As cities become more crowded, traditional car ownership is gradually being replaced by more flexible, on-demand transportation options. The younger demographic, including Millennials and Gen Z, values the convenience, affordability, and eco-friendliness that ride-sharing platforms offer. These consumers are increasingly opting for app-based services that align with their digital-first mindset, further accelerating the shift towards ridesharing in metropolitan areas.

The widespread availability of smartphones and improved digital literacy across Europe has made ride-sharing apps easily accessible to a broad range of users. Consumers can now book rides, track vehicles in real time, and make payments seamlessly through their smartphones. This has led to a surge in the number of users, particularly in urban areas, where ride-sharing services are expanding rapidly. App-based platforms such as Uber, Bolt, and BlaBlaCar are tapping into this growing trend by offering user-friendly services that cater to the evolving needs of consumers. With technology-driven solutions, real-time tracking, and secure payment options, these platforms are shaping the future of urban transportation.

The online segment, which held a 68% share in 2024, is expected to grow at a CAGR of 5.5% during 2025-2034. This dominance is attributed to the widespread use of smartphones and high-speed internet across Europe, which has made app-based ride-sharing the most preferred mode of transportation. Ride-sharing apps provide users with easy access to transportation, offering convenience and transparency through features such as GPS navigation, real-time updates, and payment security. Additionally, many ride-sharing companies offer loyalty programs and discounts to attract more users and encourage repeat business, further boosting the shift from traditional transport methods to digital services.

Intracity ride-sharing segment accounted for 77% share in 2024 and is anticipated to grow at a CAGR of 5% by 2034. Intracity ride-sharing has become increasingly popular due to urbanization and space limitations in densely populated cities. As public transportation options become overcrowded, shared mobility services are emerging as an attractive alternative.

In major cities, the demand for short, frequent trips has led to a rise in the popularity of ride-hailing services. Additionally, strict environmental regulations in many European cities, such as low-emission zones and congestion charges, are encouraging residents to opt for shared transportation, further driving the growth of intracity ride-sharing.

Germany Ride Sharing Market held a 28.9% share and generated USD 3.74 billion in 2024. The country’s strong economy, large population, and highly urbanized regions provide fertile ground for the growth of ride-sharing services. Germany’s advanced infrastructure, high smartphone penetration, and regulatory support make it a central hub for innovation in the mobility sector. Moreover, Germany's automotive legacy, home to major car brands, is positioning the country as a leader in the development of electric and autonomous vehicle technologies, which is expected to enhance the appeal of ride-sharing in the region.

Key players in the Europe Ride Sharing Market include Lyft, Uber, BlaBlaCar, Bolt, Cabify, inDrive, and Wheely, which collectively held around 17% of the market share in 2024. To strengthen their market presence, companies in the Europe Ride-Sharing Industry are focusing on expanding their service offerings to meet evolving consumer needs. This includes developing more localized and efficient ride-hailing solutions, integrating electric vehicles (EVs) into their fleets, and implementing innovative technology to improve user experience. Many companies are prioritizing the development of eco-friendly transportation options with environmental concerns. Partnerships with municipalities and regulatory bodies are also key strategies for ensuring compliance with local regulations and securing a competitive edge.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this Europe Ride Sharing Market report include:- BlaBlaCar

- Blacklane

- Bolt

- Cabify

- Cityscoot

- Cooltra

- FreeNow

- Gett

- GoTo Global

- GreenMobility

- Heetch

- inDrive

- Lyft

- Share Now

- TIER Mobility

- Ubeeqo

- Uber

- Via

- Wheely

- Zity

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

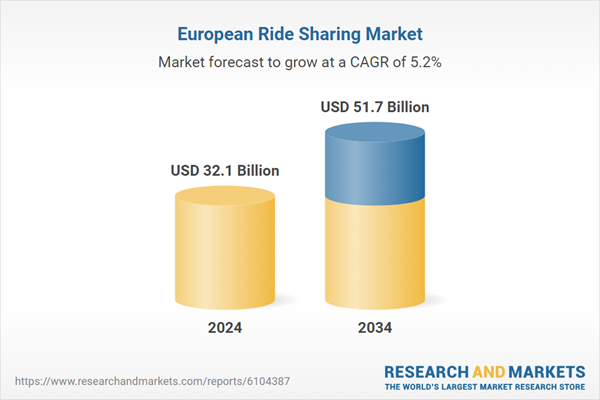

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 32.1 Billion |

| Forecasted Market Value ( USD | $ 51.7 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 21 |