Global High Frequency Transformers Market - Key Trends & Drivers Summarized

Are Power Electronics Demands Redefining the Role of High Frequency Transformers?

High frequency transformers are becoming increasingly integral to the evolution of modern power electronics as industries demand compact, efficient, and high-performance energy conversion solutions. Unlike traditional low-frequency transformers that operate at 50-60 Hz, high frequency variants function at frequencies ranging from several kilohertz to several megahertz, enabling significant reductions in size and weight. These transformers are now essential in applications such as switch-mode power supplies (SMPS), electric vehicles (EVs), solar inverters, and various telecommunication systems, where compactness and fast switching capabilities are critical. As electronics become more sophisticated and power density requirements rise, high frequency transformers provide the necessary isolation and voltage transformation while minimizing energy loss and improving thermal performance. Additionally, the integration of advanced magnetic materials like ferrites and nanocrystalline cores enhances their operational efficiency and minimizes electromagnetic interference (EMI). With the proliferation of portable electronics, renewable energy systems, and automotive electrification, the need for faster and more efficient power conversion is escalating. This demand is steering manufacturers toward custom transformer designs that offer greater design flexibility, higher reliability, and compliance with stringent regulatory standards. Consequently, high frequency transformers are no longer viewed as passive components but rather as key enablers of next-generation energy systems. Their role is expanding not just in power conversion but also in signal coupling, impedance matching, and galvanic isolation-making them critical in the seamless operation of high-speed and high-efficiency electronic devices.Is the Push Toward Miniaturization and Lightweight Systems Fueling Innovation?

In the race toward smaller, lighter, and more efficient electronic systems, high frequency transformers have emerged as pivotal components driving innovation across multiple industries. The shift toward miniaturization, especially in sectors like aerospace, consumer electronics, and medical devices, demands power components that can deliver high performance in confined spaces. High frequency transformers, by virtue of their ability to operate at elevated switching speeds, allow for the use of smaller magnetic cores and fewer windings, significantly reducing volume and weight without sacrificing functionality. This makes them ideal for compact power supplies, onboard chargers, and embedded systems. Additionally, the use of surface-mount technology (SMT) and planar transformer designs is further optimizing space utilization, improving thermal management, and enabling automated assembly processes. These trends are aligned with the broader movement toward high-efficiency, low-profile power architectures required in portable and wearable technologies. Furthermore, innovations in materials science are enabling the development of high-temperature insulation systems and thermally stable core materials, allowing transformers to operate reliably under extreme conditions. The incorporation of digital design tools and simulation software also allows engineers to optimize transformer configurations with precision, enhancing performance while meeting increasingly complex electrical and mechanical constraints. These innovations collectively support the advancement of energy-dense, lightweight solutions across a growing array of high-tech applications. As miniaturization becomes a design priority, high frequency transformers are poised to play an even greater role in enabling the next generation of compact and intelligent electronic devices.How Are Emerging Energy Systems Driving Demand for High Frequency Transformers?

The transition toward renewable and decentralized energy systems is reshaping the power electronics landscape and significantly increasing the demand for high frequency transformers. With the rapid deployment of solar photovoltaic (PV) installations, wind farms, and energy storage systems, there is a growing need for compact and efficient power converters that can manage variable inputs and integrate seamlessly into smart grids. High frequency transformers are essential components in these power conversion architectures, particularly in DC-DC converters and high-efficiency inverters that require rapid switching, precise voltage regulation, and galvanic isolation. In solar inverters, for example, these transformers enable the transformation of fluctuating DC power from panels into stable AC power suitable for grid distribution. Similarly, in battery storage and EV charging systems, they support high-speed energy transfer with minimal loss, contributing to overall system reliability and energy efficiency. The move toward high voltage, high power density converters in these applications underscores the importance of robust transformer design that can withstand high thermal and electrical stress. Government policies promoting clean energy adoption and infrastructure modernization are also fueling investments in power electronics technologies, further driving the uptake of high frequency transformers. Additionally, the rise of microgrids and distributed energy resources (DERs) is encouraging innovation in compact, high-performance energy systems that rely on efficient power conversion and isolation. As the energy sector moves away from centralized models toward dynamic, digitally controlled grids, high frequency transformers are increasingly indispensable in bridging the gap between generation, storage, and consumption.What Key Factors Are Driving Growth in the High Frequency Transformers Market?

The growth in the high frequency transformers market is driven by a blend of technological evolution, end-use sector expansion, and a broader push for energy-efficient solutions. A primary driver is the escalating demand for advanced power management in sectors such as telecommunications, electric vehicles, industrial automation, aerospace, and consumer electronics. As these industries move toward more compact, high-speed, and efficient systems, high frequency transformers are becoming a critical component for power conversion and control. The growing adoption of electric mobility is especially significant, as EVs require highly efficient onboard chargers, battery management systems, and DC-DC converters-all of which depend on precision transformers. Similarly, the increasing use of high-efficiency power supplies in servers and data centers is supporting demand, particularly as global internet usage and cloud computing expand. On the manufacturing side, advancements in core materials, thermal insulation, and winding technologies are enabling higher performance and longevity, which appeals to OEMs seeking reliability and low maintenance. Regulatory mandates focused on energy conservation and reduced emissions are also influencing component design, pushing the industry toward more efficient magnetic components that meet global standards. Furthermore, the rise of Industry 4.0 and the digitization of manufacturing processes are creating new applications for high frequency transformers in robotics, process control, and sensor-based automation. As supply chains become more integrated and localized in response to global disruptions, manufacturers are also investing in region-specific production facilities, which is enhancing availability and responsiveness in the market. Collectively, these factors are contributing to sustained growth in the high frequency transformers market, making it a key enabler of emerging technologies and energy systems worldwide.Report Scope

The report analyzes the High Frequency Transformers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Power Output (Below 50W, 51 - 100 W, 101 - 400 W, Above 401 W); Application (Power Supplies Application, Alternative Energy Inverters Application, Electronic Switching Devices Application, LED Lighting Application, Other Applications); Vertical (Military & Defense Vertical, RF & Telecommunications Vertical, Manufacturing Vertical, Healthcare Vertical).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below 50W Transformers segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 4.1%. The 51 - 100 W Transformers segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $886.4 Million in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $864 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High Frequency Transformers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High Frequency Transformers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High Frequency Transformers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

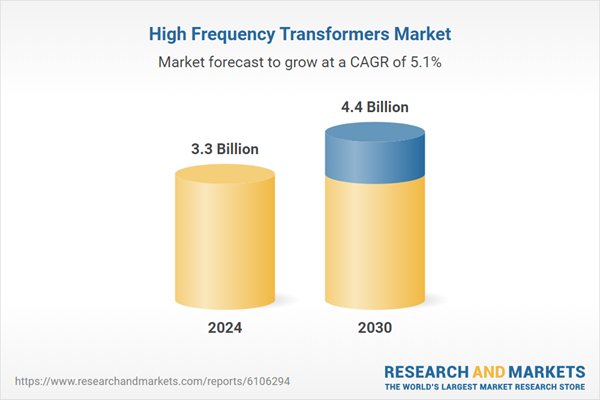

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alibaba Group (AutoNavi), Apple Inc., Baidu Inc, Carmera Inc., CE Info Systems Pvt (MapmyIndia) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this High Frequency Transformers market report include:

- Bourns Inc.

- Chilisin Electronics Corp.

- Coilcraft

- Datatronics Inc.

- Delta Electronics

- Hammond Manufacturing

- Infineon Technologies AG

- Murata Manufacturing Co. Ltd.

- MYRRA

- Payton Planar Magnetics

- Premier Magnetics

- Pulse Electronics (a Yageo company)

- Rubadue Wire

- Schaffner Group

- Standex Electronics

- Sumida Corporation

- Tamura Corporation

- TDK Corporation

- TE Connectivity

- Toshiba Corporation

- Vacuumschmelze GmbH & Co. KG

- Vishay Intertechnology, Inc.

- Würth Elektronik eiSos GmbH & Co. KG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bourns Inc.

- Chilisin Electronics Corp.

- Coilcraft

- Datatronics Inc.

- Delta Electronics

- Hammond Manufacturing

- Infineon Technologies AG

- Murata Manufacturing Co. Ltd.

- MYRRA

- Payton Planar Magnetics

- Premier Magnetics

- Pulse Electronics (a Yageo company)

- Rubadue Wire

- Schaffner Group

- Standex Electronics

- Sumida Corporation

- Tamura Corporation

- TDK Corporation

- TE Connectivity

- Toshiba Corporation

- Vacuumschmelze GmbH & Co. KG

- Vishay Intertechnology, Inc.

- Würth Elektronik eiSos GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |