Advanced technologies such as smart sensors, IoT, artificial intelligence, and energy-efficient LED lighting have further enhanced crop output and operational efficiency. Hydroponics remains the preferred method due to its ease of use and proven productivity, followed by other sustainable alternatives. With the help of climate-controlled environments, automated irrigation, fertigation, and real-time monitoring, vertical farms ensure consistent quality and quantity. The growing consumer interest in chemical-free, locally grown, and fresh produce is also pushing farmers to diversify crops, including vegetables, herbs, and fruits.

High setup costs remain one of the primary barriers to vertical farming adoption. The upfront expenses related to installing advanced environmental control systems - ranging from LED grow lights to hydroponic or aeroponic systems - can be significantly higher than conventional agriculture. Facilities also incur added costs for acquiring or constructing buildings or containers to support vertical farming infrastructure.

In 2024, the building-based vertical farming segment generated USD 4.1 billion, driven by its ability to scale efficiently and offer flexible design options. These structures - whether renovated warehouses or purpose-built facilities - can support multiple growing layers per square foot, enhancing output density. They also accommodate integrated automation systems for lighting, climate, and irrigation, supporting stable production throughout the year. Proximity to urban areas not only reduces transportation time and costs but also ensures quicker delivery of fresher products to consumers. These benefits are attracting commercial growers to invest heavily in building-based vertical farms.

Hydroponics segment accounted for 47% share in 2024, solidifying its position as the dominant method. This system enables plants to thrive in nutrient-enriched water solutions, cutting down water usage by up to 90% compared to traditional farming. It eliminates the need for chemical inputs and supports rapid crop cycles and high yields. Hydroponics is simpler to implement and manage than complex systems like aeroponics or aquaponics, making it suitable for a wide variety of crops - particularly herbs and leafy greens - and ideal for commercial-scale operations.

U.S. Vertical Farming Market held a 69% share in 2024. Demand for locally grown, sustainable produce continues to increase, aligning with consumer expectations for fresh food with minimal environmental impact. Major metropolitan areas emerge as vertical farming hubs due to their ability to host these operations close to end consumers. The country’s advanced technology infrastructure is accelerating the deployment of solutions such as hydroponic systems, AI-enabled climate control, LED lighting, and data-driven automation platforms. These innovations have significantly enhanced operational scalability and reliability, allowing farms to produce consistently even amid unpredictable external climates.

Prominent names in the Vertical Farming Industry include Ecopia, Signify, MechaTronix, Panasonic, UNI-TROLL, C-LED srl, Philips, AMS OSRAM AG, Tungsram, Nuvege, General Electronics, Artechno, LED iBond, Parus, and Organizzazione Orlandelli. Key strategies adopted by companies in the vertical farming market focus on strengthening market presence through innovation, partnerships, and geographic expansion. Players are heavily investing in research to develop energy-efficient lighting, smarter automation systems, and sustainable nutrient delivery models. Many are forming strategic alliances with retailers and food distributors to ensure better market penetration.

Some firms are exploring urban real estate opportunities to establish farms closer to consumers. In addition, companies are deploying modular farming units and scalable models that cater to small and mid-sized businesses, broadening accessibility. Focus on resource optimization and environmentally responsible packaging is also helping these brands align with consumer expectations and regulatory standards.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this vertical farming market report include:- AMS OSRAM AG

- Artechno

- C-LED srl

- Ecopia

- General Electronics

- LED iBond

- MechaTronix

- Nuvege

- Organizzazione Orlandelli

- Panasonic

- Parus

- Philips

- Signify

- Tungsram

- UNI-TROLL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | June 2025 |

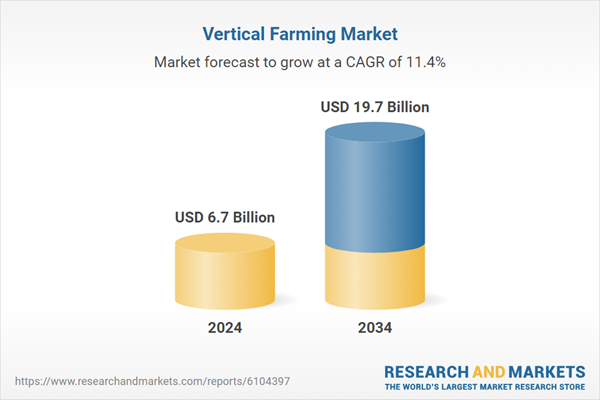

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 6.7 Billion |

| Forecasted Market Value ( USD | $ 19.7 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |