Global Hepatitis B and C Diagnostics Market - Key Trends & Drivers Summarized

Are Innovations in Diagnostic Technology Changing the Outlook for Hepatitis Detection?

The diagnostics landscape for Hepatitis B and C is undergoing a fundamental transformation driven by rapid advancements in medical technology, molecular biology, and point-of-care testing. These two forms of viral hepatitis, which collectively affect hundreds of millions worldwide, have long posed diagnostic challenges due to asymptomatic progression, limited screening in vulnerable populations, and the complexity of viral behavior in chronic cases. However, new technologies are now enabling earlier, faster, and more accurate detection of both HBV and HCV. Molecular assays, particularly nucleic acid amplification tests (NAATs), are emerging as the gold standard for confirming active viral infection and monitoring viral load. These tests offer high sensitivity and specificity, capable of identifying even low levels of viral RNA or DNA, which is critical for guiding treatment decisions. Simultaneously, advances in serological testing, including enzyme-linked immunosorbent assays (ELISA) and rapid diagnostic tests (RDTs), are making population-level screening more feasible, especially in low-resource settings. Innovations such as dried blood spot (DBS) testing, multiplex platforms, and automated immunoassay systems are increasing throughput while reducing turnaround times. The rise of digital diagnostics, including AI-assisted test interpretation and mobile-integrated diagnostic readers, is also extending access to underserved communities and improving data collection for public health interventions. Collectively, these innovations are pushing Hepatitis B and C diagnostics beyond hospital laboratories and into primary care, community clinics, and remote health centers-making early intervention, prevention of transmission, and disease management more achievable than ever before.Is the Global Push for Elimination Driving Widespread Hepatitis Screening Initiatives?

Global public health initiatives, particularly those spearheaded by the World Health Organization (WHO), are playing a crucial role in elevating hepatitis diagnostics as a top healthcare priority. With WHO's ambitious goal to eliminate viral hepatitis as a public health threat by 2030, countries are being urged to scale up screening, diagnosis, and linkage to care-especially among high-risk populations such as people who inject drugs, prisoners, sex workers, and individuals living with HIV. In response, governments and non-governmental organizations are ramping up community-based testing programs, mobile health units, and targeted outreach campaigns designed to increase diagnosis rates. As part of this effort, public health policies are increasingly mandating routine hepatitis testing in antenatal care, blood donations, and healthcare worker screenings, helping to normalize testing and reduce associated stigma. Additionally, funding from global health organizations such as the Global Fund, Gavi, and UNITAID is enabling developing countries to procure advanced testing technologies, improve laboratory capacity, and integrate hepatitis diagnostics into existing healthcare infrastructure. Regional partnerships in Asia-Pacific, Africa, and Latin America are also fostering knowledge sharing and standardized guidelines to ensure that testing strategies are both efficient and equitable. The adoption of simplified diagnostic algorithms-such as reflex testing and one-step confirmatory protocols-is further accelerating the path from screening to treatment initiation. Educational campaigns and awareness drives are playing a crucial role in encouraging individuals to get tested, particularly in communities where hepatitis remains poorly understood. This coordinated global movement is reshaping the diagnostics market, driving both volume and innovation as testing becomes a cornerstone of hepatitis elimination strategies worldwide.How Are Decentralized Testing and Point-of-Care Solutions Expanding Access to Diagnostics?

The growing availability of decentralized and point-of-care (POC) diagnostic tools is dramatically expanding access to Hepatitis B and C testing, particularly in resource-limited and rural areas where laboratory infrastructure is minimal or nonexistent. These compact, easy-to-use diagnostic kits are revolutionizing outreach by enabling frontline health workers to conduct testing outside of traditional medical settings, such as in homes, schools, community centers, and refugee camps. POC tests based on lateral flow immunoassay technology allow for rapid detection of HBV surface antigen (HBsAg) or HCV antibodies with results in as little as 15 to 30 minutes. Many of these tests require only a finger-prick blood sample and do not rely on refrigeration, making them ideal for deployment in tropical or underserved regions. Moreover, advances in microfluidics, biosensors, and battery-powered analyzers are improving the accuracy and reliability of these decentralized tools, narrowing the performance gap between POC tests and centralized laboratory assays. Integration of POC testing with digital health platforms enables immediate recording and transmission of results, which facilitates real-time disease surveillance and follow-up care. In humanitarian settings and remote communities, task-shifting models-where trained non-physician health workers conduct screenings-are further increasing testing coverage and efficiency. The affordability of these solutions is also improving, with global procurement initiatives ensuring reduced-cost diagnostics for high-burden countries. This democratization of access is especially vital in achieving early diagnosis and intervention, reducing the time from detection to treatment, and supporting broader hepatitis elimination targets. As decentralized testing technologies continue to evolve, their role in overcoming logistical, financial, and geographic barriers to hepatitis care will only become more central.What Key Market Forces Are Fueling Growth in the Hepatitis B and C Diagnostics Sector?

The growth in the Hepatitis B and C diagnostics market is driven by several factors rooted in rising disease prevalence, technological innovation, healthcare policy evolution, and shifting patterns in consumer behavior and provider priorities. The sheer scale of the global hepatitis burden-over 350 million individuals living with chronic HBV or HCV-provides a significant base for diagnostic demand, especially as treatment eligibility increasingly depends on precise viral quantification. Aging populations, rising rates of injection drug use, and increased migration from high-prevalence countries are further expanding the at-risk demographic. On the technological front, the emergence of next-generation molecular platforms, digital immunoassays, and AI-powered diagnostic analytics is accelerating test accuracy, speed, and affordability. Meanwhile, pharmaceutical advancements-particularly the availability of curative direct-acting antivirals (DAAs) for hepatitis C-are motivating more patients to seek diagnosis, creating a feedback loop of demand between treatment and diagnostics. Regulatory bodies across Europe, North America, and Asia are implementing screening mandates in blood banks, prenatal care, and hospital admissions, institutionalizing the role of hepatitis testing in public health policy. Concurrently, global investments in diagnostic infrastructure-bolstered by pandemic-era capacity building-are being repurposed to expand hepatitis testing. Consumer behavior is also changing; increased health literacy, the normalization of self-testing, and digital health tools are empowering individuals to proactively seek testing. Private diagnostic laboratories, telehealth services, and at-home testing kits are responding with customized services, further diversifying access. Combined, these forces are shaping a rapidly evolving market that is as much about innovation and access as it is about medical necessity-positioning hepatitis diagnostics as a critical frontier in the global fight against infectious diseases.Report Scope

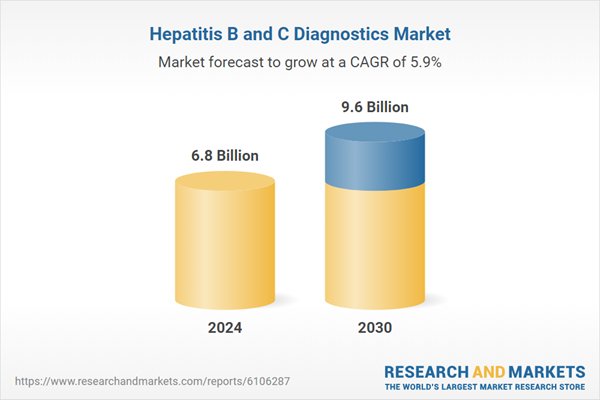

The report analyzes the Hepatitis B and C Diagnostics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Immunodiagnostics, Nucleic Acid Testing); Disease Type (Hepatitis B, Hepatitis C).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Immunodiagnostics segment, which is expected to reach US$6.3 Billion by 2030 with a CAGR of a 4.9%. The Nucleic Acid Testing segment is also set to grow at 8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hepatitis B and C Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hepatitis B and C Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hepatitis B and C Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Akrimax Pharmaceuticals, LLC, Alma Lasers Ltd., Allergan (AbbVie subsidiary), AstraZeneca plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Hepatitis B and C Diagnostics market report include:

- Abbott Laboratories

- Affymetrix (Thermo Fisher)

- Becton, Dickinson and Company

- Bio-Rad Laboratories

- Biomerieux SA

- Cepheid (Danaher)

- DiaSorin S.p.A.

- Fujirebio (H.U. Group)

- Grifols, S.A.

- Hologic, Inc.

- HORIBA, Ltd.

- InTec Products, Inc.

- Johnson & Johnson

- MedMira Inc.

- Ortho Clinical Diagnostics

- Qiagen N.V.

- Roche Diagnostics

- Siemens Healthineers

- Sysmex Corporation

- Trinity Biotech

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Affymetrix (Thermo Fisher)

- Becton, Dickinson and Company

- Bio-Rad Laboratories

- Biomerieux SA

- Cepheid (Danaher)

- DiaSorin S.p.A.

- Fujirebio (H.U. Group)

- Grifols, S.A.

- Hologic, Inc.

- HORIBA, Ltd.

- InTec Products, Inc.

- Johnson & Johnson

- MedMira Inc.

- Ortho Clinical Diagnostics

- Qiagen N.V.

- Roche Diagnostics

- Siemens Healthineers

- Sysmex Corporation

- Trinity Biotech

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 275 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.8 Billion |

| Forecasted Market Value ( USD | $ 9.6 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |