The rapid increase in electricity consumption - fueled by growing data center infrastructure, urbanization, and rising electric vehicle usage - is pushing utilities and industrial operators to adopt smarter power grid solutions. DTS systems are vital to these developments, as they assist in managing thermal loads and improving grid reliability. These sensing systems are commonly deployed in challenging environments like underground and overhead power lines, distribution nodes, and substations. Their ability to detect overheating or stress in power cables makes them indispensable in modern energy infrastructure. As industries aim to mitigate risks and improve asset lifespan, the demand for DTS is steadily rising.

In terms of fiber type, single-mode fibers are expected to record significant growth, with their market value projected to reach USD 951 million by 2034. These fibers are favored for applications requiring high-speed data transfer over long distances. Their inherent ability to transmit data with minimal signal loss and higher bandwidth capacity makes them ideal for modern telecommunication and industrial setups. As network connectivity expands globally, especially with the development of next-generation broadband and wireless systems, the use of single-mode fiber in DTS applications continues to increase. These fibers enable distributed sensors to measure temperature variations accurately along extended cable lengths.

When analyzed by technology, the market is segmented into Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR). OTDR remains the dominant technology, accounting for 72.5% of the global market in 2024. The method is widely accepted for its precision in detecting faults and verifying continuity in optical fiber networks. OTDR enables efficient maintenance by identifying exact fault points, splice losses, or fiber breaks, which is essential for sectors that rely on uninterrupted operations. DTS systems using OTDR analyze backscattered light to determine temperature profiles across a fiber’s length, enhancing real-time monitoring capabilities.

By operating principle, the market is segmented into Rayleigh scattering-based, Raman scattering-based, and Brillouin scattering-based DTS systems. Among these, Rayleigh scattering-based DTS captured 24% of the market share in 2024. This technology is particularly suitable for environments that demand fine-grained temperature monitoring. Its capacity for detailed thermal analysis supports operations where early detection of temperature spikes is critical. Industries operating in high-risk zones are increasingly relying on such technologies to ensure consistent monitoring and issue resolution before major failures occur.

From an application standpoint, DTS systems are used across several industries, including power cable monitoring, fire detection, pipeline management, environmental assessments, and more. However, oil and gas applications held the largest share of 30.1% in 2024. These sectors require continuous temperature monitoring over long distances to ensure operational efficiency and safety. DTS solutions offer the necessary precision and reliability to support these needs, contributing to optimized performance and preventive maintenance.

In regional analysis, the United States stands out as a major market, with projections indicating it will reach USD 415 million by 2034. Within the country, DTS systems are widely deployed for real-time thermal monitoring of wellbores and electrical grids. With initiatives focused on modernizing aging infrastructure, the adoption of advanced temperature sensing solutions is gaining momentum. These systems support efficient load management and early detection of performance issues, reducing the risk of unplanned outages.

The market landscape is competitive, with key players including Schlumberger Limited, Halliburton Company, AP Sensing GmbH, Silixa Ltd., and Bandweaver Technologies collectively accounting for over 43.3% of global revenue. To maintain leadership and adapt to evolving industry demands, companies are investing heavily in next-generation fiber materials and sensor technologies that improve measurement accuracy and environmental durability. Compact and energy-efficient DTS systems with enhanced resolution are being introduced to meet the growing demand for real-time, high-precision monitoring.

AI-driven diagnostics and analytics are also being integrated into DTS solutions to support predictive maintenance and extend system reliability. Industry participants are responding to user needs by offering customized DTS configurations tailored for specific industrial challenges. In addition, strategic partnerships, acquisitions, and collaborations are becoming central to expanding technological capabilities and geographic reach. By engaging with regulatory bodies and utility operators, firms are also ensuring that their DTS offerings align with evolving environmental and safety standards.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this distributed temperature sensing market report include:- AOMS Technologies

- AP Sensing GmbH

- Bandweaver Technologies

- Fluves

- GESO GmbH & Co.

- Halliburton Company

- Inventec B.V.

- Micron Optics

- NKT Photonics A/S

- OFS Fitel, LLC

- Omicron Electronics

- Omnisens SA

- Optromix, Inc.

- Schlumberger Limited

- Silixa Ltd.

- Sumitomo Electric Industries, Ltd.

- Yokogawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

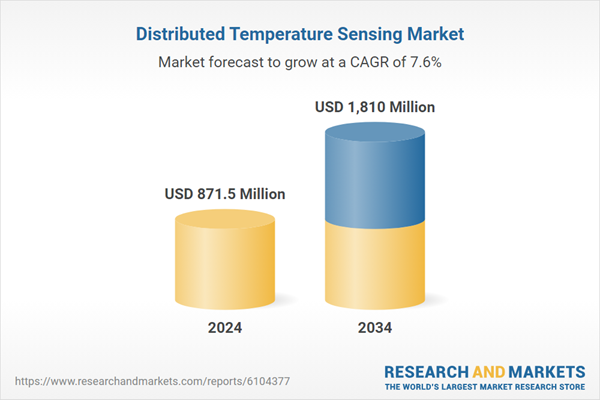

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 871.5 Million |

| Forecasted Market Value ( USD | $ 1810 Million |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |