Global Polypropylene Random (PPR) Pipes Market - Key Trends & Drivers Summarized

Thermal Resilience and Pressure Ratings Redefined: Why PPR Pipes Are Emerging as the Backbone of Modern Fluid Distribution SystemsWhat Makes PPR Pipes the Material of Choice for Modern Piping Systems?

Polypropylene Random Copolymer (PPR) pipes are increasingly being adopted in global plumbing, HVAC, and industrial fluid handling applications due to their unique combination of chemical resistance, mechanical strength, and long-term thermal stability. Engineered from random copolymerized polypropylene, PPR pipes offer a non-corrosive, smooth-walled, and low-friction alternative to traditional metal and PVC-based pipe systems. Their high resistance to scaling, pressure fatigue, and temperature-induced deformation makes them ideal for hot and cold water distribution, compressed air systems, and even certain chemical transfer applications. Unlike PVC or chlorinated polyvinyl chloride (CPVC), PPR pipes demonstrate excellent thermal expansion control and weldability, which reduces joint leakage risks and installation labor. Their ability to be joined through thermal fusion techniques such as socket fusion welding ensures leak-proof, homogeneous pipelines with extended service lifespans. PPR systems are particularly suitable for radiant heating systems, central heating infrastructure, and desalination plant pipelines-where durability, water purity, and long-term performance are paramount. Environmental sustainability is also driving PPR adoption. The material is fully recyclable, non-toxic, and inert to most mineral or biological agents. It is also lead-free and free from harmful plasticizers, aligning with drinking water safety regulations and green building certifications such as LEED.Which End-Use Sectors and Installation Scenarios Are Powering Market Expansion?

The construction and infrastructure sectors dominate global demand for PPR piping systems, particularly in residential and commercial plumbing. The material's ability to withstand water temperatures exceeding 70°C and pressures over 10 bar makes it well suited for domestic hot water lines, central heating pipes, riser mains, and internal water supply networks in high-rise buildings. In large housing developments, hospitals, and hotels, the preference for long-lasting, maintenance-free plumbing is shifting demand from galvanized iron and copper to PPR. Industrial applications are also expanding. Chemical processing plants use PPR pipes for conveying weak acids and alkalis, owing to their non-reactive surface and pressure resilience. In food and beverage manufacturing, pharmaceutical cleanrooms, and electronics fabrication units, PPR's non-leaching characteristics make it a viable alternative to stainless steel piping in low-pressure circuits.Public sector initiatives in emerging markets-such as water grid expansion, sanitation improvements, and hospital infrastructure programs-are driving large-volume PPR procurement, especially in Southeast Asia, the Middle East, and Africa. Moreover, retrofitting of aging metal pipes in Europe and the Americas with lightweight, corrosion-free alternatives is generating robust replacement demand. Municipal use of PPR in water treatment plants, stormwater systems, and effluent recycling further highlights its versatility. PPR's resistance to biological fouling and chemical degradation under continuous flow conditions positions it favorably against HDPE and uPVC in select fluid management systems.

How Are Material Innovations and Installation Practices Enhancing PPR Performance Across Applications?

Manufacturers are actively enhancing PPR formulations by integrating glass fiber reinforcement, UV stabilizers, and anti-oxidant packages to extend product longevity under thermal and outdoor exposure. Multi-layer PPR pipes-such as PPR-AL-PPR, which feature an embedded aluminum layer-are gaining popularity for applications requiring dimensional stability and lower thermal expansion coefficients. These variants also reduce pipe sagging in suspended systems and support long horizontal runs without additional bracketing. The industry is also witnessing a rise in pre-insulated PPR pipes used in district heating and chilled water systems. These composite systems, comprising PPR inner cores with polyurethane insulation and HDPE outer jackets, offer energy-efficient solutions for large-scale HVAC and infrastructure projects. Additionally, color-coded PPR variants are being used for easier system identification-green for potable water, blue for chilled water, and red for heating systems.Tooling and joining methods are evolving as well. Digital welding machines with time-temperature control, thermal imaging for joint inspection, and plug-and-play fittings are streamlining installations in commercial projects. Pipe bending guides, expansion loops, and modular clamp systems are also reducing material waste and installation timelines. Compatibility with Building Information Modeling (BIM) systems is enhancing the design and planning of large-scale piping networks. Manufacturers are offering CAD-ready digital libraries of their PPR product lines, enabling plumbing designers to simulate flow dynamics and load stresses prior to implementation.

What Are the Key Trends and Market Forces Driving PPR Pipe Adoption Globally?

The growth in the polypropylene random (PPR) pipes market is driven by a combination of urbanization-led construction booms, the global push for corrosion-free and long-life plumbing systems, and a steady shift away from legacy metal-based piping. A core driver is the increasing demand for hot and cold water systems that can withstand high thermal and mechanical loads without compromising water quality or safety. PPR's excellent resistance to scaling, rust, and chemical aggression makes it an ideal solution in this regard. Government-funded infrastructure development across emerging economies, including India's AMRUT program and Africa's Smart City Missions, are emphasizing the use of low-maintenance, sustainable piping systems-creating large-scale opportunities for PPR manufacturers. Simultaneously, energy efficiency mandates and building regulations in Europe and North America are favoring the use of thermally efficient and low-emission materials, with PPR systems increasingly being specified in commercial real estate projects.Another important driver is the rise in modular and prefabricated construction. Plumbing modules fabricated offsite using PPR pipes offer ease of transport, consistent quality, and reduced onsite labor-all aligning with fast-track construction timelines. Additionally, the increasing focus on circular economy practices is pushing institutions and developers toward recyclable piping materials like PPR, especially those with extended product certifications. The retrofit and maintenance market is also accelerating, with older buildings replacing corroded galvanized iron and copper systems. Here, PPR provides not only performance parity but also cost efficiency and ease of retrofit, especially in multistory housing and institutional buildings. As design, durability, and installation continue to be integrated into a single system offering, PPR pipes are becoming the material standard for modern fluid transport systems-ensuring sustained relevance in global water infrastructure.

Scope Of Study:

The report analyzes the Polypropylene Random (PPR) Pipes market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Type (Hot & Cold Water PPR Pipes, Composite PPR Pipes); Application (Commercial Application, Residential Application, Industrial Application, Agriculture Application)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hot & Cold Water PPR Pipes segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 4.8%. The Composite PPR Pipes segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $467.2 Million in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $443.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polypropylene Random (PPR) Pipes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polypropylene Random (PPR) Pipes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polypropylene Random (PPR) Pipes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGRU Kunststofftechnik, Aliaxis Group S.A., Aquatherm GmbH, Bänninger Kunststoff-Produkte GmbH, Borealis AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Polypropylene Random (PPR) Pipes market report include:

- AGRU Kunststofftechnik

- Aliaxis Group S.A.

- Aquatherm GmbH

- Bänninger Kunststoff-Produkte GmbH

- Borealis AG

- China Lesso Group Holdings Ltd.

- Danco

- Georg Fischer (GF Piping Systems)

- Ginde

- Kalde Klima Orman

- Kingbull (Wuhan Kingbull)

- Nupi Industrie Italiane S.p.A.

- Pipelife International GmbH

- Pestan d.o.o.

- Power Pipe* (Ros Turplast)

- Uponor Corporation

- Rehau

- Rifeng

- Wavin N.V.

- Zhejiang Weixing New Building Materials

- Zhejiang Nanxin Plastic Pipe

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGRU Kunststofftechnik

- Aliaxis Group S.A.

- Aquatherm GmbH

- Bänninger Kunststoff-Produkte GmbH

- Borealis AG

- China Lesso Group Holdings Ltd.

- Danco

- Georg Fischer (GF Piping Systems)

- Ginde

- Kalde Klima Orman

- Kingbull (Wuhan Kingbull)

- Nupi Industrie Italiane S.p.A.

- Pipelife International GmbH

- Pestan d.o.o.

- Power Pipe* (Ros Turplast)

- Uponor Corporation

- Rehau

- Rifeng

- Wavin N.V.

- Zhejiang Weixing New Building Materials

- Zhejiang Nanxin Plastic Pipe

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

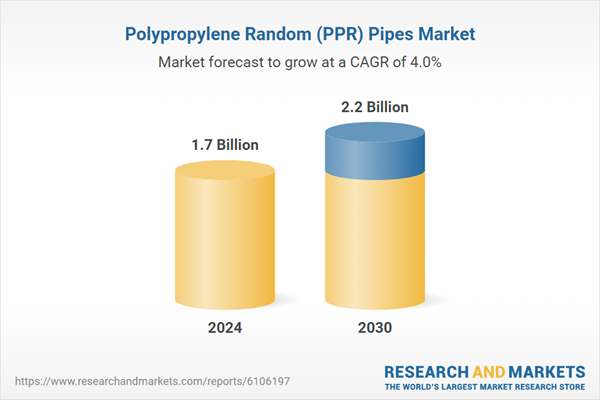

| Estimated Market Value in 2024 | 1.7 Billion |

| Forecasted Market Value by 2030 | 2.2 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |