- In February 2025, Kapsch TrafficCom AG introduced its new Automatic Number Plate Recognition (ANPR) engine for the North American market. The advanced license plate recognition solution from Kapsch is set to provide better results, more options, and lower costs for its tolling customers.

- In January 2025, ST Engineering (Transcore) introduced its Infinity tolling technology on the West Virginia Turnpike in an important update for the state’s tolling system. By doing this, the authorities hope to help travelers, streamline road use, and provide more payment methods.

- In October 2024, the Delaware River Joint Toll Bridge Commission awarded TransCore a contract to bring its toll system up to date across the bridges it controls. As the project continues, old equipment will be replaced with the Infinity Digital Lane System from TransCore, which boosts efficiency, makes road use more reliable, and ensures an improved user experience for drivers.

- In September 2024, Neology acquired P Square Solutions, a company specializing in tolling services and technology. Following the acquisition, Neology has a brand new business division called Neology PSquare that dramatically improves the company’s worldwide tolling services.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Electronic Toll Collection Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type

- Transponders/Tag Based Tolling Systems

- Others (Video, ANPR, GNSS)

By Technology

- RFID

- DSRC

- Others (GNSS, ANPR, Mobile Tolling)

By Application

- Highways

- Urban Areas

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to this industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Kapsch TrafficCom AG

- Neology, Inc.

- Thales S.A.

- Indra Sistemas S.A.

- Star Systems International Ltd.

- Tecsidel S.A.

- Q-Free ASA

- Cubic Corporation

- Conduent Incorporated

- Adaptive Recognition Inc.

- Feig Electronic GmbH

- Singapore Technologies Engineering Ltd

- Quarterhill Inc.

- Mitsubishi Heavy Industries, Ltd.

- Perceptics LLC

- EFKON GmbH

- ITIS Holding a.s.

- Toshiba Corporation

- Metro Infrasys Pvt. Ltd.

- Far Eastern Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.53 Billion |

| Forecasted Market Value ( USD | $ 16.11 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |