Stand-up pouches have emerged as a preferred packaging solution due to their reduced material usage, lower transportation costs, and enhanced shelf appeal. These pouches offer convenience with features like resealable closures and spouts, making them highly suitable for consumer-centric industries. As businesses seek more sustainable and efficient packaging options, stand-up pouch machines are becoming indispensable in modern production lines.

The growing need for flexible packaging solutions has made these machines vital for sectors such as food and beverage, personal care, pet food, and pharmaceuticals. Manufacturers are increasingly leaning towards stand-up pouches because of their ability to retain freshness, improve portability, and support attractive branding. The flexibility of pouch design also enables companies to differentiate their products on store shelves, further enhancing consumer engagement. With more brands prioritizing sustainability and operational efficiency, the demand for automated and semi-automated pouch machinery continues to expand, driving long-term market growth.

In terms of machine type, the stand-up pouch machines market is segmented into vertical form fill seal machines, horizontal form fill seal (HFFS) machines, and premade pouch machines. Among these, horizontal machines led the market with a revenue of approximately USD 667.4 million in 2024 and are forecast to grow at a CAGR of 6.7% during the 2025-2034 period.

These machines are widely adopted due to their ability to create pouches from flat film rolls and fill them in a horizontal format, which results in stronger seals and visually appealing packaging. Their high-speed production capability and compatibility with zipper or spout pouches make them an ideal solution for brands focused on quality and efficiency.

When assessed by mode of operation, the market is divided into manual, semi-automatic, and automatic machines. Manual machines held a significant share, accounting for 43.2% of the total market in 2024, and are projected to expand at a CAGR of 5.4% over the forecast timeline. These machines are popular among smaller businesses and startups due to their affordability and ease of use. They are particularly effective for short-run production and multi-product handling, requiring minimal maintenance and technical expertise. As demand rises in price-sensitive markets and among small-scale enterprises, the uptake of manual machines continues to be strong.

The market is also segmented by distribution channel into direct and indirect sales. In 2024, direct sales accounted for the largest portion, representing 51.2% of the total market share. This channel remains the preferred option for many end-users because it allows for tailored machine specifications and direct interaction with manufacturers. Customers benefit from streamlined installation, training, and after-sales support, which are critical when dealing with complex machinery. Direct engagement enables manufacturers to better understand user requirements and provide personalized service, fostering long-term relationships and improving customer satisfaction.

Regionally, North America has emerged as a dominant force in the stand-up pouch machines market, with the United States alone reaching a market valuation of USD 290.7 million in 2024. The country is forecast to grow at an impressive CAGR of 7.6% from 2025 to 2034. Growth in the region is being bolstered by a surge in demand for attractive, functional, and portable packaging for products in the food, pet food, and household goods segments. Advanced manufacturing technologies, such as smart automation and connected systems, are also enhancing the appeal of stand-up pouch machinery. In particular, the trend toward premium packaging for ready-to-consume and private-label products continues to generate strong momentum across retail sectors.

The competitive landscape of the market remains highly fragmented, with no single entity commanding a dominant share. Even well-established companies hold only a modest portion of total market value, collectively capturing about 10-15%. This is largely due to the proliferation of regional and niche manufacturers that serve specific industries with custom-built and cost-efficient machinery. These smaller players are agile, competitively priced, and often offer personalized services, allowing them to cater to the unique demands of local customers.

In addition, the low switching costs in this industry encourage frequent supplier changes based on pricing or technical needs. Although some established players have a global footprint, machine production constitutes just one part of their broader business portfolios. Meanwhile, mid-sized and emerging companies are making significant inroads by leveraging modular machine designs, rapid product development, and adoption of next-gen technologies. This dynamic environment ensures that innovation remains continuous and market control remains distributed among numerous specialized providers.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this stand-up pouch machines market report include:- Amcor

- Bartelt Packaging

- Coveris Group

- Huhtamaki

- K-Flex Packaging

- Mondi

- PFM Group

- ProAmpac

- Sealed Air

- Smurfit Kappa

- Sonoco

- Tishma Technologies

- Totani

- Unified Flex

- Hudson-Sharp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

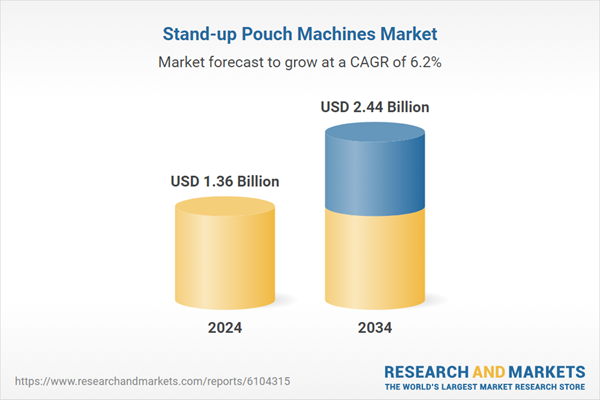

| Estimated Market Value ( USD | $ 1.36 Billion |

| Forecasted Market Value ( USD | $ 2.44 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |