The growing demand for electric and autonomous vehicles further accelerates this adoption, as these cars rely heavily on advanced human-machine interfaces. Consumers now expect personalized, responsive features, prompting automakers to invest in cutting-edge haptic solutions. North America and Europe lead the adoption of this technology, while the Asia-Pacific region is poised to grow the fastest, driven by increasing vehicle production and tech-savvy consumers.

Government regulations and safety standards also fuel market growth by emphasizing reduced driver distraction and improved road safety. Haptic feedback systems alert drivers during critical situations, such as lane departures or collision warnings, allowing them to stay focused on the road without diverting their gaze.

The actuators segment led the market with revenues of USD 1.2 billion in 2024. Actuators play a crucial role in delivering real-time tactile responses, generating vibrations, and touch sensations in steering wheels, infotainment displays, and touchscreens. As advanced driver-assistance systems and touch interfaces become more prevalent, demand for high-performance actuators grows. These components provide fast, precise feedback that enhances driving safety and comfort by replicating the feel of physical buttons on virtual controls. With the rise of connected and autonomous vehicles, the need for reliable and instantaneous haptic feedback is increasing, solidifying actuators’ dominant market position.

The tactile feedback segment accounted for a 77% share in 2024. This technology uses subtle vibrations or pulses to mimic touch sensations on surfaces like infotainment units, touchscreens, and climate control panels. Touch-based human-machine interfaces (HMIs) help drivers stay attentive and reduce distraction by offering intuitive and easy-to-use controls.

Compared to force feedback, which simulates resistance and is mostly used in steering systems, tactile feedback is more cost-effective and simpler to implement. Its compact size, efficiency, and reliability make capacitive touch technology a popular choice among automakers for virtual buttons, gear selectors, and seat adjustments. The increasing demand for responsive and intuitive user interfaces in premium vehicles has significantly driven the market share of haptic feedback.

Asia-Pacific Automotive Haptic Feedback System Market held a 54% share. China leads this regional market with a valuation of USD 586.3 million in 2024. China’s prominence stems from a robust manufacturing base, rapid vehicle production growth, and widespread adoption of ADAS and infotainment technologies. The strong automotive sectors in China, Japan, and South Korea contribute to the integration of haptic systems in next-generation vehicles. China’s leadership in automotive innovation is supported by government initiatives, substantial R&D investments, and rising consumer demand for connected and electric vehicles. As the country pushes towards intelligent mobility and autonomous driving, haptic feedback systems are being adopted at an accelerated pace.

Key players active in the Automotive Haptic Feedback System Market include Bosch, Texas Instruments, ALPS Alpine, Denso, Continental, Panasonic Automotive, Immersion, TDK, Aptiv, and ZF Friedrichshafen. Companies in the automotive haptic feedback system market focus on innovation to maintain and grow their market share. They invest heavily in R&D to develop more advanced, responsive, and energy-efficient actuators and tactile feedback technologies.

Strategic partnerships and collaborations with automakers and technology firms help accelerate product development and integration into new vehicle models. Expanding geographic reach through joint ventures and establishing local manufacturing hubs allows companies to tap into fast-growing regions, particularly in Asia-Pacific. Players emphasize creating customizable, scalable solutions to cater to the diverse needs of electric and autonomous vehicles.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this automotive haptic feedback system market report include:- ALPS Alpine

- Analog Devices

- Aptiv

- Bosch

- Continental

- Denso

- Immersion

- Johnson Electric

- Methode Electronics

- Microchip Technology

- Neonode

- Nidec

- Panasonic Automotive

- Precision Microdrives

- Stanley Electric

- Synaptics

- TDK

- Texas Instruments

- Valeo

- ZF Friedrichshafen

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

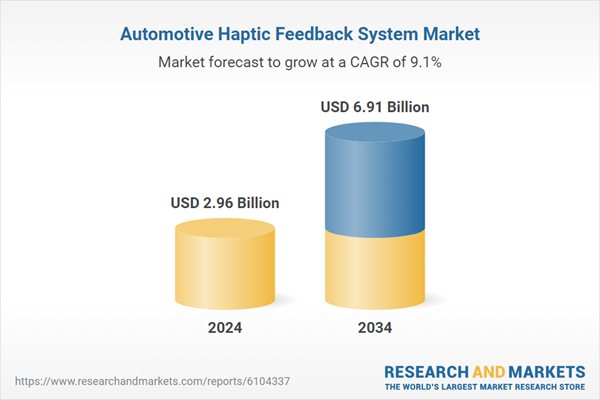

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.96 Billion |

| Forecasted Market Value ( USD | $ 6.91 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |