Global Sawmill Machinery Market - Key Trends & Drivers Summarized

Why Is Automation at the Forefront of Modern Sawmill Machinery Evolution?

The sawmill machinery market is undergoing a transformative shift driven by increasing demands for higher productivity, reduced labor dependence, and enhanced yield optimization across global wood processing industries. Modern sawmills no longer rely solely on traditional mechanical sawing equipment; instead, they are rapidly adopting smart automation, computer numerical control (CNC), and real-time monitoring systems. This transition is spurred by the need to improve material recovery rates, reduce energy usage, and minimize production downtime. Highly automated machinery-such as log scanners, debarkers, edgers, resaws, and gang saws-now integrate machine vision, laser-guided positioning, and AI-based decision-making systems to analyze log geometry and determine optimal cutting patterns.Automation is particularly crucial in regions where labor shortages and rising operational costs have constrained traditional sawmill operations. North America and parts of Europe, where aging workforces and stringent safety regulations prevail, are seeing a growing preference for fully integrated and software-driven machinery. These automated systems not only enhance throughput but also reduce worker exposure to hazardous zones within the mill. Further, digitized sawmill solutions enable predictive maintenance, remote diagnostics, and real-time performance tracking, leading to substantial improvements in uptime and asset longevity. This emphasis on smart, self-regulating equipment reflects the broader trend of digital transformation sweeping across the industrial manufacturing landscape.

What Technological Innovations Are Reshaping Sawmill Machinery Design and Functionality?

Recent technological advancements have significantly enhanced the precision, durability, and adaptability of sawmill machinery. Sophisticated 3D log scanning and optimization systems now precede primary breakdown, enabling precise volume estimation and defect detection. These scanners feed data into real-time optimization software that generates cutting instructions based on value recovery algorithms, customer-specific grading standards, and product mix goals. Laser-guided saw lines and servo-driven log handling equipment further refine this process by ensuring accurate alignment and smooth material transfer across multiple cutting zones.Advanced hydraulic and servo-electric systems have also contributed to the evolution of high-performance sawmill machinery. These systems offer faster response times, tighter process control, and lower energy consumption compared to legacy pneumatic or purely mechanical alternatives. Innovations in blade technology-such as thin-kerf band saws and carbide-tipped circular blades-reduce sawdust waste and improve lumber yield. Additionally, integration with enterprise resource planning (ERP) platforms and manufacturing execution systems (MES) allows sawmill operators to synchronize production with inventory management, customer orders, and shipping schedules. Environmental sensors and dust extraction automation are now standard in high-end machinery, supporting regulatory compliance and improving overall workplace safety and cleanliness.

Which Regional Markets and End-User Sectors Are Driving Demand for Sawmill Machinery?

The demand for advanced sawmill machinery is highest in North America and Northern and Central Europe, where large-scale commercial forestry operations and established timber value chains dominate. In Canada and the United States, the construction boom and rising demand for engineered wood products such as CLT (cross-laminated timber) and LVL (laminated veneer lumber) have fueled investments in modern sawmill upgrades. Scandinavian countries such as Sweden and Finland are adopting next-gen machinery to process sustainably harvested timber under stringent ecological and traceability norms, driven by high-value exports of pine, spruce, and birch lumber.Asia-Pacific, particularly China, Indonesia, and Vietnam, is emerging as a significant market due to rapid industrialization, rising construction activity, and increased export-oriented wood processing. In these regions, demand is split between upgrading existing mills with automation and setting up new greenfield operations to process plantation-grown species. Latin America, led by Brazil and Chile, is also ramping up capacity to meet domestic and export demand for softwood lumber. The sawmill sector in Sub-Saharan Africa remains relatively underdeveloped, but international investment in forestry concessions and infrastructure is beginning to stimulate localized demand for modular and mid-range sawmill machinery tailored to small-to-medium-sized operations.

What Are the Primary Drivers Accelerating Global Growth in the Sawmill Machinery Market?

The growth in the sawmill machinery market is driven by multiple structural and cyclical factors, including increasing global lumber demand, resource efficiency imperatives, and industrial modernization. Rapid urbanization and the global shift toward sustainable construction materials have elevated the use of wood products in housing, packaging, and infrastructure. This trend, in turn, has led to capacity expansions and automation upgrades in both softwood and hardwood sawmills worldwide. Further, the rise in demand for wood-based panels, furniture components, and high-grade lumber in global export markets is encouraging investments in value-added sawing and profiling equipment.Environmental regulations and sustainability certifications, such as FSC and PEFC, are placing added pressure on sawmill operators to maximize log utilization and reduce waste. As a result, technology that improves first-pass yield, reduces energy consumption, and minimizes offcuts is being actively prioritized. The evolution of Industry 4.0 principles into the forestry sector is another key driver, with smart sawmill systems offering data analytics, remote control, and machine learning capabilities. Finally, the consolidation of forestry enterprises and the rise of vertically integrated timber companies are enabling large-scale capital investments in cutting-edge machinery. These converging trends are ensuring robust long-term demand for efficient, intelligent, and environmentally conscious sawmill solutions.

Scope Of Study:

The report analyzes the Sawmill Machinery market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Product (Fixed Sawmills, Portable Sawmills); Type (Band Saw Headrig, Circular Saw Headrig, Frame Saw Headrig); Method (Horizontal Method, Vertical Method); Application (Forestry Application, Woodworking Application, Paper Application, Other Applications)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fixed Sawmills segment, which is expected to reach US$749.0 Million by 2030 with a CAGR of a 2.7%. The Portable Sawmills segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $259.2 Million in 2024, and China, forecasted to grow at an impressive 4.3% CAGR to reach $205.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sawmill Machinery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sawmill Machinery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sawmill Machinery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AriVislanda AB, Biesse Group, BID Group Technologies Ltd., Brewco, Incorporated, Bruks Siwertell and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Sawmill Machinery market report include:

- AriVislanda AB

- Biesse Group

- BID Group Technologies Ltd.

- Brewco, Incorporated

- Bruks Siwertell

- Esterer WD GmbH

- Felder Group

- HewSaw

- Homag Group

- Hud-Son Forest Equipment

- Kallfass GmbH

- Linck Holzverarbeitungstechnik GmbH

- Logosol

- Lucas Mill

- McDonough Manufacturing Company

- Norwood Sawmills

- Primultini S.r.l.

- SAB - Sägewerksanlagen GmbH

- SCM Group

- SERRA Maschinenbau GmbH

- Springer Maschinenfabrik GmbH

- TimberKing

- USNR, LLC

- Veisto Oy

- Weinig Group

- Wood-Mizer LLC

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AriVislanda AB

- Biesse Group

- BID Group Technologies Ltd.

- Brewco, Incorporated

- Bruks Siwertell

- Esterer WD GmbH

- Felder Group

- HewSaw

- Homag Group

- Hud-Son Forest Equipment

- Kallfass GmbH

- Linck Holzverarbeitungstechnik GmbH

- Logosol

- Lucas Mill

- McDonough Manufacturing Company

- Norwood Sawmills

- Primultini S.r.l.

- SAB - Sägewerksanlagen GmbH

- SCM Group

- SERRA Maschinenbau GmbH

- Springer Maschinenfabrik GmbH

- TimberKing

- USNR, LLC

- Veisto Oy

- Weinig Group

- Wood-Mizer LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 460 |

| Published | February 2026 |

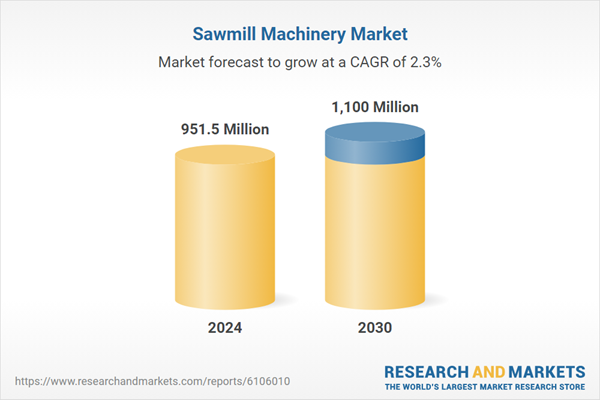

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 951.5 Million |

| Forecasted Market Value by 2030 | 1100 Million |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |