Probiotic yeast plays a vital role in improving gut health, boosting immunity, and aiding nutrient absorption, which contributes to higher productivity and healthier animals throughout the lifecycle. Additionally, the growing concerns over antibiotic resistance and tightening regulations on antibiotic use in livestock have made probiotic yeast feeds more attractive for swine farming.

Additionally, as live yeast products continue to gain traction, there is a growing demand for both dry and liquid forms of probiotic yeast. This increase in demand is driven by advancements in animal nutrition, where precision feeding solutions are becoming more prominent. These innovations are not only meeting the growing need for more effective, natural feed additives but are also aligning with the increasing focus on sustainability and regulatory compliance. The combination of new technologies and stricter regulations is pushing the market toward more tailored, efficient, and environmentally friendly approaches to animal health and productivity.

In 2024, the live yeast segment captured a 54.3% share, valued at USD 800 million. The popularity of live yeast stems from its ability to improve digestion, increase nutrient absorption, and enhance immunity, making it a key substitute for antibiotic-based health promoters. This shift is a result of growing concerns about animal welfare and regulatory changes favoring natural additives. The live yeast segment is expected to continue growing steadily, with ongoing improvements in product design and development for specific applications.

The dry form of the probiotic yeast segment held a 67.69% share in 2024. This form is favored for its extended shelf life, easy storage, and compatibility with feed mixing, making it ideal for large-scale commercial pig farms. The dry segment is more cost-effective and durable, leading to wider adoption among feed producers. While the dry form remains dominant, liquid probiotic yeast is gradually gaining traction in operations where rapid microbial activity and enhanced absorption are prioritized.

Asia Pacific Swine Feed Probiotic Yeast Market held a 34.1% share in 2024, with countries like China, Vietnam, and the Philippines leading the way. High pork consumption and the expanding swine farming industry in this region are major drivers of growth. Furthermore, consumer demand for antibiotic-free pork and yeast-based feeds that promote gut health and immunity is fueling market demand. Governments in this region are enforcing strict regulations on antibiotic use in livestock, further boosting the demand for natural probiotic alternatives.

Key players in the Global Swine Feed Probiotic Yeast Market include Chr. Hansen A/S, Koninklijke DSM N.V., Archer Daniels Midland Company, Alltech Inc., and Lallemand Inc. These companies are leading the charge in innovation, product development, and distribution across various regions. To strengthen their market position, companies in the swine feed probiotic yeast industry focus on several key strategies. First, they invest heavily in research and development to improve the efficacy of probiotic yeast products, ensuring they meet the growing demand for enhanced animal health solutions. Strategic partnerships with feed producers and livestock organizations help to expand their market reach and distribution channels.

Moreover, these companies are leveraging advanced technologies to create more sustainable, cost-effective products that align with the rising consumer preference for antibiotic-free, natural alternatives. Additionally, many of the industry’s leading players are committed to sustainability initiatives, ensuring their products are environmentally friendly, thus appealing to a broader, eco-conscious customer base.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this swine feed probiotic yeast market report include:- Chr. Hansen A/S

- Koninklijke DSM N.V.

- Archer Daniels Midland Company (ADM)

- Alltech Inc.

- Lallemand Inc.

- Phileo by Lesaffre

- Cargill Incorporated

- Evonik Industries AG

- Novus International, Inc.

- Angel Yeast Co., Ltd.

- Novozymes A/S

- Associated British Foods plc

- Biorigin

- Leiber GmbH

- Biomin Holding GmbH

- Novonesis (formerly Novozymes)

- Aniamor Nutrition

- DuPont (IFF)

- Land O'Lakes, Inc.

- Nutreco N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

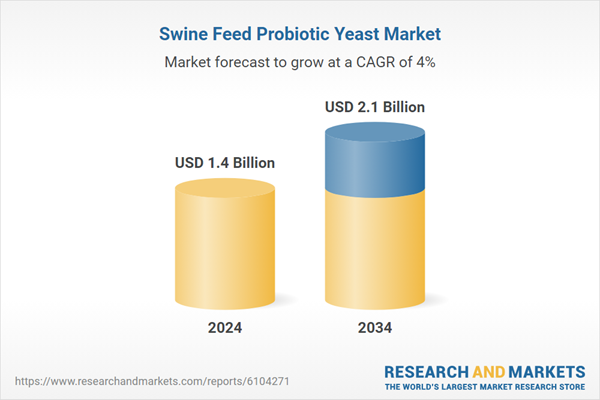

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |