Global Rose Water Market - Key Trends & Drivers Summarized

From Ancient Ritual to Daily Essential: How Rose Water Is Evolving Across Wellness and Beauty MarketsWhy Is Rose Water Gaining Traction in Formulated and Raw Product Categories?

Rose water, a hydrosol produced during the steam distillation of rose petals, has re-emerged as a widely adopted natural ingredient in both formulated skincare and standalone product formats. Its pH-balancing properties, mild astringency, and soothing aromatherapeutic qualities have made it an integral part of skin toners, facial mists, cleansing waters, and anti-inflammatory solutions. With the global surge in minimalist skincare, rose water-being multi-functional yet gentle-is increasingly preferred by formulators seeking botanical waters free from alcohol, parabens, or artificial fragrances.The shift from synthetic toners to nature-derived alternatives has amplified rose water's visibility in e-commerce and mass retail. Products marketed as 100% steam-distilled rose water, especially those using organically sourced Rosa damascena, are finding strong resonance among clean beauty consumers. Additionally, the increasing use of rose water in customized DIY routines-such as face masks, hair rinses, and serums-has elevated demand for bulk and pure-grade rose water products.

At the ingredient level, demand is also being driven by its compatibility with other actives like hyaluronic acid, niacinamide, and ceramides. As multifunctional skincare becomes the norm, rose water is being used as a delivery medium that enhances product sensoriality while providing trace botanical benefits. Its light floral scent and natural antimicrobial traits further elevate its relevance in facial wipes, after-sun products, and even baby care.

How Is Innovation in Processing and Packaging Elevating Rose Water's Market Profile?

Modern processing technologies are improving the shelf stability, clarity, and potency of rose water products. Traditional single-pass steam distillation is being replaced or augmented with vacuum distillation and dual-stage hydrosol recovery systems that yield higher concentrations of key volatiles like citronellol and geraniol. Filtration techniques using activated carbon and membrane filters have improved product clarity and microbial purity without adding preservatives-meeting rising expectations for 'waterless' or non-toxic clean beauty.Another trend reshaping the product landscape is the use of biophotonic glass and UV-resistant packaging that preserves the integrity of volatile compounds. Consumer-facing brands are increasingly using recyclable, frosted glass bottles with fine-mist sprayers to maintain premium aesthetics and ensure freshness. Single-use sachets and travel-sized mists have also emerged in response to on-the-go personal care needs.

Private labeling and co-packing services are expanding access to rose water for new entrants, especially indie brands seeking rapid product launches in wellness or aromatherapy. Some manufacturers are also blending rose water with aloe vera, witch hazel, or cucumber extracts to create hybrid formulations targeting specific skin concerns like irritation or pigmentation.

Which Regional and Cultural Markets Are Fueling Demand for Rose Water Products?

The Middle East and South Asia represent the most culturally entrenched markets for rose water, where it is used both topically and orally. In countries like Iran, India, and the UAE, rose water is a household staple for skin care, religious rituals, and culinary preparations. Local manufacturers dominate with variations tailored for facial cleansing, prayer ceremonies, and food flavoring-offering both distilled and edible-grade products. Despite their maturity, these regions continue to see innovation, particularly in packaging and purity standards.In Europe and North America, rose water is being reintroduced as a luxury wellness ingredient. Clean beauty brands, wellness spas, and boutique aromatherapists are offering cold-pressed or organically sourced variants with strong narratives around traceability and artisanal production. The U.S. and Germany are among the fastest-growing consumer bases, where rose water is marketed for its stress-reducing aroma, post-workout skin refreshment, and eco-conscious origin stories. Additionally, its inclusion in niche beverage categories such as botanical sparkling waters and herbal mocktails is on the rise.

East Asia, especially South Korea and Japan, is incorporating rose water into functional facial sheet masks and essence waters. The emphasis in these markets is on hydration, clarity, and softness-attributes that rose water naturally supports. Meanwhile, online marketplaces in Latin America and Africa are fueling accessibility and demand via direct imports and local repackaging ventures.

What Are the Key Drivers Fueling the Expansion of the Rose Water Market?

The growth in the rose water market is driven by several factors, notably increasing consumer preference for natural, multipurpose skincare ingredients and the revival of traditional wellness rituals. A major driver is the appeal of rose water as a heritage ingredient that aligns well with contemporary clean beauty narratives. As consumers seek authenticity and traceability, rose water provides a familiar yet functional alternative to synthetic toners and mists.Health-conscious buyers are also pushing for ingredient transparency and functional efficacy, particularly in toners that avoid drying alcohols. Rose water, being gentle and suitable for all skin types, is increasingly positioned as a universal hydrator and skin soother. Its incorporation into lifestyle wellness routines-such as morning sprays, meditation rituals, and travel kits-is creating new consumption occasions and boosting volume sales.

Sustainability is another influential driver. Producers are aligning with regenerative agriculture and fair trade initiatives, while formulators are seeking products that reduce water footprint and minimize chemical inputs. As rose cultivation expands to new geographies and product diversification increases-from mists and cleansers to drinks and bath additives-the global rose water market is poised for robust growth driven by holistic beauty, clean wellness, and traditional-modern fusion demand.

Scope Of Study:

The report analyzes the Rose Water market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Distribution Channel (Indirect Distribution Channel, Direct Distribution Channel); Application (Fragrance & Cosmetics Application, Pharmaceuticals Application, Food & Beverages Application, Other Applications); End-Use (Individual Consumers End-Use, Commercial Users End-Use)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Indirect Distribution Channel segment, which is expected to reach US$349.2 Million by 2030 with a CAGR of a 6.3%. The Direct Distribution Channel segment is also set to grow at 10.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $109.3 Million in 2024, and China, forecasted to grow at an impressive 12.2% CAGR to reach $134.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Rose Water Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Rose Water Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Rose Water Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alteya Organics, Aromaaz International, Avril Organics, BDK Parfums, Biopurus and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Rose Water market report include:

- Alteya Organics

- Aromaaz International

- Avril Organics

- BDK Parfums

- Biopurus

- Cortas

- Fleur & Bee

- Gulabari (Dabur)

- Heritage Store

- Karawan Authentic

- Khadi Natural

- KTC Edibles Ltd

- Lush Fresh Handmade Cosmetics

- Meena Perfumery

- Melvita

- Mountain Rose Herbs

- Neal`s Yard Remedies

- Penny Price Aromatherapy

- Pukka Herbs

- SVA Naturals

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alteya Organics

- Aromaaz International

- Avril Organics

- BDK Parfums

- Biopurus

- Cortas

- Fleur & Bee

- Gulabari (Dabur)

- Heritage Store

- Karawan Authentic

- Khadi Natural

- KTC Edibles Ltd

- Lush Fresh Handmade Cosmetics

- Meena Perfumery

- Melvita

- Mountain Rose Herbs

- Neal`s Yard Remedies

- Penny Price Aromatherapy

- Pukka Herbs

- SVA Naturals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

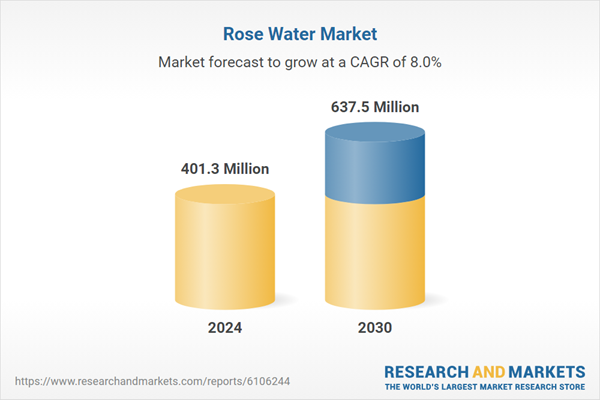

| Estimated Market Value in 2024 | 401.3 Million |

| Forecasted Market Value by 2030 | 637.5 Million |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |