Global Heptanoic Acid Market - Key Trends & Drivers Summarized

Is Heptanoic Acid Emerging as a Key Ingredient in Specialty Chemical Manufacturing?

Heptanoic acid, a seven-carbon saturated fatty acid, is carving out a niche in the global specialty chemicals sector thanks to its versatile chemical structure and compatibility with numerous industrial applications. Heptanoic acid is a colorless, oily organic compound known for its relatively low volatility and moderate reactivity. This serves as a critical intermediate in the synthesis of esters, plasticizers, corrosion inhibitors, lubricants, and fragrance compounds. It finds significant utility in producing heptanoate esters, which are highly valued for their solvent properties and are commonly used in coatings, adhesives, and cleaning agents. As global demand rises for high-performance materials that balance efficacy with environmental compliance, manufacturers are increasingly turning to heptanoic acid and its derivatives to meet performance and regulatory requirements. Its compatibility with bio-based feedstocks and biodegradable formulations is especially attractive in the transition toward sustainable chemistry. Moreover, its ability to act as a precursor in pharmaceuticals and agrochemicals-often facilitating molecular stability or enhancing compound absorption-adds to its commercial appeal. With rising demand for multifunctional chemicals in formulated products, heptanoic acid is being leveraged for its intermediate role in manufacturing specialized additives and high-value industrial compounds. Its performance in applications requiring controlled viscosity and thermal stability is also being recognized in automotive and metalworking fluids, where consistent lubrication and minimal degradation are essential. As a result, heptanoic acid is increasingly regarded as a building block for innovation across diverse end-user industries, reinforcing its status as more than just a commodity chemical.How Is the Demand from Cosmetics and Personal Care Products Shaping Market Dynamics?

In recent years, the personal care and cosmetics industry has emerged as a significant driver for the heptanoic acid market, owing to the growing preference for ingredients that are multifunctional, skin-compatible, and capable of enhancing product stability. Heptanoic acid and its derivatives, particularly heptanoates, are being utilized as emollients, viscosity modifiers, and solubilizing agents in a wide range of skin creams, lotions, sunscreens, and hair care products. Its medium-chain structure allows it to blend well with both water-soluble and oil-based compounds, making it particularly useful in formulating smooth, fast-absorbing, and non-greasy textures. Additionally, the compound's low odor profile and chemical stability make it suitable for formulations where sensory experience and shelf life are crucial. As consumers grow more conscious of ingredient labels, there is an increasing push toward transparency, minimalism, and natural or nature-derived ingredients-factors that favor the use of simpler, less-processed inputs like heptanoic acid. Moreover, the personal care industry is embracing green chemistry principles, and heptanoic acid's ability to be synthesized from renewable sources supports its adoption in eco-friendly product lines. Regulatory trends across Europe and North America that favor biodegradable, non-toxic, and non-sensitizing substances in cosmetics further underscore heptanoic acid's relevance. Its inclusion in “clean beauty” formulations is becoming more prevalent as brands seek to innovate without compromising on regulatory safety standards or performance expectations. This evolving consumer landscape is not only boosting demand but also encouraging formulators to explore new uses and delivery systems incorporating heptanoic acid and its derivatives.Is the Shift Toward Sustainable Industrial Solutions Elevating Heptanoic Acid's Role?

Amid growing concerns about environmental degradation and resource sustainability, the industrial chemical sector is undergoing a transformation in favor of bio-based and low-impact materials-a transition that has brought renewed attention to heptanoic acid. Derived either synthetically or through fermentation and catalytic processes using renewable feedstocks, heptanoic acid is increasingly viewed as a feasible alternative to petroleum-derived fatty acids. It plays a critical role in formulating eco-friendly lubricants, biodegradable plasticizers, and corrosion-resistant coatings, especially in industries seeking to reduce dependence on toxic or environmentally persistent substances. In the metalworking and automotive sectors, heptanoic acid-based formulations offer superior stability and lubrication efficiency, while also complying with tightening environmental standards. Its ability to deliver performance while reducing ecological impact is making it a preferred ingredient in green chemistry applications. Likewise, the growing interest in low-emission solvents and bio-compatible intermediates for paints and adhesives is pushing manufacturers to consider heptanoic acid as a viable component in new-generation materials. Governments and environmental agencies across Europe and Asia are promoting industrial decarbonization and waste reduction initiatives, which further support the demand for biodegradable and renewable chemical ingredients like heptanoic acid. Furthermore, industries are increasingly investing in circular economy models, where heptanoic acid fits in due to its degradability and potential for synthesis from biomass or recycled oils. These evolving industrial preferences are not only reinforcing the acid's market relevance but also positioning it as a strategic material for sustainable innovation across sectors from packaging to transportation.What Are the Key Growth Drivers Propelling the Global Heptanoic Acid Market?

The growth in the heptanoic acid market is driven by several interconnected forces related to evolving industrial needs, consumer behavior, environmental policies, and technological advancement. One of the most significant drivers is the rising demand for high-performance intermediates across multiple sectors such as cosmetics, pharmaceuticals, and specialty chemicals. Heptanoic acid's unique properties-including its intermediate carbon chain length, chemical reactivity, and ability to form stable esters-make it suitable for a wide range of uses, from lubricants and emollients to corrosion inhibitors and solvents. The expanding personal care industry, particularly in emerging economies, is creating new consumption patterns that favor natural, safe, and functionally versatile ingredients-aligning well with the profile of heptanoic acid derivatives. In parallel, stricter regulations on volatile organic compounds (VOCs) and hazardous chemical substances are pushing manufacturers to adopt cleaner alternatives, fueling demand for bio-based and low-toxicity compounds like heptanoic acid. Moreover, the pharmaceutical industry is exploring the acid as a carrier and stabilizer in drug formulations, while agrochemical producers leverage it to improve the performance and uptake of crop protection agents. Technological progress in bio-refining and green synthesis is also lowering production costs and expanding supply chain flexibility, making heptanoic acid more accessible to formulators globally. Additionally, R&D initiatives focused on novel applications such as in energy storage systems and specialty polymers are creating new revenue streams. These drivers, combined with growing cross-sectoral interest in sustainable innovation, are propelling the global heptanoic acid market onto a path of steady expansion, positioning it as a critical ingredient in both legacy and future-forward applications.Report Scope

The report analyzes the Heptanoic Acid market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Vertical (Automotive Vertical, Aerospace Vertical, Food & Beverages Vertical, Pharmaceuticals Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive Vertical segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of a 2.6%. The Aerospace Vertical segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $831.5 Million in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $712.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heptanoic Acid Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heptanoic Acid Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heptanoic Acid Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Alnylam Pharmaceuticals, Altimmune Inc., Antios Therapeutics, Arbutus Biopharma Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Heptanoic Acid market report include:

- Acme Synthetic Chemicals

- Akshay Chemicals Private Limited

- Alfa Aesar GmbH & Co. KG

- Arkema S.A.

- Cayman Chemical Company

- Central Drug House (P) Ltd.

- Handanshi Kezheng Chemical Co., Ltd.

- Intellichemie Industries LLP

- Jinan Chenghui Shuangda Chemical Co., Ltd.

- Kalpsutra Chemicals Pvt. Ltd.

- Kishida Chemical Co., Ltd.

- Kanto Chemical Co., Inc.

- Merck KGaA

- National Analytical Corporation

- Neuchatel Chemie Specialties

- OQ Chemicals GmbH

- Oxea GmbH

- Parchem Fine & Specialty Chemicals

- Spectrum Chemical Mfg. Corp.

- Thermo Fisher Scientific Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acme Synthetic Chemicals

- Akshay Chemicals Private Limited

- Alfa Aesar GmbH & Co. KG

- Arkema S.A.

- Cayman Chemical Company

- Central Drug House (P) Ltd.

- Handanshi Kezheng Chemical Co., Ltd.

- Intellichemie Industries LLP

- Jinan Chenghui Shuangda Chemical Co., Ltd.

- Kalpsutra Chemicals Pvt. Ltd.

- Kishida Chemical Co., Ltd.

- Kanto Chemical Co., Inc.

- Merck KGaA

- National Analytical Corporation

- Neuchatel Chemie Specialties

- OQ Chemicals GmbH

- Oxea GmbH

- Parchem Fine & Specialty Chemicals

- Spectrum Chemical Mfg. Corp.

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

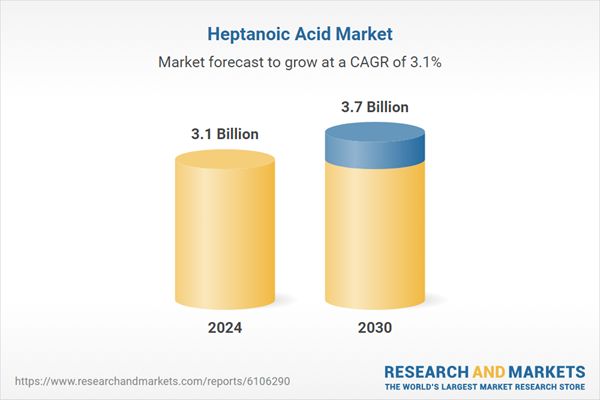

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |