Mechanical, electrical, structural, and general maintenance services are evolving with a growing demand for solutions tailored to connected and electric vehicles. The rising adoption of electric vehicles is gradually reshaping the parts and service ecosystem, pushing service providers to expand technical capabilities. New service models are emerging as industry players adapt to a connected automotive environment and prepare for the rise of EV-specific maintenance requirements.

The mechanical services segment accounted for a 35% share in 2024 and is forecasted to reach USD 430 billion by 2034. Despite shifts in vehicle architecture, demand for essential mechanical services remains stable. Braking systems, suspensions, and drivetrain components continue to require routine servicing, especially as vehicles are driven longer and ownership cycles extend.

With fleets and commercial use on the rise, wear-intensive services like tire and wheel maintenance also remain vital. However, evolving technologies such as synthetic lubricants and hybrid drivetrains are changing service intervals and reducing the frequency of traditional maintenance visits. As vehicles incorporate fewer moving parts, particularly in EVs, the type and frequency of mechanical services required are transitioning.

The passenger car segment represented a 58% share in 2024 and is expected to grow at a CAGR of 6% throughout 2034. Technological advancements in safety systems, infotainment, and emissions controls are making maintenance and repair tasks more intricate. This is boosting demand for advanced diagnostic and repair solutions capable of handling new-generation systems. As ride-sharing and shared mobility models expand, increased utilization is accelerating maintenance needs, resulting in more frequent and specialized repair cycles. Service centers are adapting their capabilities to accommodate this shift, especially in metropolitan areas where shared fleets are heavily used.

China Automotive Repair and Maintenance Services Market held a 60% share in 2024, generating USD 139.2 billion. The market is expanding rapidly in the region, mainly due to a strong push toward vehicle electrification and stricter environmental regulations. As the number of electric vehicles on the road increases, workshops are being compelled to invest in tools and training for high-voltage systems, battery diagnostics, and regenerative braking services.

This transition is reshaping service standards, influenced by growing oversight from regulatory bodies that demand compliance with safety and performance benchmarks. Certifications from regulatory agencies reinforce consistent quality in aftermarket services and parts across the region, adding to the professionalism and standardization of the repair ecosystem.

Leading market players in the Global Automotive Repair and Maintenance Services Market include AutoNation, LKQ, Driven Brands, TBC, Genuine Parts Company, O'Reilly Automotive, and Robert Bosch. To enhance their market position, key companies in the automotive repair and maintenance services sector are leveraging multiple strategic approaches. Many are expanding their global service networks and acquiring regional operators to gain local market traction.

Investment in digital platforms, such as connected diagnostics and customer-facing applications, is helping them offer seamless, real-time service experiences. Brands are also allocating significant resources to upskilling technicians to support electric and hybrid vehicle servicing. Additionally, partnerships with OEMs and fleet operators enable providers to ensure consistent volume and technical collaboration.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this automotive repair and maintenance services market report include:- ADNOC

- AutoNation

- Belron International

- Bosch Car Service

- Car Parts.com

- EUROPART Holding

- Genuine Parts Company

- Hance’s European

- Inter cars

- LKQ Corporations

- M& M Auto Repair

- Mekonomen Group

- Mobivia Groupe

- My TVS

- Nippon Express

- O'Reilly Automotive

- Sun Auto Service

- TBC

- USA Automotive

- Wrench

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

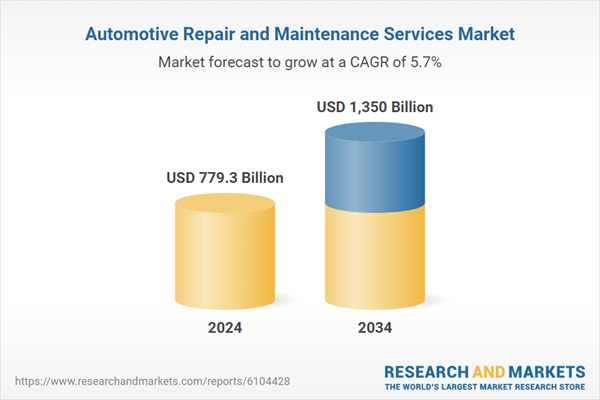

| Estimated Market Value ( USD | $ 779.3 Billion |

| Forecasted Market Value ( USD | $ 1350 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |