Global Slip And Tier Sheets Market - Key Trends & Drivers Summarized

Why Are Slip and Tier Sheets Gaining Relevance in Modern Logistics and Warehouse Optimization?

Slip and tier sheets, typically constructed from corrugated fiberboard, kraft paper, plastic, or composite materials, have become essential tools in palletized goods movement and material handling. Designed to replace or complement wooden pallets, these sheets are placed between layers of products or at the base of unit loads to provide separation, stability, load integrity, and protection from moisture or friction during transport. Their adoption has increased with the expansion of e-commerce, just-in-time logistics, and high-throughput supply chains that demand faster, cleaner, and more space-efficient palletizing solutions.Slip sheets are thin, lightweight, and cost-effective alternatives to wooden pallets, particularly in closed-loop logistics systems or export-oriented shipments where weight and disposability are concerns. Tier sheets are similarly used as intermediate separators between layers of goods-cans, bottles, cartons, sacks-on a single pallet to prevent slippage, distribute weight, and absorb vibrations. Their ability to improve stacking efficiency and minimize product damage is vital for industries such as food and beverage, pharmaceuticals, consumer goods, and industrial chemicals. As warehousing and transportation systems become more automated and space-optimized, the role of slip and tier sheets in material flow is increasingly strategic.

How Are Material Advancements and Automation Trends Reshaping Product Design?

Material science innovation is enabling manufacturers to create high-performance slip and tier sheets that meet diverse load, hygiene, and environmental requirements. While recycled paperboard and kraft liners dominate the traditional segment, coated paper, high-density polyethylene (HDPE), polypropylene (PP), and composite plastic variants are gaining traction due to their reusability, resistance to moisture, and structural durability. Anti-slip coatings, embossed textures, and edge-reinforced formats are being adopted to enhance friction control and reduce shifting during transit.In automation-centric warehouses, slip sheets are engineered with tear-resistant tabs or notched corners to interface with push-pull attachments on forklifts and automated guided vehicles (AGVs). These allow for rapid loading and unloading without the bulk of wooden pallets. Automated palletizing systems are increasingly configured to integrate tier sheets during stacking, requiring precision-cut, uniform-thickness sheets with anti-static or moisture-barrier properties-particularly in pharmaceutical or electronics logistics. Manufacturers are offering customizable sizes, thicknesses, and branding options to align with client-specific material handling configurations and supply chain workflows.

Environmental considerations are also reshaping material selection. With rising demand for eco-friendly logistics solutions, biodegradable or recyclable slip and tier sheets are gaining preference. Some manufacturers offer reusable plastic sheets with RFID tagging for tracking usage cycles, making them ideal for closed-loop distribution networks in automotive, beverage, and consumer packaged goods (CPG) sectors. Regulatory pressure to reduce wood pallet waste and international restrictions on untreated wood packaging are further accelerating adoption.

Which Industries and Use Cases Are Driving Application Diversification?

Slip and tier sheets are being deployed across an expanding array of industries. The food and beverage sector remains the largest user, particularly for palletizing glass bottles, canned goods, and packaged foods. Tier sheets help prevent container scuffing, product migration, and breakage during transport. Beverage companies use wax-coated or waterproof sheets to avoid moisture damage in cold-chain logistics. In the pharmaceutical and personal care sectors, slip sheets ensure hygienic load handling, reduce packaging weight, and simplify customs compliance for cross-border shipping.E-commerce and retail distribution centers are leveraging slip sheets for space and cost efficiency. By eliminating the need to return or dispose of wooden pallets, companies reduce transportation weight and save on labor and disposal costs. Electronics and precision manufacturing industries use anti-static and non-abrasive slip sheets to prevent electrostatic discharge or scratching of sensitive components. The chemical industry, dealing with heavy, stacked containers or sacks, uses reinforced tier sheets for load stabilization and compliance with dangerous goods transport standards.

Seasonal inventory build-ups, promotional campaigns, and international shipments also drive demand for disposable or branded sheets that improve in-store pallet presentation. Retailers often use printed tier sheets with barcodes, handling instructions, or brand logos to optimize logistics visibility and marketing. In agriculture and fresh produce logistics, breathable or ventilated sheets are used to maintain airflow and prevent spoilage during transport.

What Are the Key Factors Accelerating Global Market Expansion for Slip and Tier Sheets?

The growth in the global slip and tier sheets market is driven by structural shifts in warehousing, logistics, and sustainability mandates. The rapid expansion of third-party logistics (3PL), e-commerce fulfillment centers, and international trade is compelling supply chain managers to adopt lightweight, customizable, and eco-conscious alternatives to traditional load carriers. With cost per shipment, return logistics, and inventory throughput under scrutiny, slip and tier sheets offer measurable advantages in cubic efficiency, material handling speed, and recyclability.Global trade compliance and phytosanitary regulations are further fueling this shift. Many countries impose restrictions on wood-based pallets due to pest transmission risks, making paper or plastic-based slip sheets the preferred option for export loads. Moreover, sustainability targets in corporate ESG frameworks are pushing companies to replace disposable pallets with recyclable or reusable load stabilization solutions. Brands are seeking FSC-certified, biodegradable, or circular-use tier sheets to align with environmental commitments.

Automation and digital transformation in logistics are also influencing the market trajectory. As warehouses become smarter, slip and tier sheets must integrate seamlessly with robotic arms, AGVs, and warehouse management systems (WMS). Precision, friction optimization, and traceability are emerging as procurement criteria. Suppliers offering customizable, data-ready solutions with scalable volume support and technical consultancy are gaining a competitive edge.

With manufacturers innovating on both material and functional fronts, and logistics providers under pressure to reduce costs and waste, the slip and tier sheets market is expected to see continued expansion across industrialized and emerging economies. Their role in modernizing global freight, improving load integrity, and enabling greener supply chains cements their value in 21st-century material handling strategies.

Scope Of Study:

The report analyzes the Slip and Tier Sheets market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Material (Kraft Paperboard, Corrugated Fiberboard, High Density Polyethylene); End-Use (Food & Beverages End-Use, Consumer Electronics End-Use, Chemicals End-Use, Pharmaceuticals End-Use, Retail End-Use)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Kraft Paperboard segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 6.6%. The Corrugated Fiberboard segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $491.0 Million in 2024, and China, forecasted to grow at an impressive 10.8% CAGR to reach $561.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Slip and Tier Sheets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Slip and Tier Sheets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Slip and Tier Sheets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A&A Global Industries, Asia Pulp & Paper, Astron Plastics, Billerud, CPPC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Slip and Tier Sheets market report include:

- A&A Global Industries

- Asia Pulp & Paper

- Astron Plastics

- Billerud

- CPPC

- Crown Paper Converting

- Dura-Fibre LLC

- Fresh Pak Corporation

- Georgia-Pacific LLC

- Gunther Packaging

- INDEVCO Group

- International Paper

- JX Nippon ANCI

- KapStone Paper and Packaging Corporation

- Klabin S.A.

- Molex

- Nippon Paper Industries

- Seaman Paper Co.

- Sercalia

- Smurfit Kappa Group

- Sonoco Products Company

- Specialty Coating & Laminating LLC

- WestRock

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A&A Global Industries

- Asia Pulp & Paper

- Astron Plastics

- Billerud

- CPPC

- Crown Paper Converting

- Dura-Fibre LLC

- Fresh Pak Corporation

- Georgia-Pacific LLC

- Gunther Packaging

- INDEVCO Group

- International Paper

- JX Nippon ANCI

- KapStone Paper and Packaging Corporation

- Klabin S.A.

- Molex

- Nippon Paper Industries

- Seaman Paper Co.

- Sercalia

- Smurfit Kappa Group

- Sonoco Products Company

- Specialty Coating & Laminating LLC

- WestRock

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 290 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

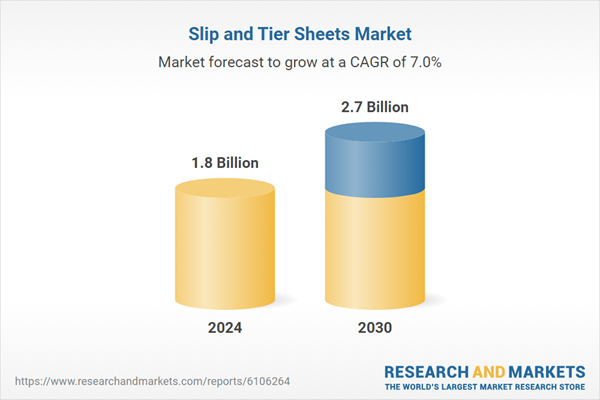

| Estimated Market Value in 2024 | 1.8 Billion |

| Forecasted Market Value by 2030 | 2.7 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |