Global Metalworking Machinery Accessories Market - Key Trends & Drivers Summarized

How Are Accessories Enhancing Capabilities in Modern Metalworking Operations?

Metalworking machinery accessories have become pivotal to enhancing the performance, precision, and productivity of core metalworking systems in today's manufacturing ecosystem. These accessories, including tool holders, clamping devices, rotary tables, coolant systems, and chip conveyors, enable machines to operate at peak efficiency while extending their operational life. Modern accessories are no longer considered simple add-ons but are integral components that contribute directly to process optimization. Precision-engineered tool holders, for instance, reduce vibration and improve surface finish, especially in high-speed machining operations. Quick-change systems and modular fixturing solutions significantly reduce downtime during part transitions, which is especially important in low-volume high-mix production setups. Rotary and tilting tables are now equipped with digital angle feedback systems, allowing for more accurate and repeatable multi-axis machining tasks. Smart accessories with embedded sensors offer real-time feedback on parameters such as tool wear, coolant levels, and vibration metrics, giving manufacturers better control over quality and machine health. Developments in thermal compensation and damping technologies are also being integrated into accessories to mitigate the impact of heat and mechanical stress on accuracy. As CNC machines become more sophisticated, accessory compatibility and precision alignment have become crucial to maintaining tolerances and surface integrity. Furthermore, advancements in materials like carbon fiber composites and high-performance alloys are being leveraged in accessory production to reduce weight and improve rigidity. These innovations collectively reflect a shift toward intelligent, performance-boosting components that support the evolving demands of metalworking applications across industries.What Role Does Customization Play in Accessory Development?

The metalworking machinery accessories market is witnessing a rapid shift toward customization as industries demand solutions tailored to specific processes, part geometries, and materials. Standardized accessories often fall short in meeting the nuanced requirements of advanced applications, prompting manufacturers to design accessories that can be fine-tuned for individual machines and jobs. Custom tool holders, clamps, and modular fixtures are increasingly being developed for specific machining tasks, such as high-precision drilling in aerospace components or complex contouring in die and mold applications. Flexible fixturing systems that can accommodate a variety of part shapes and sizes without requiring time-consuming manual changes are in high demand. Accessory makers are working closely with machine tool manufacturers and end-users to co-develop integrated solutions that ensure optimal machine-tool-accessory harmony. This is especially important in sectors like medical devices and electronics, where tight tolerances and minute features demand specialized clamping and micro-positioning systems. Additionally, accessory customization is being driven by the diversification of workpiece materials, such as titanium, Inconel, and other exotic alloys that pose unique machining challenges. Accessories with material-specific features, such as enhanced cooling channels for high-heat applications or non-marring surfaces for delicate parts, are becoming increasingly popular. Design flexibility is further enabled by advancements in additive manufacturing, allowing for the production of lightweight, geometry-optimized accessory components that would be difficult to machine traditionally. Modular accessory kits that allow easy reconfiguration on the shop floor are also seeing widespread adoption. In this environment, accessory makers must prioritize agility, engineering collaboration, and application-specific insight to stay competitive and relevant.How Are Digital Technologies Transforming Metalworking Accessories?

Digitalization is playing an increasingly central role in the evolution of metalworking machinery accessories, introducing a new level of intelligence, automation, and process insight. Smart accessories embedded with sensors, RFID chips, and connectivity modules are helping transform traditional setups into intelligent machining environments. These digital accessories enable real-time condition monitoring, helping operators track tool wear, detect misalignment, and measure clamping force with high precision. Such feedback mechanisms are vital for maintaining part accuracy and preventing machine damage. Automatic tool changers integrated with smart tool holders can now identify tool types and monitor usage cycles, enhancing workflow automation and minimizing errors. Furthermore, accessories that sync with digital twin models allow operators to simulate setups and processes virtually before actual machining, reducing trial-and-error on the shop floor. Predictive analytics powered by data from smart accessories helps schedule maintenance proactively, avoiding costly downtimes. Even traditionally passive components like chip conveyors and coolant nozzles are being digitized to optimize chip removal and thermal regulation based on real-time machining conditions. Machine learning algorithms are being trained on accessory-generated data to improve tool path planning, surface finish outcomes, and machine learning-based anomaly detection. Cloud-based accessory management platforms now allow manufacturers to track usage trends across multiple sites, creating a more unified, scalable operations model. As manufacturers embrace Industry 4.0, the role of digitally enabled accessories will only deepen, with interoperability and open communication protocols becoming essential features. This shift not only enhances operational efficiency but also opens doors for adaptive machining environments where accessories dynamically respond to process variations in real-time.What Are the Key Drivers Behind the Growth of the Accessories Market?

The growth in the metalworking machinery accessories market is driven by several factors rooted in technological advancements, changing industrial demands, and the evolution of manufacturing practices. One of the foremost drivers is the rising complexity and precision demands of end-use sectors such as aerospace, automotive, defense, medical equipment, and energy, where generic accessories cannot deliver the accuracy and reliability required. As manufacturers invest in high-speed, multi-axis, and hybrid machines, there is a corresponding need for accessories that can match the performance and capabilities of this advanced equipment. The push toward lean manufacturing and process optimization has increased demand for quick-change tooling systems, high-efficiency clamping devices, and automation-friendly accessories that reduce manual intervention. In parallel, the increasing adoption of smart factories and digital manufacturing platforms has driven the integration of intelligent accessories capable of feeding critical data into centralized monitoring systems. The shift to lighter and more complex materials, especially in aerospace and automotive sectors, necessitates accessories with material-specific engineering to handle heat, vibration, and stress differently. Furthermore, as the trend of mass customization takes hold, factories need highly flexible accessory solutions that can handle varied product designs with minimal reconfiguration. Economic incentives and government support for domestic manufacturing in many countries are also boosting the procurement of high-performance accessories to support localized production ecosystems. Rising labor costs and the shortage of skilled machinists have made user-friendly, automated accessories an attractive solution for improving throughput without escalating training requirements. Lastly, the growing awareness of total cost of ownership, including tool longevity, maintenance costs, and process reliability, is encouraging buyers to invest in premium accessory systems that deliver long-term value and operational stability.Report Scope

The report analyzes the Metalworking Machinery Accessories market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (Workholding Application, Metalworking Fluids Application, Powertool Accessories Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Workholding Application segment, which is expected to reach US$29.3 Billion by 2030 with a CAGR of a 7.4%. The Metalworking Fluids Application segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.8 Billion in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $10.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Metalworking Machinery Accessories Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Metalworking Machinery Accessories Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Metalworking Machinery Accessories Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allegheny Metallurgical, Alpha Metallurgical Resources, Inc., Anglo American plc, Anglo Pacific Group plc, Bogatyr Komir and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Metalworking Machinery Accessories market report include:

- Apar Industries Ltd.

- Chevron Corp.

- Columbia Petro Chem Pvt. Ltd.

- Daljit Machines

- DM Italia S.r.l.

- Dover Corp.

- Enerpac Tool Group Corp.

- Exxon Mobil Corp.

- FUCHS SE

- Idemitsu Kosan Co. Ltd.

- Jergens Inc.

- Jiangsu Dongcheng M & E Tools

- Kurt Manufacturing

- Makita USA Inc.

- PJSC LUKOIL

- Robert Bosch GmbH

- Sandvik AB

- Sturmer Maschinen GmbH

- The Lubrizol Corp.

- TotalEnergies SE

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apar Industries Ltd.

- Chevron Corp.

- Columbia Petro Chem Pvt. Ltd.

- Daljit Machines

- DM Italia S.r.l.

- Dover Corp.

- Enerpac Tool Group Corp.

- Exxon Mobil Corp.

- FUCHS SE

- Idemitsu Kosan Co. Ltd.

- Jergens Inc.

- Jiangsu Dongcheng M & E Tools

- Kurt Manufacturing

- Makita USA Inc.

- PJSC LUKOIL

- Robert Bosch GmbH

- Sandvik AB

- Sturmer Maschinen GmbH

- The Lubrizol Corp.

- TotalEnergies SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

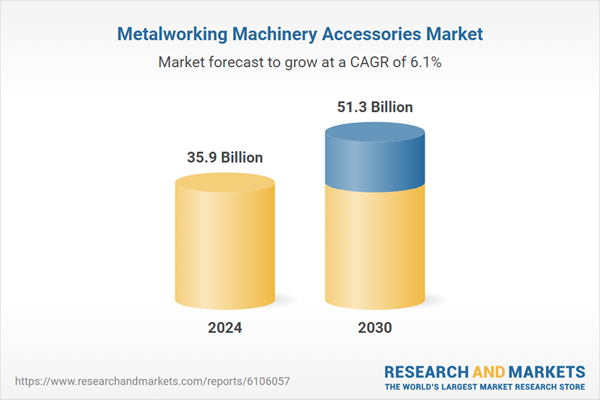

| Estimated Market Value ( USD | $ 35.9 Billion |

| Forecasted Market Value ( USD | $ 51.3 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |