The evolution of shrink sleeve labeling technology has significantly transformed product aesthetics and branding, pushing businesses across multiple verticals to embrace high-speed, efficient, and adaptable labeling machinery. As companies focus on visual appeal and brand identity, these machines play a pivotal role in delivering seamless full-body decoration on various types of containers. Advancements in heat tunnel mechanisms and automation frameworks are also accelerating the pace of adoption. Moreover, the industry is responding to increasing regulatory and consumer demand for packaging safety, prompting further upgrades in shrink sleeve equipment.

Fully automatic shrink sleeve labeling machines led the global market in 2024, generating revenue of USD 398.5 million and are expected to grow at a CAGR of 4.1% during the forecast period. These machines are gaining widespread acceptance due to their ability to support uninterrupted, high-volume production lines without manual intervention. Their integration with smart systems allows for rapid label application, along with built-in error detection and rejection mechanisms, contributing to reduced downtime and improved efficiency. These systems are especially popular in large-scale manufacturing environments where speed, accuracy, and repeatability are essential.

Semi-automatic variants, although more modest in scale, remain relevant for small and mid-sized enterprises. These machines are equipped with basic sensor-based technologies that can automatically apply shrink labels to bottles, vials, or containers without requiring manual precision. They are ideal for businesses handling diverse product shapes and sizes, and they offer a cost-effective entry point for manufacturers transitioning from manual labeling processes.

Manual shrink sleeve labeling machines continue to serve niche markets, particularly where customization or short-run production is necessary. Although they offer limited automation, they provide flexibility and are easy to operate, making them suitable for start-ups or low-volume production settings.

From an end-use perspective, the food and beverage industry dominated the global market with a 45% share in 2024, and the segment is projected to grow at a CAGR of 4.2% through 2034. This sector is experiencing rapid changes in consumer preferences, leading to a surge in packaged foods, flavored beverages, and convenient meal options. As a result, the need for dynamic labeling systems that can handle containers of varied sizes and shapes is increasing. Shrink sleeve labeling machines enable complete 360°-degree branding, which is a key selling point for manufacturers in this space. Their ability to provide tamper-evident features also adds a layer of safety and assurance to the product packaging, further driving demand.

The cosmetics and personal care segment is also registering robust growth as brands strive to stand out in a highly competitive retail environment. Shrink sleeve machines allow for high-resolution printing on irregular container shapes, which is crucial for companies looking to enhance shelf appeal. With a growing focus on environmentally friendly packaging, many manufacturers are also opting for biodegradable and recyclable sleeve materials, which align well with global sustainability goals.

The pharmaceutical and chemical industries are adopting these machines to meet strict compliance standards and to support batch-level identification and tracking. In particular, the demand for highly precise, tamper-proof labeling solutions is spurring the adoption of advanced shrink sleeve systems in these sectors.

By container diameter, the up to 50 mm segment emerged as the top contributor to the market in 2024 and is estimated to grow at a CAGR of over 3.7% during the forecast period. Small-diameter containers such as tubes, vials, and sample bottles are extensively used in personal care, pharmaceutical, and nutraceutical industries. These applications require high-speed, compact labeling systems that can handle fragile packaging with precision, contributing to segment growth.

Regionally, the United States led the North American market, accounting for 83% of regional revenue in 2024, with earnings reaching USD 160.1 million. The strong presence of food and beverage manufacturers, combined with an established infrastructure for automated packaging, is fueling the demand for shrink sleeve labeling equipment. Technological upgrades and an increasing shift toward lean manufacturing have further enhanced the attractiveness of these machines for US-based firms.

Companies operating in this market are actively investing in R&D and forming strategic alliances to enhance their market presence. Technological improvements and automation-focused upgrades are helping firms stay ahead of changing industry requirements. For instance, industry players are integrating smart features into their machines, enabling faster setup times, predictive maintenance, and seamless integration into existing production lines. These strategies are not only helping companies meet customer expectations but also offering scalable solutions that adapt to emerging trends in packaging and labeling.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this shrink sleeve labeling machine market report include:- Accutek Packaging Equipment

- Axon

- Bhagwati Labelling Technologies

- BW Integrated Systems

- Crown Packaging

- Dase-Sing Packaging

- Esleeve Enterprise

- Fuji Seal

- King Machine

- Magic Special Purpose Machineries

- Pack Leader USA

- PDC International

- Procus Machinery

- Quadrel

- XH Labeling Machine

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

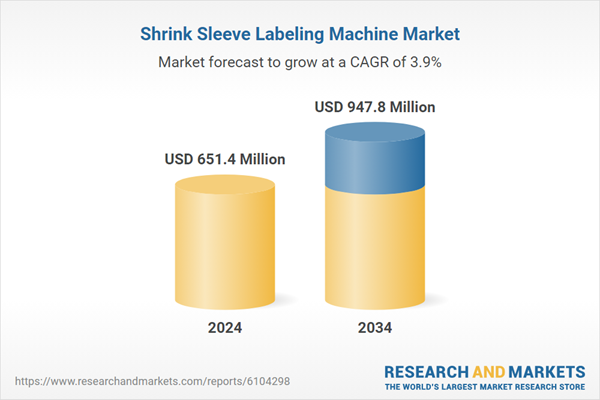

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 651.4 Million |

| Forecasted Market Value ( USD | $ 947.8 Million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |