Global Organic Infant Formula Market - Key Trends & Drivers Summarized

Why Is Organic Infant Formula Becoming a Trusted Alternative for Early Nutrition?

Organic infant formula is gaining traction as a preferred choice among parents seeking cleaner, safer, and more natural feeding options for infants. Formulated to replicate breast milk in nutritional composition, these products are manufactured using certified organic milk and ingredients derived from farms that follow stringent regulations around pesticide use, GMO avoidance, and animal welfare. This positions organic infant formula as a more transparent and health-conscious alternative to conventional options.The demand for organic varieties is increasing due to growing concerns about synthetic additives, hormone residues, and artificial preservatives in traditional formulas. Parents are also more aware of potential links between early-life nutrition and long-term health outcomes, leading them to prioritize products free from antibiotics, chemical contaminants, and unnecessary processing. As a result, brands offering certified organic infant formula are expanding rapidly across retail shelves and e-commerce platforms.

How Are Formulation Standards and Ingredient Profiles Evolving to Meet Nutritional Goals?

Modern organic infant formulas are designed to meet international nutritional standards while adhering to organic principles. Key components include organic cow or goat milk, lactose, vegetable oils, and essential vitamins and minerals, with growing emphasis on DHA, ARA, and prebiotics to support brain development and gut health. Increasingly, brands are offering specialized variants for allergy-prone infants, such as soy-free, gluten-free, and goat milk-based formulations.Processing methods aim to preserve nutrient integrity while avoiding synthetic emulsifiers and colorants. Many producers use cold blending, low-temperature drying, and minimal thermal exposure. Certifications such as USDA Organic, EU Organic, and NSF International validate the production process, providing assurance of quality and traceability. As competition increases, manufacturers are investing in research-backed improvements to protein digestibility and infant-specific fat blends.

Where Is Demand Growing and Which Channels Are Supporting Access?

Demand is particularly strong in North America, Europe, and Asia-Pacific, where awareness of organic living and access to certified infant nutrition products are high. Urban parents, especially in middle- to high-income brackets, are driving uptake through both retail and digital channels. In emerging markets, growing disposable income, rising birth rates, and expansion of premium baby care segments are contributing to higher adoption of organic formula.E-commerce platforms and parenting-focused online retailers are key distribution channels, offering access to global brands and detailed product information. Hospitals, pediatricians, and maternity care providers are also playing a role in encouraging early-stage adoption. Subscription-based delivery models and direct-to-consumer formats are further expanding market penetration, particularly in regions with limited physical retail access to organic options.

Growth in the Organic Infant Formula market is driven by several factors…

Growth in the organic infant formula market is driven by factors such as increasing parental awareness of chemical-free nutrition, stricter safety expectations, and rising preference for organic dairy and plant-based ingredients in early feeding. Advances in protein processing, fatty acid enrichment, and gut microbiome support are improving product efficacy while retaining organic certification.Expansion of certified organic dairy supply chains and growing transparency in ingredient sourcing are enabling consistent product quality. Higher acceptance of goat milk-based and hypoallergenic organic formulas is broadening appeal across infant dietary needs. Growth of digital retail platforms, along with regulatory support for organic labeling and clean-label infant nutrition, is supporting global market expansion.

Report Scope

The report analyzes the Organic Infant Formula market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Starting-Milk Formula, Follow-On Milk Formula, Special Milk Formula, Other Products); Formulation (Powdered Formulation, Concentrated Milk Formulation, Ready-to-Feed Formulation); Distribution Channel (Supermarkets / Hypermarkets, Convenience Stores, Specialty Stores, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Starting-Milk Formula segment, which is expected to reach US$12.9 Billion by 2030 with a CAGR of a 6.9%. The Follow-On Milk Formula segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.8 Billion in 2024, and China, forecasted to grow at an impressive 9.6% CAGR to reach $6.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Organic Infant Formula Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Organic Infant Formula Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Organic Infant Formula Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alaffia, Bunge Limited, Cargill, Incorporated, Clearspring Ltd., Daabon Organic and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Organic Infant Formula market report include:

- Abbott Laboratories

- Arla Foods

- Ausnutria Dairy Corporation Ltd.

- Bellamy's Organic

- Bioland

- Bubs Australia Ltd.

- Dana Dairy Group

- Earth's Best (Hain Celestial)

- Holle Baby Food AG

- HiPP GmbH & Co. Vertrieb KG

- Kabrita (Ausnutria)

- Kendamil (Kendal Nutricare)

- Lactalis Group (Picot Bio)

- Lebenswert Bio (Holle)

- Mead Johnson Nutrition (Reckitt)

- Nestlé S.A.

- Nature One Dairy

- Nutribén (Alter Group)

- Organix Brands Ltd

- Topfer GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Arla Foods

- Ausnutria Dairy Corporation Ltd.

- Bellamy's Organic

- Bioland

- Bubs Australia Ltd.

- Dana Dairy Group

- Earth's Best (Hain Celestial)

- Holle Baby Food AG

- HiPP GmbH & Co. Vertrieb KG

- Kabrita (Ausnutria)

- Kendamil (Kendal Nutricare)

- Lactalis Group (Picot Bio)

- Lebenswert Bio (Holle)

- Mead Johnson Nutrition (Reckitt)

- Nestlé S.A.

- Nature One Dairy

- Nutribén (Alter Group)

- Organix Brands Ltd

- Topfer GmbH

Table Information

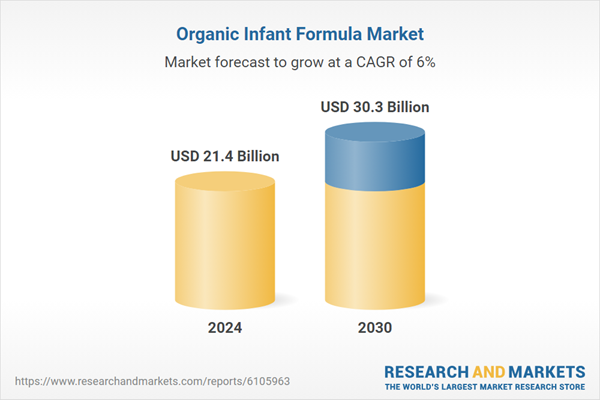

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.4 Billion |

| Forecasted Market Value ( USD | $ 30.3 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |