Global Sealant Web Films Market - Key Trends & Drivers Summarized

What Is Fueling the Rising Adoption of Sealant Web Films Across Flexible Packaging Applications?

Sealant web films have emerged as a critical enabler of high-performance packaging, particularly in flexible and multilayer packaging solutions used in food, pharmaceuticals, and consumer goods. These films serve as the inner sealing layer in laminate structures and are engineered to provide excellent heat seal properties, barrier protection, puncture resistance, and compatibility with various substrates such as polyethylene terephthalate (PET), biaxially oriented polypropylene (BOPP), and aluminum foil. As product shelf-life expectations and packaging performance criteria intensify, the demand for tailored sealant webs that offer high seal integrity and process adaptability is expanding rapidly.One of the primary drivers behind their widespread adoption is the growth of snack foods, ready-to-eat meals, and frozen products, where seal integrity, peelability, and reclosability are essential. Sealant webs play a vital role in forming tamper-evident and hermetically sealed packages that maintain product freshness and prevent contamination. The films are also central to vacuum packaging, stand-up pouches, retort pouches, and lidding films, where resistance to high temperatures and aggressive fill conditions is required. As brands aim to optimize supply chain efficiency and ensure consistent packaging line throughput, the machinability and versatility of sealant web films are increasingly seen as critical to packaging success.

How Are Technological Innovations Shaping the Performance and Sustainability of Sealant Web Films?

Technological evolution in sealant web films is centered on performance enhancement, material reduction, and environmental compatibility. Modern formulations are moving beyond conventional polyethylene-based webs toward co-extruded and metallocene-based polymers that offer lower seal initiation temperatures (SIT), broader sealing windows, and superior optical clarity. These innovations enable high-speed form-fill-seal (FFS) processes while reducing energy consumption and material waste. Sealant webs are now being tailored for applications ranging from cold seals for heat-sensitive products to high-temperature retort packaging requiring steam or pressure cooking tolerance.Sustainability imperatives are also driving the development of recyclable, mono-material, and bio-based sealant films. Polyethylene and polypropylene-based webs compatible with recycling streams are gaining preference, especially in Europe, where the Packaging and Packaging Waste Directive is shaping product design criteria. Some manufacturers are exploring bio-based sealant layers derived from starch, polylactic acid (PLA), or other renewable sources to meet carbon footprint reduction goals. Moreover, solvent-free and water-based adhesive technologies are being paired with sealant webs to lower emissions and enhance packaging safety. These innovations are allowing brands and converters to meet regulatory, operational, and environmental objectives simultaneously.

Which End-Use Segments and Geographies Are Shaping Market Expansion Trajectories?

The food and beverage sector accounts for the majority of sealant web film demand, particularly in categories such as snacks, confectionery, dairy, meat, and frozen foods. Films with antifog properties, microwave resistance, and modified atmosphere packaging (MAP) capabilities are being widely deployed to meet consumer expectations for freshness and convenience. The pharmaceutical industry is another major user of sealant webs, especially in blister packs, unit dose formats, and flexible pouches that demand barrier protection against moisture, oxygen, and light. Medical device packaging also uses peelable webs for sterile barrier systems.Geographically, Asia-Pacific leads global consumption, driven by high-volume food production, growing middle-class demand for convenience foods, and rapid industrial packaging growth in India, China, and Southeast Asia. Europe is a close follower, characterized by innovation in recyclable structures and regulatory alignment with circular economy goals. North America is witnessing moderate but steady growth, with a strong emphasis on performance-driven films for automated filling lines and medical-grade applications. Latin America and Africa, while still emerging, present long-term opportunities fueled by urbanization, cold chain development, and localized food processing expansion.

What Factors Are Driving the Growth of the Global Sealant Web Films Market?

The growth in the sealant web films market is driven by several factors, including the proliferation of flexible packaging formats, rising sustainability mandates, and advances in polymer engineering. The ongoing shift from rigid to flexible packaging across multiple sectors is increasing the need for sealant layers that provide robustness, seal strength, and product safety. As global food logistics become more complex, packaging materials that can withstand varied transportation and storage conditions while maintaining integrity are gaining preference. Furthermore, consumers' inclination toward portable, resealable, and single-serve packs is expanding the use of specialized sealant films with easy-peel, tamper-evident, and barrier functionalities.Environmental regulations and brand-led sustainability commitments are also shaping product development. Global brands are setting aggressive targets for recyclable or compostable packaging by 2025-2030, prompting converters and film manufacturers to adopt mono-material film architectures where sealant webs play a central role. The integration of smart packaging features such as laser scoring, QR-coded labels, and antimicrobial coatings is further expanding the functional scope of sealant films. As end-use industries demand thinner, lighter, yet high-performance films, sealant web innovations are set to remain integral to the evolution of advanced and sustainable packaging ecosystems.

Scope Of Study:

The report analyzes the Sealant Web Films market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Sealant Material (Polyethylene Sealant Material, Polylactic Acid Sealant Material); Thickness (Below 15 Microns Thickness, 16 - 35 Microns Thickness, 36 - 50 Microns Thickness, Above 50 Microns Thickness); Application (Bags Application, Pouches Application, Flat Pouches Application, Standup Pouches Application); End-Use (Food & Beverages End-Use, Pharmaceuticals End-Use, Cosmetics & Personal Care End-Use, Electronics & Electricals End-Use, Textile End-Use, Homecare Products End-Use)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyethylene Sealant Material segment, which is expected to reach US$336.6 Million by 2030 with a CAGR of a 4.1%. The Polylactic Acid Sealant Material segment is also set to grow at 1.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $113.7 Million in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $101.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sealant Web Films Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sealant Web Films Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sealant Web Films Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amcor Group, Avery Dennison Corporation, Berry Global Inc, Cosmo Films Ltd., Dai Nippon Printing Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Sealant Web Films market report include:

- Amcor Group

- Avery Dennison Corporation

- Berry Global Inc

- Cosmo Films Ltd.

- Dai Nippon Printing Co., Ltd.

- DIC Corporation

- DuPont de Nemours, Inc.

- Jindal Poly Films Ltd

- Mitsui Chemicals, Inc.

- Mondi PLC

- Polyfilm Group

- Plastic Suppliers, Inc.

- Toray Industries, Inc.

- Dai Nippon Printing Co., Ltd.

- Bemis Company Inc.

- Amcor Group

- Charter NEX Films

- Dow / DuPont

- Mitsui Chemicals

- Winpak Ltd.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor Group

- Avery Dennison Corporation

- Berry Global Inc

- Cosmo Films Ltd.

- Dai Nippon Printing Co., Ltd.

- DIC Corporation

- DuPont de Nemours, Inc.

- Jindal Poly Films Ltd

- Mitsui Chemicals, Inc.

- Mondi PLC

- Polyfilm Group

- Plastic Suppliers, Inc.

- Toray Industries, Inc.

- Dai Nippon Printing Co., Ltd.

- Bemis Company Inc.

- Amcor Group

- Charter NEX Films

- Dow / DuPont

- Mitsui Chemicals

- Winpak Ltd.

Table Information

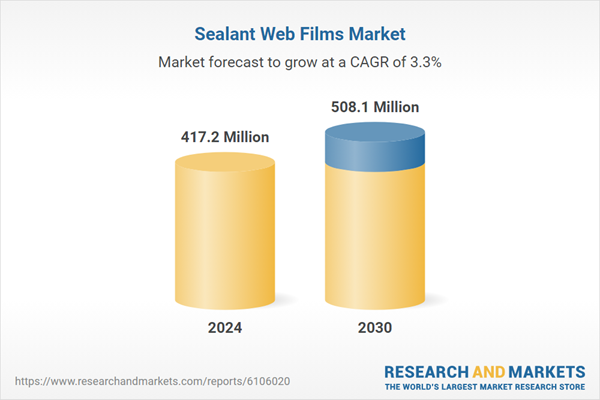

| Report Attribute | Details |

|---|---|

| No. of Pages | 478 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 417.2 Million |

| Forecasted Market Value by 2030 | 508.1 Million |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |