Global Metalworking Equipment Market - Key Trends & Drivers Summarized

What Is Driving Innovation in Modern Metalworking Equipment?

In recent years, the metalworking equipment market has undergone a remarkable transformation, fueled by rapid advancements in automation, digitalization, and precision engineering. Computer Numerical Control (CNC) machines are now at the heart of manufacturing operations, replacing conventional tools with more accurate, repeatable, and productive systems. Key innovations include multi-axis machining centers, integrated robotic arms, and smart tooling solutions that minimize downtime while maximizing throughput. The adoption of Industrial Internet of Things (IIoT) technologies allows for real-time machine monitoring and predictive maintenance, significantly reducing operational costs. In parallel, the development of high-speed laser cutting machines and additive manufacturing processes such as Directed Energy Deposition (DED) and Wire Arc Additive Manufacturing (WAAM) are enabling new possibilities in metal fabrication. These advancements are particularly relevant in industries demanding complex geometries and rapid prototyping, such as aerospace and automotive sectors. Additionally, environmentally-conscious engineering is pushing for machines that consume less energy and offer cleaner coolant and lubrication systems, aligning with stricter sustainability mandates. As digital twins and virtual simulation tools become mainstream, metalworking equipment is no longer just mechanical - it's becoming highly data-centric, modular, and adaptable for Industry 4.0 applications. Furthermore, the rise of edge computing and machine learning is enabling smarter process optimization at the machine level, helping manufacturers achieve consistent quality and higher throughput. Cloud connectivity is also supporting remote diagnostics and software updates, enhancing equipment longevity. With manufacturers seeking agility in both design and execution, the role of digitally integrated systems in metalworking continues to expand, fostering unprecedented levels of productivity and precision in a highly competitive industrial environment.Are Global Supply Chains Reshaping Equipment Manufacturing?

The metalworking equipment market is being reshaped by a broader realignment of global supply chains, triggered in part by geopolitical tensions, trade realignments, and lessons learned during the COVID-19 pandemic. With many countries moving toward reshoring or nearshoring strategies, there is a growing demand for more compact, flexible, and high-performance machinery that supports decentralized production environments. This shift has especially impacted equipment manufacturers in North America and Europe, who are now investing heavily in localized production units and customizing equipment to suit smaller batch sizes and faster changeover times. Simultaneously, Asian manufacturing hubs continue to dominate in terms of volume, supported by cost-effective labor and rapidly scaling industrial bases. However, even in these regions, rising labor costs and a focus on quality are pushing manufacturers toward high-tech solutions that integrate automation and human-machine collaboration. Export patterns are also changing, with countries such as India and Vietnam emerging as both producers and end-users of sophisticated metalworking systems. As raw material costs fluctuate, manufacturers are also re-evaluating machine designs to improve material efficiency and minimize waste. This evolving landscape underscores a heightened focus on equipment that can adapt to fluid global production dynamics while maintaining precision and scalability. Additionally, growing regulatory scrutiny around cross-border trade and environmental impact is forcing companies to reassess logistics and supply routes, further incentivizing regionalization of production assets. In response, manufacturers are adopting flexible modular systems that can be rapidly configured on-site to meet specific regional production needs without compromising global quality standards.How Are Shifting End-Use Demands Influencing Equipment Design?

The downstream industries relying on metalworking equipment are experiencing shifts in demand that are directly influencing equipment design, performance expectations, and production techniques. In the automotive sector, the transition to electric vehicles (EVs) has altered the requirements for metal parts and assemblies, prompting increased use of lightweight alloys and high-precision components. This, in turn, necessitates machines with enhanced capabilities for handling aluminum and advanced composites, alongside the traditional ferrous materials. The aerospace industry is leaning further into customization and lightweight structures, driving demand for 5-axis CNC machines and hybrid equipment that can alternate between additive and subtractive processes. Meanwhile, the construction and energy sectors are scaling up their requirements for large-format machining and metal-forming tools that can work with heavy-duty materials like structural steel and titanium. Consumer electronics, characterized by short product cycles and miniaturized components, is generating demand for micro-machining and laser etching tools with nanoscale precision. Even the medical device industry is contributing to this evolution by requiring ultra-precise and contamination-free machining environments. These divergent end-use demands are reshaping the equipment landscape, fostering greater modularity, material-specific configurations, and multi-process capabilities in modern metalworking solutions. As each industry evolves toward greater specialization and responsiveness to market trends, manufacturers are under pressure to develop equipment that is not only versatile but also tailored for particular output specifications and regulatory conditions. This trend has accelerated the development of machine learning algorithms and advanced simulation platforms that allow equipment to be fine-tuned virtually before deployment, saving both time and cost. The increasing interdependence between design software and hardware controls is thus becoming central to creating next-generation metalworking systems.Why Is the Metalworking Equipment Market Experiencing Accelerated Growth?

The growth in the metalworking equipment market is driven by several factors rooted in technological progression, sector-specific manufacturing demands, and evolving consumer behavior. A key driver is the surge in demand from precision-centric industries like aerospace, medical devices, and electric vehicles, all of which require advanced metal components with tight tolerances. Additionally, the expansion of industrial automation and the proliferation of smart factories are prompting manufacturers to invest in intelligent, interconnected machines that enhance productivity and decision-making. The global emphasis on energy efficiency and emissions reduction is compelling producers to adopt newer equipment that supports cleaner, leaner manufacturing processes. Simultaneously, the rise of mass customization and shortened product development cycles especially in consumer goods and electronics demands versatile machines capable of rapid retooling and low-volume high-mix production. The construction boom in emerging markets and increased investments in renewable energy infrastructure are also fueling demand for heavy-duty metal fabrication equipment. Moreover, as manufacturers across various sectors prioritize operational resilience post-pandemic, the push for locally sourced, technologically advanced equipment has intensified. Also significant is the influence of government incentives aimed at boosting domestic manufacturing, which is driving procurement of modern machine tools that align with national industry goals. Changing workforce demographics, including labor shortages and skill gaps, are pushing adoption of intuitive, semi-automated systems that reduce dependency on highly skilled operators. With end-users expecting faster turnaround times and lower costs, the pressure on manufacturers to continuously upgrade their equipment portfolios remains high. All these factors combined are setting the stage for sustained and robust growth in the global metalworking equipment market.Report Scope

The report analyzes the Metalworking Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Lathe Machines, Milling Machines); End-Use (Automotive End-Use, Manufacturing End-Use, Construction End-Use, Marine End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lathe Machines segment, which is expected to reach US$265.9 Billion by 2030 with a CAGR of a 7.7%. The Milling Machines segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $76.9 Billion in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $86 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Metalworking Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Metalworking Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Metalworking Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMADA Co., Ltd., Baykal Makina, Bystronic AG, Cidan Machinery Group, Durma (Durmazlar Machinery) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Metalworking Equipment market report include:

- Amada Co., Ltd.

- ANDRITZ Group

- DMG MORI

- Esab

- FANUC Corp.

- GF Machining Solutions

- Haas Automation, Inc.

- Hardinge Inc.

- Hoffmann Group

- Kennametal Inc.

- Knuth Machine Tools

- Makino Milling Machine Co. Ltd.

- Okuma Corporation

- Prima Power

- Sandvik AB

- Takraf GmbH

- TRUMPF Group

- Yamazaki Mazak Corporation

- XCMG Group

- Doosan Machine Tools

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amada Co., Ltd.

- ANDRITZ Group

- DMG MORI

- Esab

- FANUC Corp.

- GF Machining Solutions

- Haas Automation, Inc.

- Hardinge Inc.

- Hoffmann Group

- Kennametal Inc.

- Knuth Machine Tools

- Makino Milling Machine Co. Ltd.

- Okuma Corporation

- Prima Power

- Sandvik AB

- Takraf GmbH

- TRUMPF Group

- Yamazaki Mazak Corporation

- XCMG Group

- Doosan Machine Tools

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

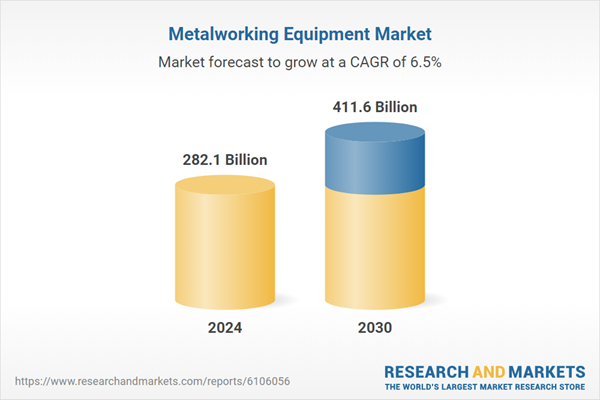

| Estimated Market Value ( USD | $ 282.1 Billion |

| Forecasted Market Value ( USD | $ 411.6 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |