Global Omega-3 and Omega-6 Market - Key Trends & Drivers Summarized

Why Are Omega-3 and Omega-6 Fatty Acids Essential for Human Health?

Omega-3 and Omega-6 are essential polyunsaturated fatty acids (PUFAs) that the human body cannot synthesize and must be obtained through diet. These nutrients play critical roles in cardiovascular function, brain development, immune regulation, and inflammatory response. Omega-3 fatty acids, primarily eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), are found in fish oil, krill oil, algae oil, and flaxseed. Omega-6 fatty acids, especially linoleic acid (LA) and arachidonic acid (AA), are commonly sourced from vegetable oils such as sunflower, corn, and soybean.While both fatty acids are essential, maintaining a balanced intake is key. Omega-3s are known for their anti-inflammatory properties and support for heart and cognitive health, while Omega-6s contribute to cellular structure and skin health. Imbalanced consumption, especially excess Omega-6 relative to Omega-3, is associated with chronic inflammatory conditions. This has raised consumer awareness around the importance of managing dietary PUFA ratios, supporting demand for supplements and fortified foods containing balanced Omega-3 and Omega-6 blends.

How Are Formulation Innovations Expanding Omega Applications?

Technological advancements in microencapsulation, emulsification, and purification are enabling broader use of Omega-3 and Omega-6 in various product categories. Microencapsulation protects these sensitive oils from oxidation, improving shelf life and allowing their integration into beverages, powders, and functional snacks. Plant-based Omega-3s from algal sources are gaining traction among vegetarians and flexitarians, offering DHA and EPA alternatives without marine ingredients. Similarly, high-purity Omega-6 products derived from safflower, evening primrose, or borage oil are being used in nutraceuticals and skin care products.Refined processing methods, including molecular distillation and supercritical CO2 extraction, are improving oil purity, reducing contaminants, and concentrating beneficial fatty acid content. Combination supplements that include Omega-3, Omega-6, and Omega-9 are becoming popular for their holistic support of metabolic, neurological, and cardiovascular health. These innovations are enhancing consumer access and expanding usage across food, pharmaceutical, and cosmetic industries.

What Market Trends Are Driving Omega-Enriched Products Across Industries?

Rising interest in preventive healthcare and functional nutrition is fueling demand for Omega-enriched products. Consumers increasingly seek dietary solutions to manage heart health, cholesterol, cognition, and joint inflammation, with Omega-3s gaining strong scientific and consumer endorsement. The aging population and rising incidence of lifestyle-related disorders are further boosting supplement intake. Omega-6, although abundant in many diets, is being reformulated in skincare and pediatric nutrition due to its role in skin barrier repair and growth.The food and beverage sector is witnessing a steady rise in Omega-fortified products such as milk, yogurt, infant formulas, and baked goods. Pet nutrition is another growth area, with Omega-3 and Omega-6 blends included in formulations to support coat health and joint mobility in dogs and cats. In cosmetics, Omega-rich oils are incorporated into moisturizers, anti-aging serums, and hair care formulations to provide hydration, elasticity, and anti-inflammatory benefits. These trends reflect the multifunctional appeal and cross-industry relevance of essential fatty acids.

What Factors Are Driving Growth in the Omega-3 and Omega-6 Market?

Growth in the Omega-3 and Omega-6 market is driven by several factors. Rising health awareness and consumer preference for natural, functional ingredients are increasing demand for PUFA-rich supplements and fortified foods. Scientific validation of cardiovascular, cognitive, and anti-inflammatory benefits is supporting widespread adoption, particularly in aging populations and wellness-focused demographics. Innovation in plant-based and algae-derived sources is broadening accessibility and aligning with vegan and sustainability trends. Improvements in encapsulation, stability, and flavor-masking technologies are enhancing product versatility and consumer acceptance. Additionally, expanding applications in infant nutrition, pet care, and personal care are opening new avenues for market growth across diverse end-use segments. These dynamics are sustaining global momentum in the development and commercialization of Omega-3 and Omega-6 products.Report Scope

The report analyzes the Omega 3 and Omega 6 market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Omega 6 Fatty Acids, Omega 3 Fatty Acids); Application (Functional Food & Supplements Application, Infant Nutrition Application, Pharmaceuticals Application, Pet Food & Feed Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Omega 6 Fatty Acids segment, which is expected to reach US$11.1 Billion by 2030 with a CAGR of a 8.5%. The Omega 3 Fatty Acids segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 11.7% CAGR to reach $3.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Omega 3 and Omega 6 Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Omega 3 and Omega 6 Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Omega 3 and Omega 6 Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abokichi, Azumaya Co., Ltd., Blue Farm GmbH, Bonsoy Australia Pty Ltd, Eden Foods, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Omega 3 and Omega 6 market report include:

- Aker BioMarine AS

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Croda International Plc

- DSM Nutritional Products (Royal DSM)

- GSK plc

- i-Health, Inc.

- KD Pharma Group SA

- Luhua Biomarine (Shandong) Co., Ltd

- Nature’s Sunshine Products, Inc.

- Nature's Bounty Co.

- Nature's Way Products, LLC

- Nordic Naturals, Inc.

- NOW Foods

- Nutiva, Inc.

- Pharma Nord Inc.

- Reckitt Benckiser Group PLC

- Royal DSM N.V.

- Wilmar International Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aker BioMarine AS

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Croda International Plc

- DSM Nutritional Products (Royal DSM)

- GSK plc

- i-Health, Inc.

- KD Pharma Group SA

- Luhua Biomarine (Shandong) Co., Ltd

- Nature’s Sunshine Products, Inc.

- Nature's Bounty Co.

- Nature's Way Products, LLC

- Nordic Naturals, Inc.

- NOW Foods

- Nutiva, Inc.

- Pharma Nord Inc.

- Reckitt Benckiser Group PLC

- Royal DSM N.V.

- Wilmar International Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

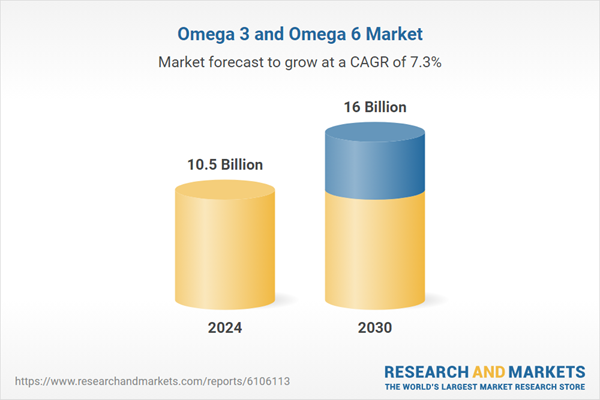

| Estimated Market Value ( USD | $ 10.5 Billion |

| Forecasted Market Value ( USD | $ 16 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |