Commercial laundry machines are now designed to streamline productivity while addressing global needs for eco-friendly practices and reliable performance. The shift in consumer lifestyle, driven by urbanization and improved income levels, is also accelerating the adoption of on-demand laundry services. These machines are becoming essential tools in a variety of settings, from urban laundromats to institutional operations, helping providers meet evolving customer expectations while boosting process automation.

Increasing awareness around cleanliness, coupled with regulatory pressure to maintain hygiene standards, has prompted businesses to invest in advanced laundry systems. Modern machines come with features that reduce manual intervention and optimize resources like water and electricity. Technological advancements in machine design have made it possible to deliver high-throughput laundry solutions with real-time monitoring and control. As the demand for efficient laundry processing grows, more businesses are adopting machines with multifunctional capabilities that cater to large-scale needs. Commercial laundry service providers are also gravitating toward solutions that offer long-term cost savings through enhanced durability and reduced maintenance requirements.

By product type, the market includes washers, dryers, washer & dryer combos, and others. The washer segment led the market with a valuation of USD 2 billion in 2024 and is expected to rise to USD 3.4 billion by 2034. Washers hold a dominant position because they offer essential functions that suit high-capacity environments. The ability to handle bulk loads while maintaining wash quality makes washers indispensable in settings where cleanliness is non-negotiable. These machines often feature load sensing, programmable settings, and water efficiency systems that improve their operational effectiveness while supporting sustainability goals.

In terms of distribution channel, the market is segmented into direct and indirect sales. The direct segment was valued at USD 3.2 billion in 2024 and is projected to grow at a CAGR of 5.2% through the forecast period. Direct sales are favored due to the personalized support and service agreements that typically accompany them. Buyers benefit from post-sale service offerings, custom setup solutions, and transparent pricing structures. These factors help businesses build trust with vendors, reduce downtime, and ensure optimal performance of laundry systems over time. The ability to bypass intermediaries also allows for better control over the buying process and service delivery, giving buyers a more tailored experience.

Based on the mode of operation, commercial laundry machines are classified into semi-automatic and automatic types. The automatic segment was valued at USD 3.7 billion in 2024 and is set to grow steadily at a CAGR of 5.2% through 2034. Automatic machines are becoming the preferred choice due to their integrated programming, sensor-based operation, and compatibility with digital platforms. These features collectively reduce labor costs and human error while supporting consistent quality standards. Automated systems are increasingly embedded with smart technologies that enable remote diagnostics, predictive maintenance, and performance tracking, making them more resilient and efficient in high-demand settings.

Regionally, the United States led the North American commercial laundry machines market, reaching a value of USD 1.1 billion in 2024. The country’s dominance is underpinned by strong infrastructure and widespread deployment of advanced laundry technologies. Organizations across the country are investing in machines that can process high volumes efficiently while complying with industry hygiene requirements. The robust presence of service providers and a culture of technological innovation further support the growth of this regional market.

Leading companies in the market are focusing on enhancing machine functionality by integrating IoT, AI, and real-time data analytics. This shift is aimed at offering predictive maintenance capabilities, intelligent load distribution, and energy-efficient operations. Sustainability is another key area of focus, with manufacturers striving to reduce water and energy consumption while maintaining regulatory compliance. Global expansion efforts are also gaining momentum, particularly in emerging markets across Asia, Africa, Latin America, and Eastern Europe, as players seek to tap into underserved areas with increasing demand for commercial-grade laundry infrastructure.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this commercial laundry machines market report include:- Alliance Laundry Systems

- BSH

- Dexter Laundry

- Electrolux

- Fagor Professional

- GE Appliances

- Girbau

- Haier

- JLA

- LG Electronics

- Mag Laundry Equipment

- Miele

- Pellerin Milnor

- Samsung Electronics

- Whirlpool

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 225 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

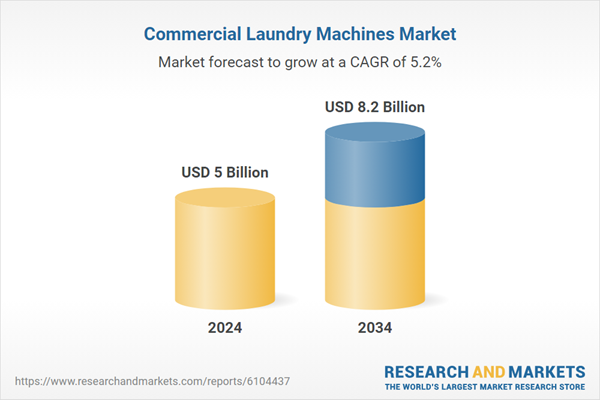

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 8.2 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |