Waste heat recovery’s role in powering district heating infrastructure is becoming increasingly relevant. These systems make use of residual thermal energy that would otherwise go unused during production processes or power generation. When redirected to centralized heating grids, this energy significantly reduces reliance on conventional fuels, thus lowering emissions. As cities seek to implement greener energy frameworks, these solutions offer a pathway to circular resource use and smarter energy planning. These benefits strengthen the market potential by appealing to energy planners focused on reducing waste and boosting system-wide performance.

The steam Rankine cycle remains the cornerstone for recovering heat from high-temperature manufacturing sectors like glass, steel, and cement. Growing regulatory focus on lowering industrial carbon intensity is accelerating the modernization of these systems. Additionally, the Organic Rankine Cycle is gaining traction due to its suitability in low- to medium-temperature settings, supported by public investment. Although the Kalina Cycle holds a smaller share, it continues to receive funding for selective applications that require high thermal efficiency. Altogether, these cycles point to a broader international momentum around implementing cleaner energy conversion technologies for enhanced sustainability.

In 2024, the cement segment generated a 25.8% share. Known for being one of the most energy-intensive industries, cement producers are increasingly adopting waste heat recovery systems to meet emission goals. Incentive programs and renewable power obligations (RPOs) across various regions have provided strong motivation for companies to invest in WHRS. In some jurisdictions, energy generated through these systems qualifies as renewable, giving producers additional compliance and economic benefits.

United States Electricity & Steam Generation Waste Heat Recovery Systems Market reached USD 7.1 billion in 2024, with North America capturing a 21.3% share. A focus on energy policy reform, combined with the integration of renewable technologies, has played a pivotal role in increasing demand for waste heat recovery solutions across the region. The push for cleaner energy, coupled with rising industrial energy demand, continues to drive the adoption of these systems in electricity and steam generation applications.

Key players shaping the Electricity & Steam Generation Waste Heat Recovery Systems Market include Siemens Energy, Climeon, Mitsubishi Heavy Industries Ltd., Thermax Limited, Bosch Industriekessel GmbH, Fortum, IHI Corporation, Forbes Marshall, General Electric, Ormat, HRS, AURA, Viessman, Promec Engineering, Exergy International SRL, BIHL, Rentech Boilers, Sofinter S.p.A, Durr Group, and Cochran.

Companies in the electricity & steam generation waste heat recovery systems market are focusing on technology upgrades and integrated solutions to solidify their market presence. Many are investing in R&D to develop more compact, efficient systems that cater to both high- and low-temperature industrial processes. Strategic collaborations with energy-intensive sectors such as steel, cement, and petrochemicals are enabling customized installations tailored to client requirements. Firms are also expanding their geographic footprint through mergers, acquisitions, and partnerships, especially in regions with growing industrial bases.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this electricity and steam generation waste heat recovery systems market report include:- AURA

- BIHL

- Bosch Industriekessel GmbH

- Climeon

- Cochran

- Durr Group

- Exergy International SRL

- Forbes Marshall

- Fortum

- General Electric

- HRS

- IHI Corporation

- Mitsubishi Heavy Industries Ltd.

- Ormat

- Promec Engineering

- Rentech Boilers

- Siemens Energy

- Sofinter S.p.a

- Thermax Limited

- Viessman

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | June 2025 |

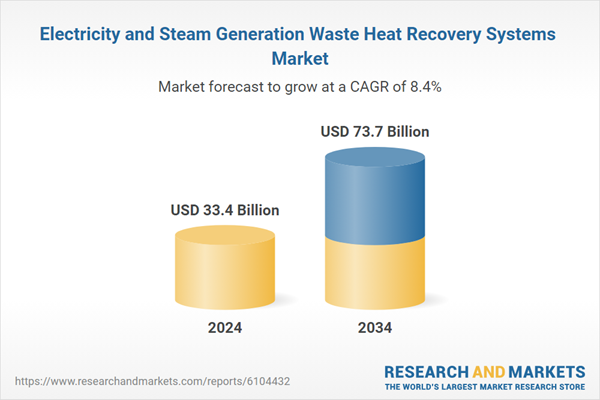

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 33.4 Billion |

| Forecasted Market Value ( USD | $ 73.7 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |