With increasing supply chain challenges, industry participants are integrating advanced technologies, including temperature indicators, intelligent sensors, and real-time data loggers, to ensure quality assurance across the entire cold chain. Furthermore, the adoption of smart cooling systems, automation tools, and eco-conscious refrigerants is becoming a standard, enabling companies to align with global sustainability mandates while remaining compliant with environmental regulations.

The integration of remote monitoring, IoT capabilities, and predictive analytics has greatly enhanced operational transparency and performance in cold chain management. The ongoing investment in digital infrastructure, combined with international immunization initiatives and expanded access to life-saving treatments, is further accelerating the need for medical cold storage systems across various healthcare segments.

In terms of product type, freezers led the global market in 2024, accounting for 37.7% of total revenue, and are projected to register a CAGR of 6% from 2025 to 2034. Their growing use is driven by the need to store critical healthcare products such as vaccines, drugs, and laboratory samples at specific low temperatures. These systems are widely regarded for their stability and ability to function efficiently under diverse environmental conditions.

The demand is also supported by the need for compliance with industry regulations, as freezers equipped with accurate temperature controls and alarm mechanisms are considered essential in medical logistics. Their adaptability in handling varying volumes makes them suitable for use in different environments, including hospitals, pharmaceutical manufacturing units, and diagnostic laboratories. Multipurpose features such as dual compartments and energy-efficient designs also contribute to their widespread preference.

Based on end-user analysis, pharmaceutical companies held a 32.73% share of the market in 2024 and are anticipated to expand at a CAGR of 5.8% through 2034. These companies operate under strict temperature requirements to store and transport vaccines, biologics, and clinical research materials. Adherence to international standards for temperature control is non-negotiable, especially when dealing with sensitive or experimental compounds.

Maintaining an uninterrupted cold chain is critical for product viability and shelf life. As production volumes increase, pharmaceutical firms require scalable and compliant storage systems that reduce the risk of spoilage and optimize inventory management. These capabilities not only help in meeting regulatory requirements but also enhance operational efficiency, encouraging further investment in advanced cold storage equipment.

In terms of applications, vaccine storage dominated the global market in 2024, generating USD 1.2 billion in revenue. It is expected to grow at a CAGR of 5.8% from 2025 to 2034. Vaccines must be stored within a narrow temperature range to retain their potency, making dedicated cold chain systems essential. Global efforts to improve vaccination access and awareness continue to boost demand for vaccine storage equipment. Real-time monitoring technologies, coupled with high-performance refrigeration units, ensure consistent temperature control during transit and storage. This application segment remains a cornerstone of the medical cold chain industry due to the critical role vaccines play in public health.

Regionally, the United States led the global market in 2024, accounting for 78.71% of North America's total share, with revenue reaching USD 800 million. The country benefits from a robust healthcare infrastructure and a highly regulated pharmaceutical logistics environment. Investments in innovative storage technologies and end-to-end supply chain visibility tools have made the US a leader in cold chain management. Additionally, the presence of major healthcare logistics providers and a high concentration of pharmaceutical manufacturing facilities contribute to regional dominance. Stringent regulations from US agencies have also pushed companies to deploy advanced cold storage systems that offer energy efficiency and real-time compliance tracking.

Key companies operating in the global medical cold chain storage equipment market include Binder, Azenta, Cardinal Health, Darwin Chambers, Carebios Biological Technology, Elanpro, Haier Biomedical, Farrar, Hoshizaki America, Memmert, Philipp Kirsch, Kendall Cold Chain System, Summit Appliances, Roemer Industries, and Thalheimer Kuhlung. These players continue to invest in product innovation and digital solutions to meet evolving market demands and maintain a competitive edge.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this medical cold chain storage equipment market report include:- Azenta Inc.

- Binder

- Cardinal Health

- Carebios Biological Technology

- Darwin Chambers

- Elanpro

- Farrar

- Haier Biomedical

- Hoshizaki America

- Kendall Cold Chain System

- Memmert

- Philipp Kirsch

- Roemer Industries

- Summit Appliances

- Thalheimer Kuhlung

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

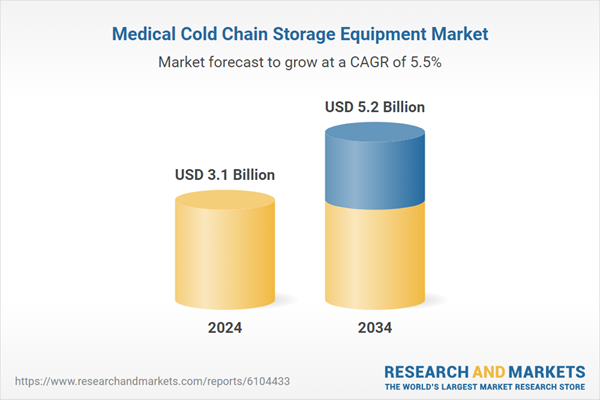

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 5.2 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |