Stretch wrappers, especially machine-operated types, help streamline pallet wrapping with higher accuracy and repeatability than manual alternatives. This is vital for handling large-scale operations, ensuring load stability, and minimizing product damage during transit and storage. Automation also contributes to reducing labor costs, addressing labor shortages, and preventing repetitive strain injuries.

Stretch wrappers integrated with features such as programmable settings, pre-stretch film systems, and factory interface capabilities improve load consistency, decrease packaging time, and minimize waste. With sensors and smart monitoring systems, these machines automatically adjust film usage in real-time, further optimizing resources. Data from government agencies indicate increased deployment of such systems, reflecting an overall market shift toward automation. As firms explore smarter, sustainable, and more efficient wrapping processes, the demand for flexible, intelligent machinery continues to escalate across a broad range of industrial and commercial applications.

The turntable stretch wrappers segment generated USD 1.3 billion in 2024 and is projected to register a CAGR of 6% through 2034. Their rising popularity stems from their affordability, adaptability, and appeal to mid-sized and smaller enterprises. These systems require less upfront investment than ring or rotary arm wrappers while still offering sufficient speed and efficiency for operations not demanding high throughput. Their compact design makes them suitable for space-constrained environments, and their ability to handle varied pallet shapes and weights enhances their utility. Many models now incorporate semi-automatic or automatic functionality, offering a future-proof solution that can evolve with operational needs.

The semi-automatic machines segment held a 56.3% share in 2024 and is projected to grow at a CAGR of 4.5% during 2025 - 2034. These systems provide a practical balance of affordability, performance, and ease of use, making them attractive for companies aiming to step up from manual methods without investing in fully automated systems. They deliver consistent wrapping quality, accommodate various pallet sizes, and require minimal training or installation.

These machines are particularly suitable for industries that demand moderate automation and flexibility while maintaining budgetary control. As modernization becomes a priority for businesses in developing markets and among small-to-midsize firms, semi-automatic wrappers are increasingly seen as a strategic upgrade that enables automation without massive capital outlay.

United States Stretch Wrappers Market generated USD 900 million in 2024 and is projected to grow at a CAGR of 6.8% through 2034. This dominance is driven by the country's established retail, manufacturing, and logistics industries, all of which require efficient and reliable packaging automation. The growth of e-commerce has accelerated demand for semi-automatic and automatic systems that support high-volume packaging environments. The growing need for rapid and consistent packaging processes. As labor expenses continue to rise, more companies are turning to automation to increase productivity and cut operational costs.

Leading companies in the Global Stretch Wrappers Market include Arpac, Berran Industrial, Nitech IPM, Technowrapp, Signode Industrial, Atlanta Stretch, Robopac, Premier Tech, Fromm Packaging Systems, Paxiom Group, Phoenix Wrappers, Orion Packaging Systems, Webster Griffin, Lantech, and Wulftec International. To enhance their presence and competitive standing, stretch wrapper manufacturers are focusing on multiple strategic approaches. These include investing heavily in research and development to introduce smarter, more energy-efficient machines equipped with AI-enabled controls and adaptive technology.

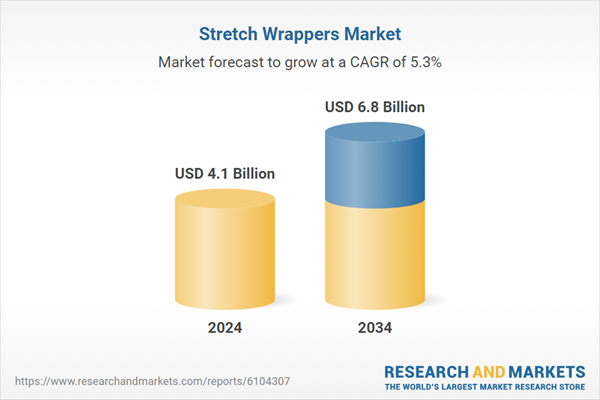

Companies are also expanding their product portfolios by offering modular systems that can scale with business needs, ensuring flexibility for end users. Forming strategic partnerships with distributors and supply chain stakeholders is another approach used to widen market reach. Many firms are also localizing production and support centers to provide faster service and build stronger client relationships.o reach USD 6.8 Billion by 2034.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this stretch wrappers market report include:- Arpac

- Atlanta Stretch

- Berran Industrial

- Fromm Packaging Systems

- Lantech

- Nitech IPM

- Orion Packaging Systems

- Paxiom Group

- Phoenix Wrappers

- Premier Tech

- Robopac

- Signode Industrial

- Technowrapp

- Webster Griffin

- Wulftec International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 6.8 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |