Global High Precision Asphere Market - Key Trends & Drivers Summarized

Is the Shift Toward Optical Miniaturization Fueling Demand for High Precision Aspheres?

High precision aspheres are playing an increasingly pivotal role in the ongoing miniaturization of optical systems across multiple high-tech sectors. Unlike conventional spherical lenses, aspheric lenses are designed with a more complex geometry that allows them to reduce optical aberrations, minimize component counts, and improve image quality-all while enabling smaller, lighter device architectures. This makes them indispensable in compact devices such as smartphone cameras, augmented reality (AR) headsets, medical endoscopes, and drone vision systems. As the push for portability, efficiency, and performance intensifies, manufacturers are leveraging high precision aspheres to meet strict spatial constraints without compromising on optical clarity. These lenses allow for simpler and lighter optical assemblies by eliminating the need for multiple spherical components, which not only reduces size and weight but also enhances system reliability and reduces assembly time. The growing convergence of optics with electronics, particularly in wearable technology and miniaturized sensors, is further reinforcing the relevance of aspheric optics. As demand for compact, high-performance imaging systems grows in consumer electronics, automotive, aerospace, and healthcare, high precision aspheres are emerging as a foundational technology in next-generation optical design. Their ability to deliver superior optical performance in tight spaces positions them at the heart of innovation in precision imaging and sensing technologies.How Are Advanced Manufacturing Technologies Enhancing Asphere Quality and Accessibility?

The production of high precision aspheres has historically been a complex and resource-intensive process, but recent advancements in manufacturing technologies are revolutionizing the field, improving quality while driving down cost and lead times. Techniques such as precision glass molding, computer-controlled optical surfacing (CCOS), and magnetorheological finishing (MRF) have significantly elevated the industry's ability to fabricate aspheres with exacting tolerances and flawless surface profiles. These innovations have made it possible to produce aspheres at scale without compromising on the high degrees of optical accuracy required for demanding applications in defense, aerospace, metrology, and photonics. Moreover, the rise of ultra-precision diamond turning, often coupled with real-time interferometric feedback, allows for single-point fabrication of complex geometries with nanometer-level surface roughness. These methods not only enhance performance but also support reproducibility in large-volume production-something critical for markets such as consumer electronics or automotive LiDAR systems. Additive manufacturing and hybrid processes are also being explored to enable the creation of custom aspheric elements with integrated features, paving the way for more sophisticated optical system integration. The use of advanced materials like chalcogenide glass, low-expansion ceramics, and specialized polymers has further broadened application scopes by improving thermal stability and wavelength range compatibility. As these manufacturing capabilities continue to evolve, they are making high precision aspheres more accessible across industries, turning what was once a specialized and costly optical component into a versatile solution with broad commercial viability.Is the Rise of Precision Optics in Emerging Technologies Expanding Asphere Applications?

Emerging technologies in fields such as autonomous vehicles, space exploration, photonic computing, and high-resolution imaging are driving an unprecedented demand for optical components that deliver ultra-high performance-and high precision aspheres are stepping up to meet this need. In the automotive sector, for example, aspheric lenses are critical in advanced driver assistance systems (ADAS) and LiDAR units, where clear, distortion-free imaging over varying focal lengths is essential for object detection and navigation. In aerospace and satellite systems, where weight reduction and resilience to harsh environments are paramount, aspheres help achieve high performance in compact formats that meet stringent mission criteria. The medical imaging industry also benefits from aspheric optics, particularly in devices like endoscopes and ophthalmic instruments, where high-resolution imaging in confined anatomical spaces is necessary. Similarly, in laser systems used for scientific research or industrial cutting and welding, aspheres enhance beam focusing and reduce thermal distortions, thereby improving precision and energy efficiency. In consumer electronics, aspheric lenses contribute to sharper imaging in high-megapixel smartphone cameras and AR/VR headsets, delivering immersive visual experiences. The ability of aspheres to deliver aberration-free performance over wide apertures and varying wavelengths makes them ideal for next-generation optics used in quantum sensing, optical communications, and biomedical diagnostics. As these frontier technologies continue to evolve and scale, they are opening up new and sophisticated use cases for high precision aspheres, expanding their influence well beyond traditional optics markets.What Key Market Forces Are Driving the Global Adoption of High Precision Aspheres?

The growth in the high precision asphere market is being driven by a combination of technological innovation, industrial diversification, and changing end-user expectations. As optical systems become more complex and multifunctional, there is a growing demand for components that can simultaneously enhance performance, reduce system size, and improve manufacturing efficiency-objectives that high precision aspheres are uniquely suited to fulfill. In sectors such as defense and aerospace, the increasing emphasis on high-performance optics for surveillance, targeting, and satellite imaging is fueling investment in advanced aspheric elements. Similarly, the rapid proliferation of smart devices and connected technologies is pushing the consumer electronics industry to adopt high-precision optics that offer compactness without sacrificing quality. The increasing affordability and scalability of asphere production, thanks to modern fabrication techniques, are removing earlier barriers to entry and enabling broader adoption across small and mid-sized enterprises. Additionally, as nations invest in upgrading their industrial capabilities under initiatives like Industry 4.0 and smart manufacturing, demand for high-precision metrology tools-which often rely on aspheric optics-is also on the rise. International standards bodies are now incorporating tighter tolerances and performance benchmarks in optical system certifications, further pushing OEMs toward using high-performance aspheric components. Moreover, collaborations between optical component manufacturers, research institutions, and system integrators are fostering innovation and accelerating product development cycles. As industries continue to seek compact, efficient, and high-resolution optical solutions, high precision aspheres are poised to remain at the forefront of optical engineering, serving as key enablers in the design and deployment of cutting-edge technologies worldwide.Report Scope

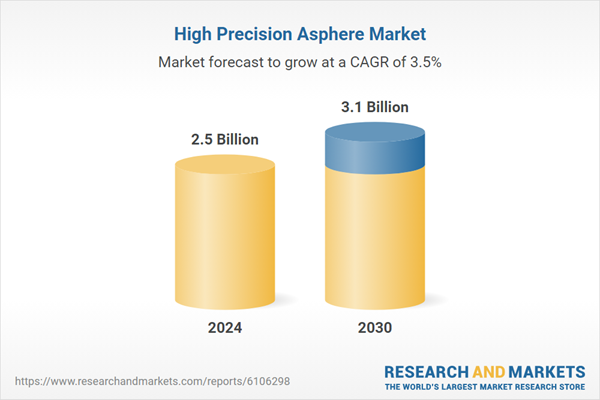

The report analyzes the High Precision Asphere market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (High Precision Glass Aspherical Lens, High Precision Plastic Aspherical Lens); End-Use (Automotive End-Use, Cameras End-Use, Optical Instruments End-Use, Mobile Phones & Tablets End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Glass Aspherical Lens segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of a 4.1%. The Plastic Aspherical Lens segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $692.7 Million in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $626.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High Precision Asphere Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High Precision Asphere Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High Precision Asphere Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AYM Syntex Limited, Coats Group plc, Hengli Group, Huvis Corporation, Hyosung Advanced Materials Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this High Precision Asphere market report include:

- Accusy Photontech Ltd.

- AGC Inc.

- Asia Optical Co., Inc.

- Asphericon GmbH

- Asphera

- Canon Inc.

- Carl Zeiss AG

- Edmund Optics Inc.

- Genius Electronic Optical Co. Ltd.

- Hoya Corporation

- Jenoptik AG

- Kinko Optical Co. Ltd.

- Largan Precision Co., Ltd

- LaCroix Precision Optics

- LightPath Technologies

- Optimax Systems, Inc.

- OptoSigma Corporation

- Panasonic Corporation

- SCHOTT AG

- Sunny Optical Technology Co., Ltd.

- Tokai Optical Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accusy Photontech Ltd.

- AGC Inc.

- Asia Optical Co., Inc.

- Asphericon GmbH

- Asphera

- Canon Inc.

- Carl Zeiss AG

- Edmund Optics Inc.

- Genius Electronic Optical Co. Ltd.

- Hoya Corporation

- Jenoptik AG

- Kinko Optical Co. Ltd.

- Largan Precision Co., Ltd

- LaCroix Precision Optics

- LightPath Technologies

- Optimax Systems, Inc.

- OptoSigma Corporation

- Panasonic Corporation

- SCHOTT AG

- Sunny Optical Technology Co., Ltd.

- Tokai Optical Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 3.1 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |