Global Optical Ceramics Market - Key Trends & Drivers Summarized

Why Are Optical Ceramics Emerging as Viable Alternatives to Conventional Materials?

Optical ceramics are gaining traction as transparent polycrystalline materials that serve as alternatives to traditional glass and single-crystal optics. They exhibit high strength, thermal resistance, and excellent transmittance across visible, infrared, and even ultraviolet spectra, depending on composition. Applications in defense, aerospace, energy, and optoelectronics are expanding due to their ability to withstand extreme environments without compromising optical performance.Ceramics such as spinel (MgAl2O4), ALON (aluminum oxynitride), and yttrium aluminum garnet (YAG) offer mechanical durability and chemical stability that far exceed conventional optical glass. These materials are being used in sensor windows, laser host materials, IR domes, and transparent armor where both optical clarity and resilience are essential. Their non-hygroscopic nature and compatibility with high-energy radiation are supporting their use in harsh environments and advanced optical systems.

What Technological Developments Are Improving Optical Ceramic Quality and Utility?

Advances in powder synthesis, hot isostatic pressing, and vacuum sintering are improving the microstructural uniformity and optical transparency of ceramic components. Innovations in dopant control and grain boundary engineering are enhancing spectral range transmission and reducing scattering. As a result, newer formulations now achieve near-single crystal transparency while retaining mechanical toughness.Precision machining, polishing, and coating methods are also evolving to produce ceramic optics with minimal surface defects and improved anti-reflective properties. Laser applications are particularly benefiting from YAG and spinel ceramics that allow tailored doping for wavelength-specific gain media. Integration of ceramics into optoelectronic modules and IR sensors is facilitated by improvements in bonding, shaping, and thermal compatibility with other optical components.

Where Is Demand Concentrated and Which Applications Are Driving Material Adoption?

Defense and aerospace sectors are leading adopters of optical ceramics for use in transparent armor, missile domes, and UAV sensor windows. These applications demand high optical clarity under mechanical stress, thermal shock, and environmental exposure. In industrial laser systems, ceramic components are used in both laser hosts and beam delivery optics, offering long service life and stable performance at high temperatures.Growth is also notable in consumer and commercial sectors - such as high-performance lighting, medical imaging, and night vision optics - where ceramic components are used for protective windows, collimators, and reflectors. Research institutions and precision instrumentation companies are exploring ceramics for use in high-intensity optical systems, space-based sensors, and radiation detection devices.

Growth in the Optical Ceramics market is driven by several factors…

Growth in the optical ceramics market is driven by factors such as the need for durable, high-performance optical materials in military, aerospace, and laser applications. Superior mechanical strength, wide spectral transmission, and thermal stability are pushing adoption in environments where traditional glass fails. Rising deployment of IR-guided weapon systems and unmanned aerial platforms is further expanding defense-related demand.Laser system advancements, including high-power industrial and medical lasers, are creating consistent demand for doped ceramic components and beam delivery optics. Growth in precision imaging and sensor-based applications, particularly in harsh environments, is driving investment in transparent ceramic materials. Improvements in processing techniques and growing commercial awareness are also reducing cost barriers, accelerating broader industry acceptance.

Report Scope

The report analyzes the Optical Ceramics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Material (Sapphire Material, Phosphor Material, Alumina Material, Selenide Material, Oxynitride Material, Spinel Material, Other Materials); Application (Active Devices Application, Passive Devices Application); End-Use (Optics & Optoelectronics End-Use, Aerospace & Defense End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sapphire Material segment, which is expected to reach US$162.8 Million by 2030 with a CAGR of a 6%. The Phosphor Material segment is also set to grow at 7.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $97.4 Million in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $84.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optical Ceramics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optical Ceramics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optical Ceramics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

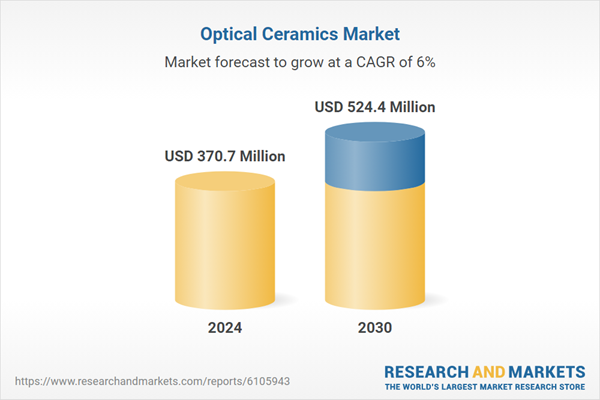

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie, Astellas Pharma, Bayer AG, Boehringer Ingelheim, Cipla Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Optical Ceramics market report include:

- Blasch Precision Ceramics

- Cerad yne, Inc.

- CeraNova Corporation

- CeramTec GmbH

- Coorstek / CoorsTek, Inc.

- Hoya Corporation

- II-VI Incorporated

- Jenoptik AG

- Konoshima Chemical Co., Ltd.

- Kyocera Corporation

- McDanel Advanced Ceramics Technologies

- Morgan Advanced Materials plc

- Murata Manufacturing Co., Ltd.

- NGK Insulators, Ltd.

- Ohara Corporation

- Rauschert GmbH

- Saint-Gobain S.A.

- Schott AG

- Shin-Etsu Chemical Co., Ltd.

- Surmet Corporation

- Toshiba Materials Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Blasch Precision Ceramics

- Cerad yne, Inc.

- CeraNova Corporation

- CeramTec GmbH

- Coorstek / CoorsTek, Inc.

- Hoya Corporation

- II-VI Incorporated

- Jenoptik AG

- Konoshima Chemical Co., Ltd.

- Kyocera Corporation

- McDanel Advanced Ceramics Technologies

- Morgan Advanced Materials plc

- Murata Manufacturing Co., Ltd.

- NGK Insulators, Ltd.

- Ohara Corporation

- Rauschert GmbH

- Saint-Gobain S.A.

- Schott AG

- Shin-Etsu Chemical Co., Ltd.

- Surmet Corporation

- Toshiba Materials Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 226 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 370.7 Million |

| Forecasted Market Value ( USD | $ 524.4 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |