Global Road Reclaimer Market - Key Trends & Drivers Summarized

Recycling Roads, Reviving Infrastructure: How Road Reclaimers Are Reshaping Pavement Rehabilitation StrategiesWhy Are Road Reclaimers Gaining Ground in Pavement Recycling and Full-Depth Reclamation Projects?

Road reclaimers are witnessing increased deployment as infrastructure maintenance agencies and contractors shift toward more cost-effective, environmentally sustainable, and structurally sound rehabilitation methods. These heavy-duty machines are designed for full-depth reclamation (FDR) and soil stabilization, pulverizing deteriorated asphalt surfaces and blending them with base materials and stabilizing agents to reconstruct the roadbed in a single pass. This process eliminates the need for costly material removal and replacement, significantly reducing construction timelines, labor intensity, and environmental impact. As global road networks continue to age-particularly in North America and Europe-reclaimers are becoming indispensable in extending the life of existing road infrastructure without full reconstruction.Government agencies and municipal road departments are prioritizing sustainable pavement practices, and road reclaimers are at the forefront of this trend. The ability to reprocess in-place materials and reduce reliance on virgin aggregates and hot-mix asphalt aligns with circular economy principles and climate action goals. In addition, the rapid mobilization, versatility, and compatibility of reclaimers with a variety of additives-such as cement, fly ash, foamed asphalt, or bitumen emulsion-allow for tailor-made stabilization of varied subgrade conditions. This makes them suitable for a range of applications including highways, municipal roads, airstrips, and rural routes where subgrade variability and budget constraints are critical challenges.

How Are Technological Advancements Enhancing Machine Performance, Precision, and Versatility?

Recent innovations in road reclaimer design have significantly improved efficiency, accuracy, and operational safety. Modern machines now come equipped with automated depth control systems, GPS-based grade referencing, and real-time mixing volume measurement, allowing operators to maintain consistent milling depths and achieve homogeneous material blending. Advanced rotor configurations, such as dual or variable-speed rotors, enhance cutting precision and allow for optimized fragment sizes based on material type, base thickness, and moisture content.The integration of digital controls and telematics is further transforming machine operation and fleet management. OEMs like Caterpillar, Wirtgen, and Roadtec now offer reclaimers with remote diagnostics, machine health monitoring, and data logging for performance metrics such as rotor load, temperature, travel speed, and additive spray rates. These insights help reduce fuel consumption, prevent breakdowns, and enhance planning for maintenance cycles. Additionally, programmable mix control systems allow precise metering of stabilizers, ensuring that additive injection aligns with engineering specifications while minimizing material waste.

Operator comfort and safety are also being prioritized through enhancements such as noise- and vibration-dampened cabins, joystick-based maneuvering, rearview cameras, and ergonomic dashboards. These upgrades not only reduce operator fatigue but also contribute to higher productivity, especially during long shifts or in remote locations. The modular design of reclaimers with customizable drum widths and interchangeable rotors allows contractors to deploy the same machine across various job profiles, further increasing return on investment.

What Are the Regional Drivers and End-User Priorities Shaping Market Demand?

Regional adoption of road reclaimers is closely linked to infrastructure investment cycles, climate conditions, and maintenance philosophies. In North America, the demand is propelled by aging interstate systems, federal rehabilitation programs, and an increasing focus on sustainable pavement practices. Agencies such as the Federal Highway Administration (FHWA) have issued guidelines supporting full-depth reclamation, and contractors are leveraging reclaimers to meet both structural and sustainability performance metrics while lowering lifecycle costs. States like Texas, California, and Florida have emerged as key adopters due to high road network density and weather-related pavement distress.In Europe, stringent environmental standards and circular economy mandates are fueling market expansion. The emphasis on reuse of in-situ materials, combined with national targets for greenhouse gas reduction in construction, makes reclaimers a natural choice for road renewal projects. Germany, France, and the Nordic countries are witnessing steady machine fleet modernization, with contractors integrating reclaimers into broader pavement management strategies. Additionally, EU funding for infrastructure resilience is creating opportunities for reclaimers in secondary and rural roads where traditional reconstruction is economically unviable.

Asia-Pacific represents a mixed landscape. While countries like Japan and Australia are early adopters of mechanized FDR techniques, others like India and Indonesia are gradually introducing reclaimers into their rural connectivity and state highway development programs. Local governments are beginning to recognize the cost and time savings that reclaimers offer in terrains with inconsistent subgrades or limited access to raw materials. In Latin America and Africa, road reclaimers are also gaining popularity in mining belts, oilfield access roads, and transnational corridors where rapid base stabilization is critical for commercial movement.

What Is Powering the Long-Term Growth of the Road Reclaimer Market?

The growth in the road reclaimer market is driven by a strategic shift toward more sustainable, cost-efficient, and time-saving road rehabilitation methods. Rising public investment in infrastructure maintenance-particularly in response to post-pandemic stimulus and climate-resilient infrastructure initiatives-is accelerating the adoption of full-depth reclamation as a preferred alternative to traditional overlay or reconstruction.Cost reduction remains a key driver. By recycling in-situ materials and minimizing haulage of virgin aggregates, reclaimers significantly reduce total project cost and environmental footprint. With global fuel prices fluctuating and supply chain risks affecting material procurement, the value proposition of reclaimers is becoming stronger. Their application versatility-ranging from highways and airports to mining and oilfield roads-ensures year-round equipment utilization and better capital efficiency for contractors and rental fleets.

Environmental and regulatory factors are also pushing the market forward. Reclaimers contribute to emissions reduction by minimizing truck trips, lowering energy consumption, and supporting pavement recycling goals. Many public contracts now mandate sustainability assessments or grant points for the use of eco-friendly construction methods-creating demand pull for reclaiming technology. As technological sophistication improves and training programs increase operator adoption, road reclaimers are poised to become a mainstay in modern pavement preservation toolkits globally.

Scope Of Study:

The report analyzes the Road Reclaimer market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Capacity (Below 10 Tons, 10 - 20 Tons, 20 - 30 Tons, Above 30 Tons); Application (Construction Application, Airports Application, Wharves Application, Public Engineering Application, Mining Application, Oil Application, Agriculture Application)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below 10 Tons segment, which is expected to reach US$295.5 Million by 2030 with a CAGR of a 1.8%. The 10 - 20 Tons segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $155.7 Million in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $127.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Road Reclaimer Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Road Reclaimer Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Road Reclaimer Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ammann Group, Astec Industries, Bauer Maschinen GmbH, BENNINGHOVEN GmbH & Co. KG, BOMAG (Fayat Group) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Road Reclaimer market report include:

- Ammann Group

- Astec Industries

- Bauer Maschinen GmbH

- BENNINGHOVEN GmbH & Co. KG

- BOMAG (Fayat Group)

- Caterpillar Inc.

- CIBER Equipamentos Rodoviários

- CMI Roadbuilding Inc.

- Dynapac (Fayat Group)

- FAE Group S.p.A.

- Fayat Group

- HAMM AG (Wirtgen Group)

- Indeco Ind. SpA

- John Deere (via Wirtgen Group)

- Kleemann GmbH (Wirtgen Group)

- Komatsu Ltd.

- LiuGong Machinery Co., Ltd.

- MB Crusher

- Marini (Fayat Group)

- Wirtgen Group (John Deere)

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ammann Group

- Astec Industries

- Bauer Maschinen GmbH

- BENNINGHOVEN GmbH & Co. KG

- BOMAG (Fayat Group)

- Caterpillar Inc.

- CIBER Equipamentos Rodoviários

- CMI Roadbuilding Inc.

- Dynapac (Fayat Group)

- FAE Group S.p.A.

- Fayat Group

- HAMM AG (Wirtgen Group)

- Indeco Ind. SpA

- John Deere (via Wirtgen Group)

- Kleemann GmbH (Wirtgen Group)

- Komatsu Ltd.

- LiuGong Machinery Co., Ltd.

- MB Crusher

- Marini (Fayat Group)

- Wirtgen Group (John Deere)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

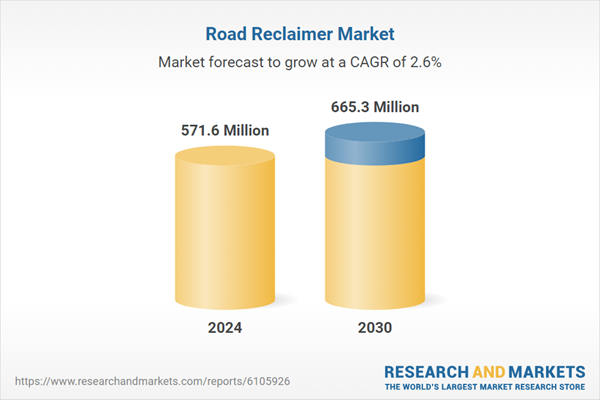

| Estimated Market Value in 2024 | 571.6 Million |

| Forecasted Market Value by 2030 | 665.3 Million |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |